Bitcoin $50 trillion potential has been the subject of both optimism and skepticism in the financial world for an extended period. Although some consider it to be the future of money, others regard it as an asset that is excessively speculative and susceptible to extreme volatility.

However, Matt Hougan, the Chief Investment Officer (CIO) of Bitwise Asset Management, has made a daring and ambitious prediction that has captivated the attention of crypto enthusiasts, analysts, and investors. He posits that Bitcoin Surge could ultimately reach a market capitalization of $50 trillion. This figure is truly remarkable; however, Hougan’s perception of Bitcoin’s potential may not be as unrealistic as it initially appears.

Bitcoin’s $50 Trillion Potential

A wide view of Bitcoin’s function in the global economy led Hougan to predict a $50 trillion market cap. He expects Bitcoin’s value to rise as it becomes more mainstream and integrated into the international financial system. Bitcoin, like gold, is a store of value, and Hougan thinks it might eventually take over the market from gold and government bonds.

The global market valuation of all gold is estimated at $12 trillion. Bitcoin’s market valuation would leap to unimaginable levels if it captured even a fraction of that value. Hougan believes Bitcoin might reach $500,000 per Bitcoin and take 25% of gold’s market value. This might put Bitcoin’s market cap beyond $9 trillion.

Hougan goes further. He believes Bitcoin might replace gold as the principal store of value if institutional use rises and governments grasp its potential as a hedge against inflation and economic instability. Bitcoin might replace gold as a global store of wealth and reach $50 trillion in market cap, with each Bitcoin valued at over $2.5 million.

Bitcoin in Reserves

Hougan’s prediction is influenced by Bitcoin’s growing position in national reserves. He predicts more governments and sovereign wealth funds will hold Bitcoin in their reserves like gold or foreign currencies as they understand its value. A “Strategic Bitcoin Reserve” (SBR) could be vital to countries’ financial policies, according to Hougan.

To hedge against inflation and fiat currencies, the US may include Bitcoin in its reserves. If this happens, other governments may follow suit, changing how they view and hold digital assets globally. Bitcoin’s price and market cap might grow dramatically in such a scenario.

Institutional Bitcoin Adoption

Along with geopolitical influence, Hougan believes institutional adoption will boost Bitcoin’s value to unprecedented levels. Many believe Bitcoin exchange-traded funds (ETFs) accelerated institutional acceptance. Pension funds, mutual funds, and other institutional investors would invest billions in a Bitcoin ETF because it would make cryptocurrency exposure easier.

Bitcoin demand may skyrocket as more institutions enter the market. This increasing demand and a limited supply of Bitcoin (there will only be 21 million BTC) could raise its price and market size. Some observers anticipate that Bitcoin’s price might reach $200,000 or more in the coming years as institutional money floods the market.

Bitcoin’s Inflation Hedge

Bitcoin’s inflation hedge is another significant forecast of Hougan’s. Investors have sought alternative assets that can preserve value during monetary growth as central banks worldwide have printed money at an unprecedented rate. Bitcoin, with its fixed supply and decentralization, is unlike fiat currencies, which can be depreciated by inflation.

Bitcoin may become more appealing to wealth protectors as global inflation rises. In hyperinflationary countries, Bitcoin may be a more reliable store of value than the official currency. Bitcoin demand and price will rise as this tendency accelerates, according to Hougan.

Bitcoin may become more appealing to wealth protectors as global inflation rises. In hyperinflationary countries, Bitcoin may be a more reliable store of value than the official currency. Bitcoin demand and price will rise as this tendency accelerates, according to Hougan.

Bitcoin Valuation Challenges

Hougan’s $50 trillion Bitcoin estimate is ambitious, but some dangers and hurdles could prevent it from reaching such high valuations. The biggest issue is regulatory ambiguity. Governments worldwide are currently debating how to regulate cryptocurrencies, and any negative judgments might hurt Bitcoin’s price and market value.

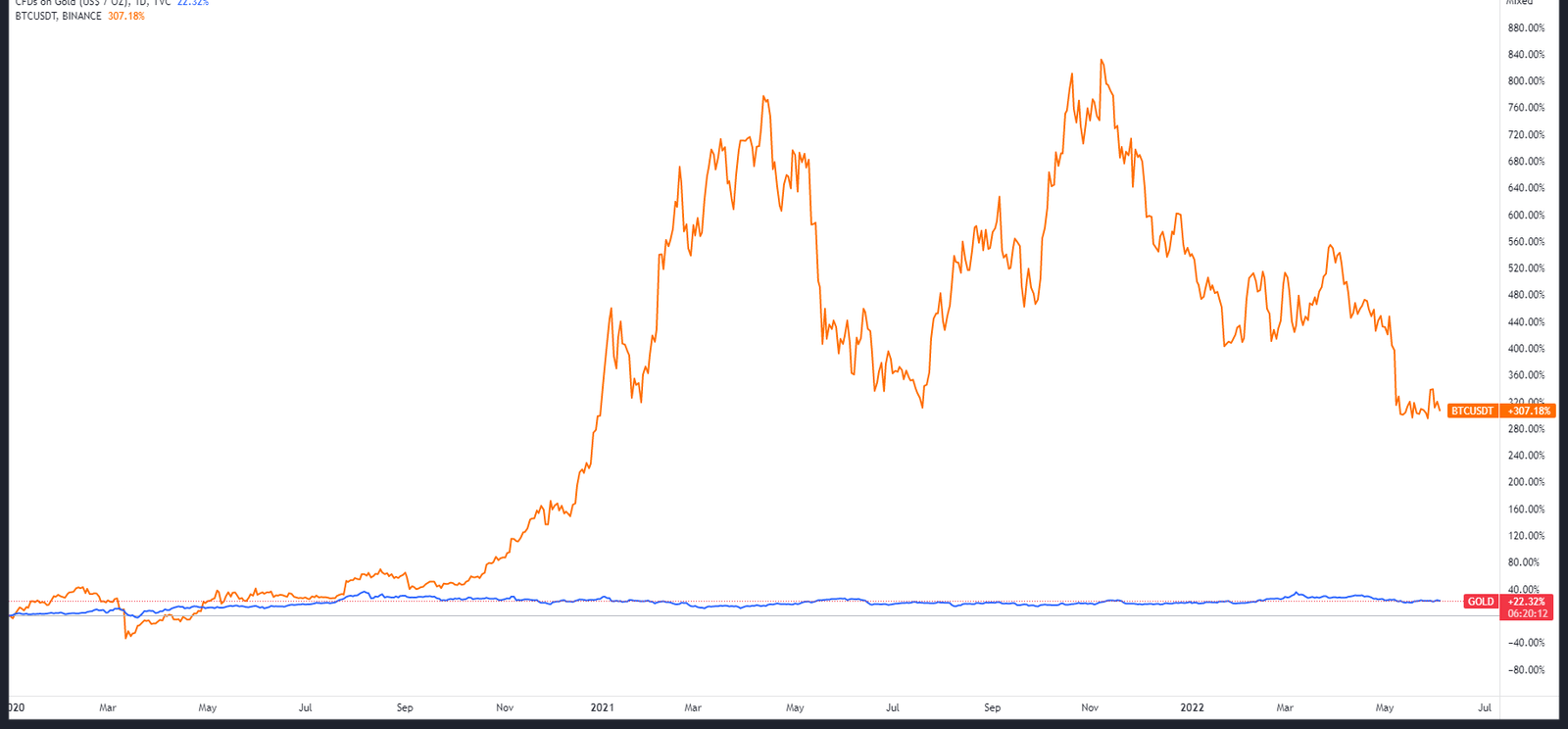

Many investors worry about Bitcoin Market volatility. Bitcoin has fluctuated dramatically over the years, but its long-term trend has been upward. Short-term volatility may prevent some investors from investing in the asset class.

Final thoughts

Despite these obstacles, Hougan’s $50 trillion Bitcoin projection shows his faith in the cryptocurrency’s future. Bitcoin is more than a speculative asset to him; it might change the entire financial landscape. Bitcoin’s market worth might reach record levels as institutional usage rises, governments understand its strategic potential, and inflationary concerns continue. This prediction is theoretical, but it shows Bitcoin’s potential to revolutionize the world economy. The financial system’s use of Bitcoin will be actively monitored by investors and analysts.