Investors and experts both find great interest in Solana’s (SOL) rapid comeback. Its price has jumped by more than 35% in recent weeks. Multiple on-chain developments, a surge in distributed finance (DeFi) activity. The fresh market hope for the Solana Blockchain help to explain this amazing price growth. Solana is destined for a continuous positive run with better network performance and an increase in more players. The important elements causing Solana’s price increase are closely examined here.

Solana’s DeFi Growth Surge

Solana’s amazing price recovery is mostly driven by the notable increase in network activity, especially in the DeFi area. The Total Valuelocked (TVL) on Solana-based DeFi platforms has skyrocketed to new highs as of late 2024. Some platforms have seen significant deposit and liquidity increase. This rise in DeFi activity points to fresh investor hope for Solana’s capacity as a DeFi center.

For TVL, for example, platforms such Jupiter, Raydium, and Sanctum have all witnessed remarkable rise—13%, 18%, and 17%, respectively, during the last month. As distributed exchanges (DEXs) and other DeFi protocols on the network appeal to consumers, these growth numbers suggest to a larger trend of liquidity moving toward Solana. Solana has also kept high trade volumes, especially on its dispersed exchanges, which exceeds Ethereum in DEX counts. This change reflects rising support for Solana’s ecosystem, which gains from faster processing times and reduced transaction fees above Ethereum.

For TVL, for example, platforms such Jupiter, Raydium, and Sanctum have all witnessed remarkable rise—13%, 18%, and 17%, respectively, during the last month. As distributed exchanges (DEXs) and other DeFi protocols on the network appeal to consumers, these growth numbers suggest to a larger trend of liquidity moving toward Solana. Solana has also kept high trade volumes, especially on its dispersed exchanges, which exceeds Ethereum in DEX counts. This change reflects rising support for Solana’s ecosystem, which gains from faster processing times and reduced transaction fees above Ethereum.

Meme Coins Surge

Growing popularity of meme currencies and the explosion of NFTs (non-fungible tokens) on the network also help Solana’s price spike get impetus. Tokens such Moo Deng (MOODENG), Goatseus Maximus (GOAT), and Nosana (NOS) have seen notable price gains over the last several weeks. These meme currencies have drawn investors and new users to the Solana network, hence driving a rise in network activity generally.

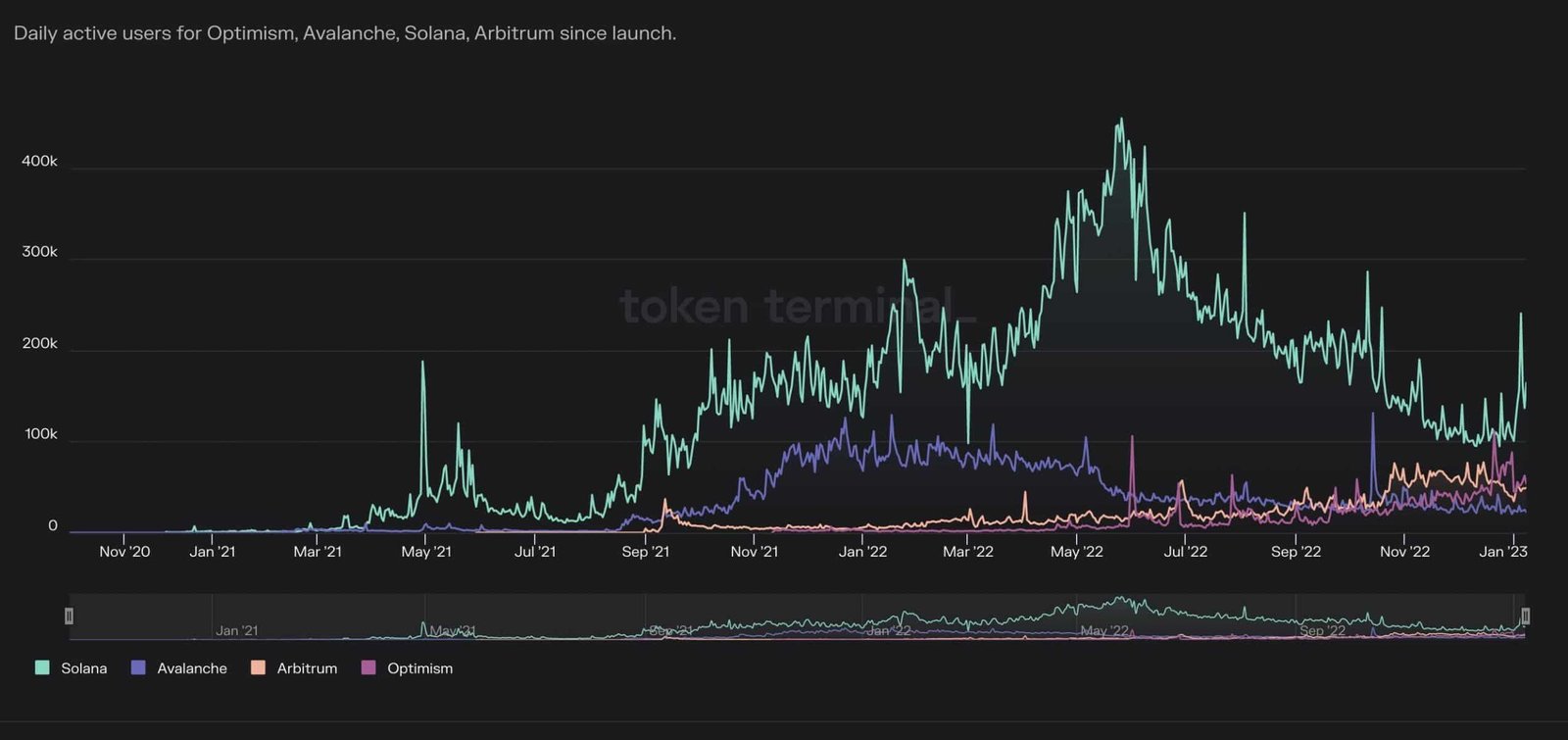

Apart from meme coins, Solana has experienced a surge in NFT activity since various viable NFT initiatives have become popular. The number of active addresses on the Solana blockchain has increased thanks in part to the flood of these fresh assets onto it. Reflecting a rising user base and higher demand for Solana-based assets, the number of active addresses on Solana actually dropped dramatically from 26.31 million in August to 60.55 million in September. The current price surge has a strong basis thanks to higher user involvement and asset acceptance.

Firedancer Boosts Solana

Web3 firm Jump Crypto’s new validator client, Firedancer, is driving Solana’s optimism. Firedancer works to improve Solana’s network speed, security, and reliability. This invention fixes Solana’s network problems and outages, boosting investor confidence.

Firedancer’s launch is a crucial step toward improving Solana’s infrastructure to handle heavier traffic and growth as its user base expands. Solana improved its performance by increasing validator diversity and deploying a powerful validator client, solving network instability. The network’s increasing dependability is attracting developers and investors, strengthening the Solana ecosystem’s image.

Solana’s Price Surge

In addition to technical advances, Solana’s price increase was driven by market optimism. The approval of Bitcoin ETFs and institutional funding have revived investor interest in the bitcoin market. As the crypto industry grows, institutional investors are turning to Solana for unique blockchain projects with high scalability and growing user bases.

Apart from institutional interest, Solana futures open interest has increased, indicating that more traders are dependent on price rise. Solana’s bullish pricing is supported by its growing institutional interest as a key blockchain project. The rise in futures trading suggests market players expect Solana to continue rising, making it appealing to institutional and retail investors.

Apart from institutional interest, Solana futures open interest has increased, indicating that more traders are dependent on price rise. Solana’s bullish pricing is supported by its growing institutional interest as a key blockchain project. The rise in futures trading suggests market players expect Solana to continue rising, making it appealing to institutional and retail investors.

Final thoughts

Solana’s 35% price explosion can be attributed to institutional interest in the blockchain, the growth of meme coin NFTs, Firedancer’s network performance improvements, and its DeFi ecosystem activities. As it builds its infrastructure, Solana will benefit from the growing demand for scalable, high-performance blockchain systems.

A growing user base, a dynamic DeFi industry, and excellent infrastructure should help Solana maintain its momentum in the coming months. Good on-chain advancements and a positive market suggest Solana can retain its price gains and possibly rise further. As usual, the bitcoin price is volatile, but Solana’s events signal the blockchain will continue to thrive.