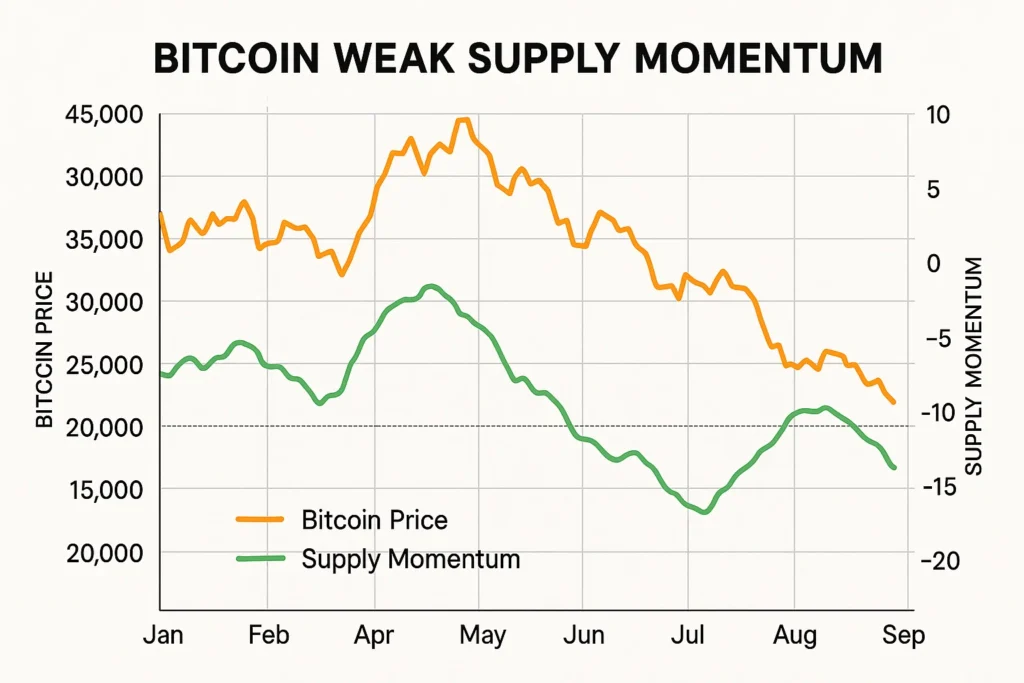

Bitcoin’s weak supply momentum has become increasingly apparent as the leading cryptocurrency struggles to maintain genuine upward pressure. While surface-level metrics might suggest bullish sentiment, a deeper 30-day momentum analysis reveals that Bitcoin’s recent gains are built on fragile foundations rather than robust market demand.

This concerning trend highlights a critical disconnect between price action and underlying market fundamentals. As institutional investors and retail traders alike scrutinize Bitcoin’s performance, understanding the nuances of supply dynamics and demand patterns becomes essential for making informed investment decisions in today’s volatile crypto landscape.

Bitcoin’s Current Market Position

Bitcoin Weak Supply Momentum: A Technical Overview

The concept of Bitcoin weak supply momentum refers to a market condition where Bitcoin’s price increases occur despite limited selling pressure rather than strong buying interest. This phenomenon creates a deceptive bullish appearance while masking underlying weakness in market conviction.

Recent on-chain data reveals several concerning indicators:

- Exchange outflows have decreased significantly, suggesting reduced accumulation activity

- Whale addresses show minimal net accumulation patterns

- Trading volumes remain below historical averages during similar price movements

- Market depth analysis indicates thin order books on major exchanges

These metrics collectively paint a picture of a market struggling to generate authentic momentum. When Bitcoin experiences weak supply conditions, prices can rise artificially due to reduced selling pressure rather than increased buying interest, creating unsustainable price levels.

Analyzing the 30-Day Momentum Indicators

The 30-day momentum analysis provides crucial insights into Bitcoin’s current trajectory. Unlike traditional technical indicators that focus solely on price movements, momentum analysis examines the underlying forces driving market behavior.

Key momentum indicators over the past 30 days include:

Volume-Weighted Average Price (VWAP): Bitcoin’s VWAP has remained relatively flat despite price increases, indicating that higher prices haven’t been supported by proportional volume increases. This suggests that Bitcoin market trends lack the conviction typically seen in genuine bull markets.

Relative Strength Index (RSI): The RSI readings show Bitcoin entering overbought territory without corresponding fundamental improvements, a classic sign of weak momentum patterns.

On-Balance Volume (OBV): OBV trends have diverged from price action, with volume failing to confirm recent price gains. This divergence is a critical warning sign that current Bitcoin price analysis reveals concerning underlying weakness.

The Supply-Demand Imbalance Reality

Dissecting Bitcoin’s Supply Dynamics

Cryptocurrency supply dynamics play a fundamental role in determining long-term price sustainability. Bitcoin’s fixed supply of 21 million coins creates natural scarcity, but the distribution and movement of existing coins significantly impact market behavior.

Recent supply analysis reveals several troubling patterns:

Dormant Bitcoin Movement: Long-term holders, often considered the backbone of Bitcoin’s stability, have shown increased movement of previously dormant coins. This suggests that conviction among strong hands may be weakening.

Mining Pool Distributions: Bitcoin mining pools have been distributing rewards more quickly to exchanges, indicating that miners are taking profits rather than accumulating for future gains.

Institutional Holdings: While some institutions continue to hold Bitcoin, the rate of new institutional accumulation has slowed dramatically compared to previous bull cycles.

The Demand Side Equation

Cryptocurrency demand analysis reveals equally concerning trends that complement the weak supply narrative. Genuine demand for Bitcoin typically manifests through multiple channels, but current data suggests limited authentic buying interest.

Retail Interest Metrics: Google search trends, social media engagement, and retail trading platform activity all show declining interest in Bitcoin despite recent price appreciation. This disconnect between price and public interest is a classic indicator of artificial momentum.

Institutional Demand: Corporate treasury additions and ETF inflows have decreased significantly, with many institutional players adopting a wait-and-see approach rather than actively accumulating Bitcoin positions.

Geographic Demand Patterns: Analysis of global Bitcoin trading patterns shows reduced activity in key markets, suggesting that the current price action lacks broad-based international support.

Market Sentiment vs. Fundamental Reality

The Psychology Behind Weak Momentum Markets

Understanding market psychology becomes crucial when analyzing Bitcoin’s current state. Weak supply momentum often creates false confidence among traders who mistake reduced selling pressure for genuine bullish sentiment.

FOMO (Fear of Missing Out) dynamics can temporarily sustain prices even in weak momentum conditions. However, these psychological factors typically prove unsustainable without underlying fundamental support.

Technical Analysis Limitations: Traditional technical analysis may provide misleading signals during weak momentum periods, as price patterns can appear bullish while underlying market health deteriorates.

Social Sentiment Indicators

Social media sentiment analysis provides additional insights into Bitcoin’s current market position. Despite recent price gains, sentiment indicators show:

- Neutral to bearish overall sentiment across major crypto communities

- Reduced engagement on Bitcoin-related content

- Increased skepticism among experienced traders and analysts

- Limited viral content generation compared to previous bull markets

These social indicators align with the technical analysis, suggesting that Bitcoin’s current upward movement lacks the enthusiasm and conviction typically associated with sustainable bull markets.

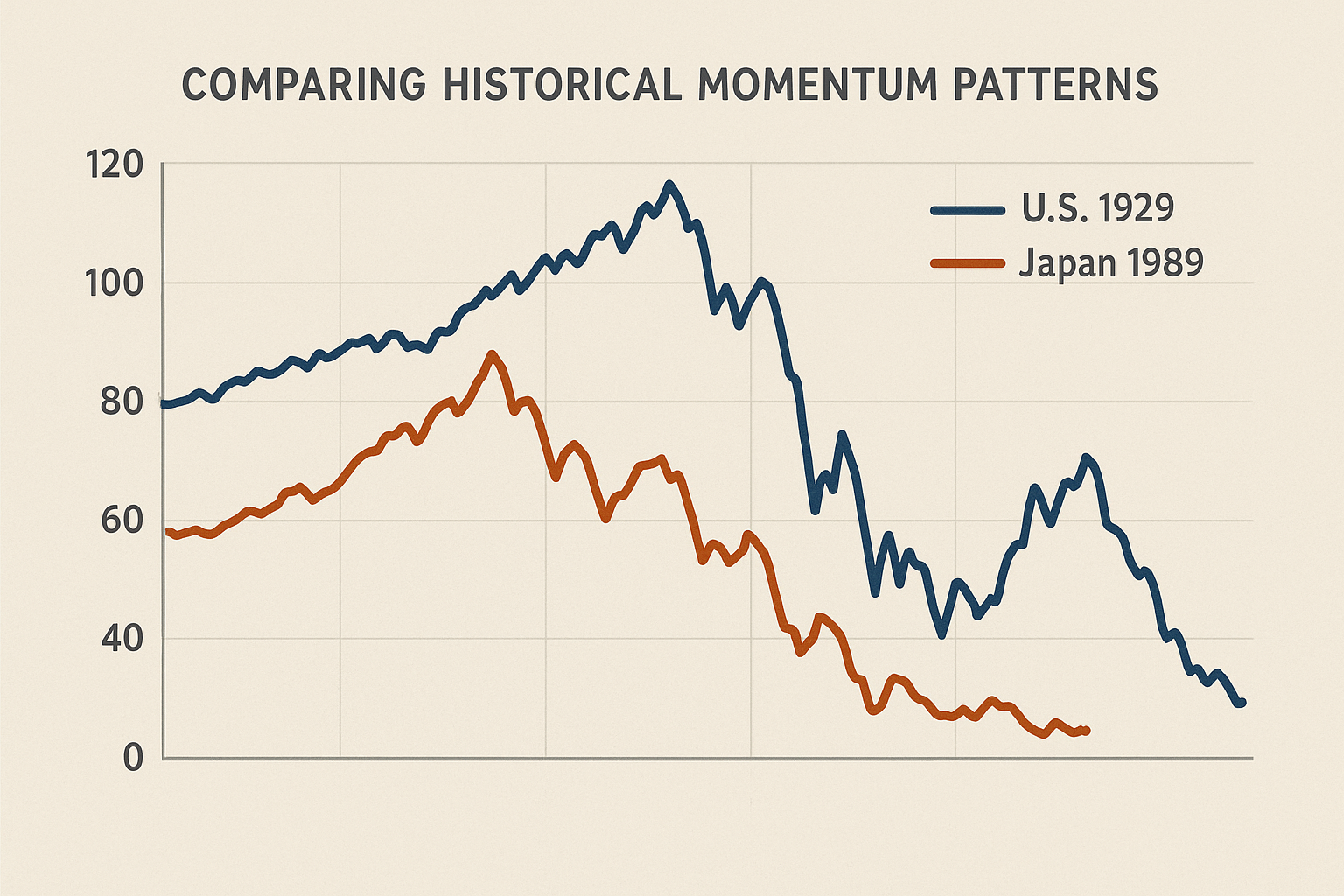

Comparing Historical Momentum Patterns

Lessons from Previous Bitcoin Cycles

Historical Bitcoin market trends provide valuable context for understanding current conditions. Comparing the present weak supply momentum with previous market cycles reveals important patterns.

2017 Bull Run: During Bitcoin’s historic 2017 surge, momentum indicators showed consistent strength across multiple metrics. Volume increased proportionally with price, institutional interest grew rapidly, and social sentiment reached euphoric levels.

2020-2021 Cycle: The institutional adoption cycle of 2020-2021 demonstrated strong momentum characteristics, including significant institutional buying, increased network activity, and sustained volume growth.

Current Cycle Comparison: The present market conditions show marked differences from previous successful bull markets, with weak momentum indicators suggesting caution is warranted.

Identifying Momentum Divergences

Momentum divergence analysis helps identify potential market turning points. Current divergences include:

Price vs. Volume Divergence: Bitcoin prices have increased while trading volume has remained subdued, a classic sign of unsustainable momentum.

Network Activity Divergence: On-chain transaction counts and network fees haven’t increased proportionally with price appreciation, suggesting limited actual utility growth.

Institutional Flow Divergence: While prices have risen, institutional investment flows have decreased, indicating reduced conviction among sophisticated investors.

Risk Assessment and Market Implications

Short-term Risk Factors

The Bitcoin weak supply momentum creates several immediate risk factors that traders and investors should consider:

Liquidity Risks: Thin order books and reduced trading volume increase the potential for significant price volatility during market stress periods.

Sentiment Reversal Risks: Current price levels may be particularly vulnerable to negative news or market sentiment shifts due to weak underlying support.

Technical Breakdown Risks: Key technical support levels may prove less reliable during weak momentum conditions, as there are fewer committed buyers to defend important price levels.

Long-term Strategic Considerations

From a strategic perspective, weak supply momentum conditions require careful portfolio management and risk assessment:

Position Sizing: Reduced position sizes may be appropriate given the uncertain momentum environment and increased downside risks.

Diversification Strategy: Over-concentration in Bitcoin during weak momentum periods may expose portfolios to unnecessary volatility and potential losses.

Time Horizon Adjustment: Investment time horizons may need adjustment to account for potentially extended periods of market uncertainty and weak momentum patterns.

Technical Analysis Deep Dive

Advanced Momentum Indicators

Professional traders utilize sophisticated tools to analyze Bitcoin market trends and identify weak momentum conditions:

Money Flow Index (MFI): Recent MFI readings suggest that Bitcoin’s price appreciation hasn’t been supported by proportional money flow, indicating potential supply-demand imbalances.

Accumulation/Distribution Line: This indicator has shown divergence from price action, suggesting that institutional and sophisticated investors may be distributing rather than accumulating Bitcoin positions.

Williams %R: Momentum oscillator readings indicate that Bitcoin may be approaching overbought conditions without corresponding fundamental strength, a hallmark of weak momentum markets.

Order Book Analysis

Market depth analysis provides insights into the quality of current support and resistance levels:

Bid-Ask Spreads: Increased spreads on major exchanges suggest reduced market-making activity and potential liquidity challenges.

Order Book Depth: Analysis of cumulative order book depth shows thinner support levels compared to previous bull market periods.

Large Order Impact: The potential price impact of large orders has increased, suggesting that the market may be more susceptible to significant price movements from institutional trading activity.

Regulatory and Macroeconomic Factors

External Market Influences

Bitcoin’s weak supply momentum doesn’t occur in isolation but is influenced by broader market conditions:

Regulatory Environment: Ongoing regulatory uncertainty in key markets continues to impact investor confidence and long-term accumulation strategies.

Macroeconomic Conditions: Global economic conditions, including inflation concerns and monetary policy changes, affect institutional and retail appetite for risk assets like Bitcoin.

Traditional Market Correlation: Bitcoin’s increasing correlation with traditional risk assets during uncertain periods may be contributing to weak momentum conditions.

Federal Reserve Policy Impact

Central bank policies significantly influence cryptocurrency demand and market momentum:

Interest Rate Environment: Current interest rate policies affect the relative attractiveness of Bitcoin as an investment alternative.

Quantitative Tightening: Reduced liquidity in traditional markets may be impacting cryptocurrency markets and contributing to weak supply momentum.

Inflation Hedge Narrative: The weakening of Bitcoin’s inflation hedge narrative may be reducing institutional demand and contributing to current momentum challenges.

Future Outlook and Scenarios

Potential Momentum Reversal Catalysts

Several factors could potentially reverse the current Bitcoin weak supply momentum trend:

Institutional Re-engagement: Renewed institutional interest and accumulation could provide the genuine demand needed to support sustainable price appreciation.

Regulatory Clarity: Clear regulatory frameworks in major markets could reduce uncertainty and encourage increased participation.

Network Development: Significant technological improvements or adoption milestones could reignite genuine interest and demand.

Downside Risk Scenarios

Conversely, several scenarios could exacerbate current weak momentum conditions:

Market Sentiment Deterioration: Continued weak performance could lead to broader market sentiment deterioration and increased selling pressure.

Institutional Exits: Large institutional holders reducing positions could overwhelm the current limited demand and trigger significant price corrections.

Regulatory Crackdowns: Adverse regulatory developments could further reduce demand and exacerbate supply-demand imbalances.

Strategic Investment Recommendations

Portfolio Management During Weak Momentum Periods

Navigating Bitcoin’s weak supply momentum requires strategic portfolio adjustments:

Risk Management: Implementing appropriate stop-loss levels and position sizing becomes crucial during uncertain momentum periods.

Diversification Benefits: Maintaining exposure to other cryptocurrency assets and traditional investments can help mitigate concentration risks.

Dollar-Cost Averaging: Systematic investment approaches may be preferable to lump-sum investments during weak momentum conditions.

Timing Considerations

Market timing becomes particularly challenging during weak supply momentum periods:

Entry Strategies: Waiting for clear momentum confirmation may be prudent before establishing significant new positions.

Exit Strategies: Having predetermined exit criteria becomes essential when momentum indicators suggest underlying weakness.

Rebalancing Frequency: More frequent portfolio rebalancing may be appropriate to manage risks associated with weak momentum markets.

Conclusion

The current Bitcoin weak supply momentum represents a critical juncture for the cryptocurrency market. While surface-level price appreciation may suggest bullish conditions, deeper analysis reveals concerning underlying trends that challenge the sustainability of recent gains.

The 30-day momentum analysis clearly demonstrates that Bitcoin’s current upward trajectory lacks the robust demand characteristics typically associated with sustainable bull markets. Cryptocurrency demand patterns, supply dynamics, and market sentiment indicators all point to a market struggling to generate authentic buying interest.

For investors and traders, understanding these Bitcoin market trends becomes essential for making informed decisions. The current environment requires heightened risk awareness, careful position management, and realistic expectations about future price performance.