Bitcoin Price Today Subdued at $95k Amid US Crypto Bill Delay, reflecting a pause in momentum as a US crypto bill speedbump introduces uncertainty into the market. After a period of strong advances and heightened optimism, Bitcoin has entered a consolidation phase that mirrors the cautious tone across broader crypto markets. Investors are weighing long-term bullish fundamentals against near-term policy friction, resulting in restrained price action around a psychologically significant level.

The $95,000 mark carries symbolic and technical importance. It represents confidence built over months of accumulation and institutional participation, while also serving as a level where traders reassess risk amid evolving regulatory signals. The current stall is not characterized by panic or capitulation, but by patience. Market participants are parsing headlines, monitoring legislative progress, and positioning for what comes next.

This comprehensive analysis explores why Bitcoin price today is subdued at $95k, how the US crypto bill speedbump is influencing sentiment, and what this environment means for short-term traders and long-term holders alike. From market structure and technical dynamics to policy implications and investor psychology, the article connects the factors shaping Bitcoin’s present and future.

Bitcoin Price Today Is Subdued at $95k

Bitcoin price today is subdued at $95k primarily because markets are digesting uncertainty rather than reacting to a definitive negative catalyst. When prices stall near highs, it often reflects a balance between buyers who believe in continued upside and sellers who are locking in profits after a strong run. The presence of a legislative speedbump adds to this equilibrium by encouraging a wait-and-see approach.

The $95k level has acted as a magnet for price discovery. Buyers defend it as a sign of strength, while sellers test it as resistance to further acceleration. This tug-of-war results in compressed volatility, a common feature when markets anticipate clarity. Bitcoin price today reflects this compression, signaling indecision rather than weakness.

Importantly, subdued price action does not equate to bearish reversal. In many historical cycles, Bitcoin consolidated near highs before resuming its trend. The current pause suggests the market is recalibrating expectations in light of policy developments rather than abandoning the broader thesis.

The US Crypto Bill Speedbump Explained

The US crypto bill speedbump refers to delays, amendments, or procedural hurdles affecting proposed legislation aimed at clarifying the regulatory framework for digital assets. While not a rejection of crypto-friendly policy, such speedbumps introduce ambiguity about timelines and final outcomes. Markets tend to dislike uncertainty, and Bitcoin price today reflects this cautious posture.

Legislative processes are inherently complex, involving negotiations, revisions, and competing priorities. Even broadly supportive bills can face delays as stakeholders seek alignment on definitions, oversight, and enforcement mechanisms. For investors, the lack of immediate resolution tempers enthusiasm without necessarily changing long-term convictions.

This speedbump matters because regulation influences institutional participation, product launches, and market structure. When clarity is delayed, capital may pause rather than retreat. Bitcoin price today subdued at $95k suggests that investors are holding positions while awaiting signals that reduce policy risk.

Market Sentiment in Crypto Markets Today

Market sentiment today is best described as cautiously constructive. There is no widespread fear, but there is restraint. Bitcoin price today reflects a market that has internalized strong fundamentals yet respects near-term uncertainty. Social sentiment and derivatives positioning indicate moderation rather than extremes.

Traders appear comfortable holding core positions while trimming leverage. Long-term holders continue to accumulate or sit tight, viewing policy delays as temporary. This blend of patience and prudence supports a stable price floor around $95k.

Sentiment cycles often oscillate between exuberance and caution. The current phase leans toward caution without tipping into pessimism. That balance helps explain why Bitcoin price today remains subdued rather than sharply corrective.

Technical Structure Supporting the $95k Level

From a technical perspective, Bitcoin price today holding near $95k suggests solid support. The market has repeatedly tested this area without significant breakdowns, indicating buyer interest. Consolidation above key moving averages reinforces the notion that the broader trend remains intact.

Volume patterns show steady participation rather than distribution. When volume dries up during consolidation, it often precedes a breakout once a catalyst arrives. Bitcoin price today appears to be coiling, with volatility compressing as traders await clarity from the policy front.

Key technical indicators point to neutrality, which aligns with the narrative of indecision. This neutrality is constructive when paired with higher-timeframe uptrends. As long as support holds, the technical case for continuation remains viable.

Institutional Positioning Amid Policy Uncertainty

Institutional investors play a critical role in shaping Bitcoin price today. Institutions tend to be sensitive to regulatory developments, adjusting exposure based on perceived risk. The US crypto bill speedbump has prompted a measured response rather than an exodus.

Large allocators often favor incremental positioning during uncertainty. They may slow new inflows or hedge exposure while maintaining core holdings. This behavior supports price stability but limits upside acceleration in the short term.

The subdued tone at $95k suggests institutions are neither aggressively buying nor selling. Instead, they are managing risk while awaiting policy clarity that could unlock further allocations. This dynamic underscores the importance of regulation in modern crypto markets.

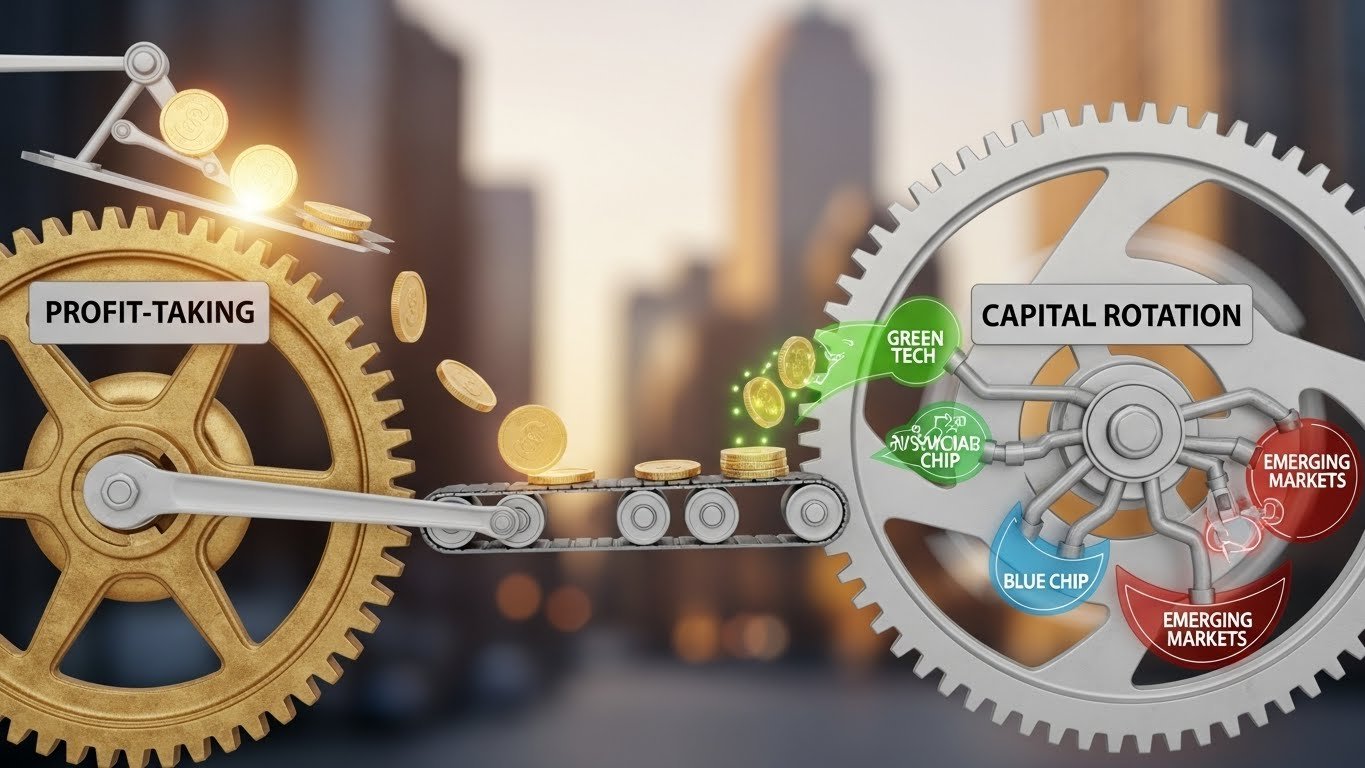

The Role of Profit-Taking and Capital Rotation

Another factor influencing why Bitcoin price today is subdued at $95k is profit-taking after substantial gains. As Bitcoin approaches milestone levels, some investors naturally realize profits. This selling is often absorbed by longer-term buyers, resulting in sideways movement.

Capital rotation also plays a role. When Bitcoin consolidates, capital may flow into other assets or remain sidelined. This rotation does not imply weakness; it reflects portfolio management strategies adapting to market conditions.

Such behavior contributes to range-bound price action. Bitcoin price today captures this balance, where selling pressure is met by demand, keeping prices anchored near support.

Macroeconomic Context and Risk Appetite

The broader macroeconomic environment influences Bitcoin price today. Global markets are navigating interest rate expectations, inflation dynamics, and growth outlooks. In this context, risk appetite fluctuates, affecting speculative assets.

Bitcoin has increasingly been viewed as digital gold, a hedge against long-term monetary debasement. This narrative supports holding during uncertainty. However, short-term traders remain sensitive to macro signals, adjusting exposure accordingly.

The US crypto bill speedbump intersects with macro considerations, amplifying caution. When multiple uncertainties converge, markets often pause. Bitcoin price today subdued at $95k reflects this intersection.

Regulatory Clarity and Long-Term Confidence

Despite near-term delays, long-term confidence in regulatory progress remains relatively strong. Many market participants believe that clearer frameworks are inevitable, even if timelines slip. This belief underpins resilience in Bitcoin price today.

Regulatory clarity is expected to facilitate broader adoption, including spot crypto ETFs, institutional custody solutions, and mainstream financial integration. Delays slow momentum but do not negate these trends.

As a result, investors differentiate between temporary friction and structural setbacks. The current speedbump is viewed as the former, supporting patience and stability around $95k.

Bitcoin Dominance and Market Leadership

Bitcoin’s dominance remains a stabilizing force. When uncertainty rises, capital often consolidates in Bitcoin rather than dispersing into higher-risk assets. This behavior supports Bitcoin price today while dampening volatility elsewhere.

Leadership matters during policy-driven uncertainty. Bitcoin’s liquidity, recognition, and infrastructure make it the preferred asset for cautious positioning. This preference helps explain why Bitcoin holds its ground while markets digest legislative developments.

Dominance cycles can influence future moves. A stable Bitcoin often sets the stage for renewed activity once uncertainty clears.

Short-Term Outlook for Bitcoin Price Today

In the short term, Bitcoin price today is likely to remain range-bound until the policy narrative evolves. Traders will watch for headlines that clarify the fate of the US crypto bill or signal progress through legislative stages.

Breakouts typically require catalysts. In their absence, consolidation persists. This environment favors strategies that emphasize patience, risk management, and selective positioning.

As volatility compresses, the probability of a decisive move increases. Whether that move is upward or downward depends on the nature of forthcoming news. For now, stability at $95k suggests balance.

Long-Term Outlook Beyond the Speedbump

Looking beyond the immediate speedbump, the long-term outlook remains constructive. Adoption trends, institutional participation, and technological maturation continue to support Bitcoin’s thesis.

Policy delays may even strengthen outcomes by producing more robust frameworks. Thorough legislation can provide durable clarity, reducing future uncertainty. Investors who understand this dynamic may view the current pause as an opportunity rather than a threat.

Bitcoin price today subdued at $95k fits within a broader pattern of consolidation during maturation phases. History suggests that such phases often precede renewed trends once uncertainty resolves.

Investor Strategies in the Current Environment

Investors are adapting strategies to the current environment. Long-term holders focus on fundamentals and accumulation, while traders emphasize range trading and risk controls. This diversity of approaches contributes to market stability.

Risk management is paramount. With policy uncertainty in play, avoiding excessive leverage becomes critical. Bitcoin price today reflects a market that has internalized this lesson, favoring sustainability over speculation.

Strategic patience often proves rewarding during consolidation. Investors who align positions with time horizons are better equipped to navigate policy-driven pauses.

What the US Crypto Bill Speedbump Signals for Policy

The speedbump itself signals engagement rather than rejection. Legislative debate indicates that crypto remains a priority topic. While delays can frustrate markets, they also suggest that policymakers are grappling with complexity rather than sidelining the issue.

This engagement bodes well for long-term integration. Bitcoin price today subdued at $95k reflects respect for the process rather than fear of outcomes.

Understanding policy dynamics helps contextualize price action. Markets move not only on outcomes but on expectations and timelines.

The Psychological Impact of Round Numbers

Psychology plays a subtle role at round numbers like $95k. Such levels attract attention, orders, and narratives. Traders anchor expectations to these milestones, intensifying consolidation.

Bitcoin price today hovering near this level reflects collective focus. Breaking decisively above or below would require conviction. Until then, the market tests resolve on both sides.

Psychological levels often become battlegrounds. The current standoff suggests neither side has overwhelming advantage.

Conclusion

Bitcoin price today is subdued at $95k as a US crypto bill speedbump tempers momentum and encourages caution. This pause reflects uncertainty rather than weakness, with buyers and sellers balanced amid evolving policy signals. Technical support remains intact, institutional positioning is measured, and long-term confidence persists.

The current environment underscores the maturing nature of crypto markets, where policy developments meaningfully influence behavior. As clarity emerges, Bitcoin is positioned to respond decisively. For now, stability at $95k represents patience, resilience, and anticipation rather than retreat.

FAQs

Q: Why is Bitcoin price today subdued at $95k instead of breaking higher?

Bitcoin price today is subdued at $95k because markets are waiting for clarity around a US crypto bill. The uncertainty encourages consolidation rather than aggressive buying or selling.

Q: What does the US crypto bill speedbump mean for Bitcoin’s future?

The speedbump suggests delays, not rejection. While it slows short-term momentum, it does not undermine long-term adoption and may lead to more durable regulatory clarity.

Q: Is consolidation at $95k a bearish signal for Bitcoin price today?

Consolidation is not inherently bearish. It often indicates balance and accumulation, especially when price holds above key support levels.

Q: How are institutional investors reacting to the current policy uncertainty?

Institutions are managing risk by maintaining core positions and moderating new inflows. This behavior supports price stability while limiting short-term upside.

Q: What should investors watch next for Bitcoin price today?

Investors should monitor legislative updates, technical support levels, and broader market sentiment. Clear policy signals could act as the catalyst for the next major move.