GameFi News Axie Infinity, The Sandbox Defy Sector Pullback GameFi news has taken an unexpected turn as Axie Infinity and The Sandbox show notable strength while the broader GameFi sector faces a pullback. Over recent months, blockchain gaming tokens have struggled under market pressure, declining user activity, and shifting investor sentiment. Many projects that once thrived during the peak of the play-to-earn boom have seen reduced engagement and falling valuations. Against this backdrop, the rally in Axie Infinity and The Sandbox stands out as a compelling development that has captured the attention of both traders and long-term investors.

The resilience of these two flagship GameFi projects suggests that not all blockchain gaming platforms are moving in lockstep. Instead, fundamentals, ecosystem maturity, and strategic evolution appear to be playing a larger role in determining which projects can outperform during challenging market conditions. GameFi news surrounding Axie Infinity and The Sandbox reflects a broader narrative shift, one that emphasizes sustainability, quality gameplay, and real user engagement over speculative hype.

We explores why Axie Infinity and The Sandbox are rallying despite a sector-wide pullback, what differentiates them from other GameFi projects, and what their performance could signal for the future of blockchain gaming. By examining market trends, ecosystem developments, and investor psychology, this analysis provides a comprehensive look at the current GameFi landscape.

GameFi News Axie Infinity

The GameFi sector has undergone a significant correction following its explosive growth during earlier crypto cycles. At its peak, play-to-earn gaming attracted millions of users and billions in capital, driven by the promise of earning digital assets through gameplay. However, as market conditions tightened, many projects struggled to maintain momentum.

One key factor behind the pullback has been declining user incentives. In many cases, rewards outpaced sustainable revenue models, leading to inflationary tokenomics and reduced long-term value. As speculative interest waned, token prices followed suit, dragging the broader GameFi market lower.

GameFi news over recent months has frequently highlighted falling daily active users, shrinking in-game economies, and a shift in investor focus toward infrastructure and artificial intelligence narratives. Within this challenging environment, the ability of Axie Infinity and The Sandbox to rally suggests that selective strength is emerging within the sector.

Axie Infinity’s Evolution and Market Resilience

From Play-to-Earn Pioneer to Sustainable Ecosystem

Axie Infinity was one of the earliest and most influential GameFi projects, pioneering the play-to-earn model. At its height, it became a cultural phenomenon, particularly in emerging markets. However, rapid growth exposed weaknesses in token economics and gameplay depth, leading to a sharp correction.

In response, the Axie Infinity team embarked on a comprehensive transformation. Rather than relying solely on financial incentives, the project shifted its focus toward sustainable GameFi models, improved gameplay, and community-driven development. This evolution has been central to its recent resurgence and positive GameFi news.

Renewed Interest in Axie Infinity Tokens

Recent price movements indicate renewed interest in Axie Infinity’s native tokens. Investors appear encouraged by the project’s efforts to rebalance rewards, reduce inflation, and enhance long-term value. While the broader GameFi sector remains under pressure, Axie Infinity’s clearer roadmap and active user base have helped restore confidence.

The rally reflects a belief that Axie Infinity has moved beyond its early experimental phase. Instead of being viewed purely as a speculative asset, it is increasingly seen as a mature blockchain gaming platform with staying power.

The Sandbox and the Power of the Metaverse Narrative

Building a Creator-Driven Virtual World

The Sandbox occupies a unique position within GameFi as a metaverse-focused platform emphasizing user-generated content. Rather than centering solely on play-to-earn mechanics, The Sandbox empowers creators to build, own, and monetize virtual experiences. This approach aligns closely with broader trends in digital ownership and immersive online worlds.

GameFi news surrounding The Sandbox often highlights partnerships, virtual land development, and creator activity. These elements contribute to a perception of long-term value that extends beyond short-term token price movements.

Why The Sandbox Is Rallying Amid Weakness Elsewhere

The recent rally in The Sandbox token suggests that investors are responding positively to its differentiated strategy. As speculative gaming projects fade, platforms offering creative freedom and diverse monetization options appear more resilient.

The Sandbox benefits from a strong brand, a recognizable metaverse vision, and an ecosystem that encourages continuous innovation. These strengths help explain why it has managed to outperform during a period of sector-wide weakness.

Comparing Axie Infinity and The Sandbox to Other GameFi Projects

Quality Over Quantity in GameFi

One of the clearest lessons from recent GameFi news is that not all projects are created equal. Many early GameFi platforms prioritized rapid user acquisition through aggressive rewards, sacrificing sustainability. When market conditions shifted, these weaknesses became apparent.

Axie Infinity and The Sandbox, by contrast, have invested in long-term ecosystem development. Their focus on gameplay quality, creator engagement, and evolving use cases has helped them weather the downturn more effectively than competitors.

Community Strength and Developer Commitment

Both Axie Infinity and The Sandbox benefit from strong communities and active development teams. Regular updates, transparent communication, and responsiveness to user feedback have fostered loyalty. In a sector where trust has been shaken, these qualities are increasingly valuable.

This community-driven resilience is a recurring theme in positive GameFi news and plays a critical role in sustaining momentum during challenging periods.

Market Sentiment and Investor Psychology in GameFi

Selective Risk Appetite Returns

While overall risk appetite in crypto remains cautious, investors are becoming more selective rather than abandoning the space entirely. GameFi news reflects a shift from broad sector exposure to targeted bets on high-quality projects.

The rallies in Axie Infinity and The Sandbox suggest that investors are willing to re-enter GameFi when they see credible paths to sustainability. This selective approach may mark the beginning of a healthier market phase.

The Role of Narrative in Price Performance

Narratives continue to influence crypto markets, and GameFi is no exception. Axie Infinity’s transformation story and The Sandbox’s metaverse vision provide compelling narratives that resonate with investors.

These narratives help explain why certain tokens can rally even as the broader sector pulls back. When fundamentals align with a clear story, market participants are more likely to assign value despite external pressures.

Broader Implications for the GameFi Sector

Signs of Maturation in Blockchain Gaming

The divergence between leading projects and weaker platforms suggests that the GameFi sector is maturing. Rather than rising and falling together, projects are being evaluated on individual merits. This differentiation is a positive sign for the long-term health of blockchain gaming.

GameFi news highlighting resilience amid adversity indicates that the sector may be transitioning from speculative experimentation to a more sustainable industry.

What This Means for Future GameFi Development

Developers and investors alike can draw lessons from the performance of Axie Infinity and The Sandbox. Sustainable economies, engaging gameplay, and strong communities are essential for long-term success. Projects that adapt and innovate are more likely to survive and thrive.

As capital becomes more discerning, future GameFi development may prioritize quality over rapid expansion, leading to more robust ecosystems.

Technical and Fundamental Factors Supporting the Rally

On-Chain Activity and User Engagement

On-chain metrics often provide insight into the health of blockchain projects. For Axie Infinity and The Sandbox, signs of stable or improving activity have supported positive price action. User engagement, transaction volumes, and ecosystem participation all contribute to investor confidence.

These indicators suggest that the rallies are not purely speculative but grounded in underlying usage.

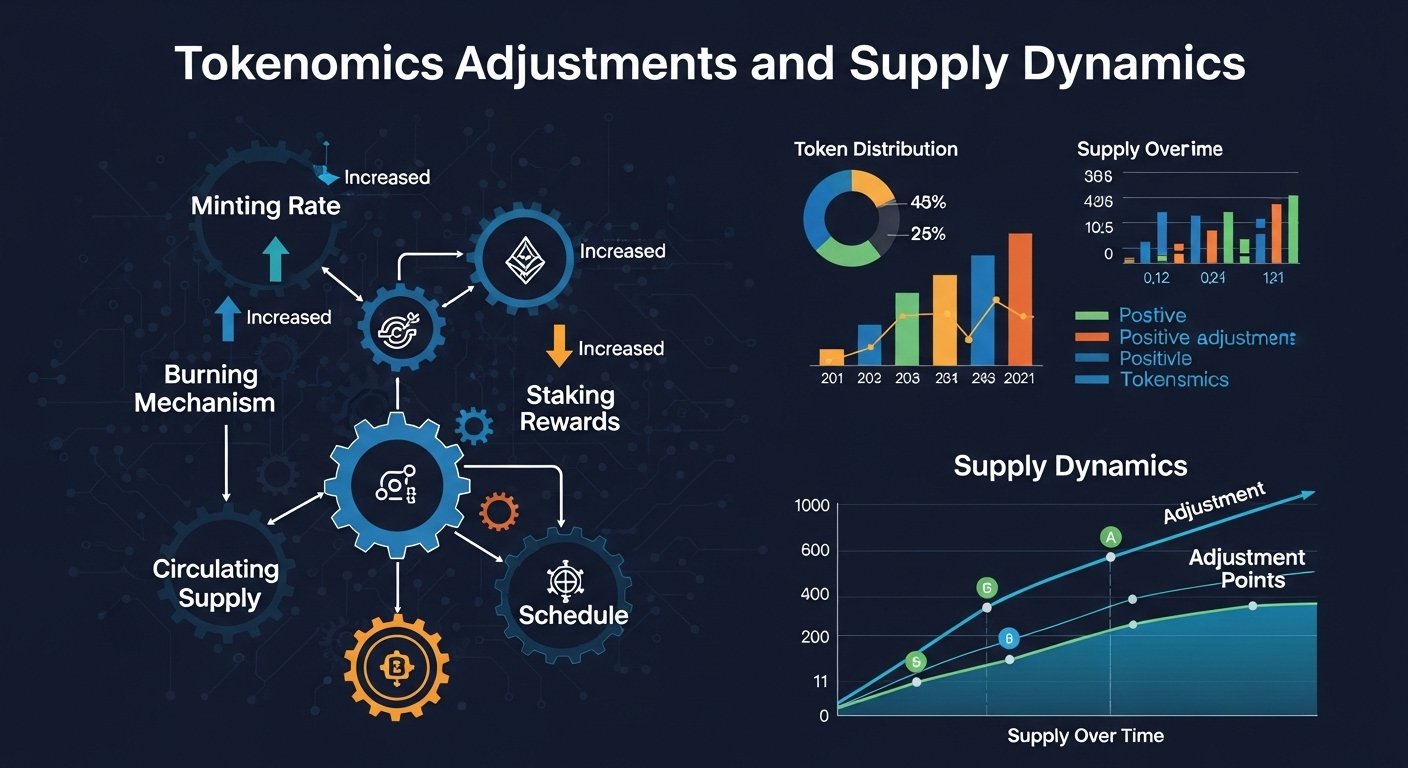

Tokenomics Adjustments and Supply Dynamics

Tokenomics play a crucial role in GameFi performance. Both Axie Infinity and The Sandbox have implemented measures to manage supply and incentives more effectively. Reduced inflationary pressure can stabilize prices and support long-term value.

GameFi news increasingly emphasizes tokenomics reform as a key factor in determining which projects can recover and grow.

Challenges That Still Face Axie Infinity and The Sandbox

Despite recent rallies, challenges remain. Competition within blockchain gaming is intense, and user expectations continue to evolve. Maintaining engagement without over-reliance on financial incentives is an ongoing balancing act.

Market volatility also remains a risk. Even strong projects are not immune to broader crypto downturns. As such, while recent performance is encouraging, sustained success will require continued execution and adaptability.

Long-Term Outlook for GameFi

The performance of Axie Infinity and The Sandbox offers cautious optimism for the future of GameFi. Their resilience suggests that the sector is not fading but rather undergoing a necessary transformation.

As weaker projects fall away, stronger platforms may emerge with clearer value propositions and sustainable models. GameFi news in the coming years is likely to focus less on hype and more on real adoption, user experience, and integration with broader digital ecosystems.

Conclusion

GameFi news highlighting Axie Infinity and The Sandbox rallying despite a sector pullback underscores an important shift within blockchain gaming. While the broader GameFi market faces challenges, these two projects demonstrate that resilience is possible through adaptation, strong fundamentals, and clear vision.

Their performance suggests that investors are becoming more discerning, rewarding projects that prioritize sustainability and engagement over short-term speculation. As the GameFi sector continues to evolve, the success of Axie Infinity and The Sandbox may serve as a blueprint for future development, signaling a more mature and resilient phase for blockchain gaming.

FAQs

Q: Why are Axie Infinity and The Sandbox rallying while the GameFi sector pulls back?

Axie Infinity and The Sandbox are rallying due to stronger fundamentals, ongoing development, and clearer long-term strategies. Investors view them as more sustainable compared to other GameFi projects.

Q: Does this GameFi news signal a broader recovery for blockchain gaming?

While it does not guarantee a full sector recovery, it suggests selective strength. High-quality projects may outperform even if the broader GameFi market remains under pressure.

Q: How important is sustainability in modern GameFi projects?

Sustainability is critical as investors and users now prioritize long-term value, balanced tokenomics, and engaging gameplay rather than short-term rewards.

Q: What role does the metaverse narrative play in The Sandbox’s performance?

The metaverse narrative supports The Sandbox by emphasizing creativity, digital ownership, and immersive experiences, which appeal to both users and investors beyond play-to-earn mechanics.

Q: Should investors view GameFi differently after this sector pullback?

Yes, the pullback highlights the need for selective evaluation. Investors are increasingly focusing on fundamentals, community strength, and adaptability when assessing GameFi opportunities.