The bitcoin price prediction 2025 news landscape has become increasingly bullish as the world’s largest cryptocurrency continues its remarkable ascent toward unprecedented heights. With Bitcoin recently touching new all-time highs above $123,000 in July 2025, market analysts and institutional investors are revising their forecasts upward, creating a compelling narrative for the remainder of the year.

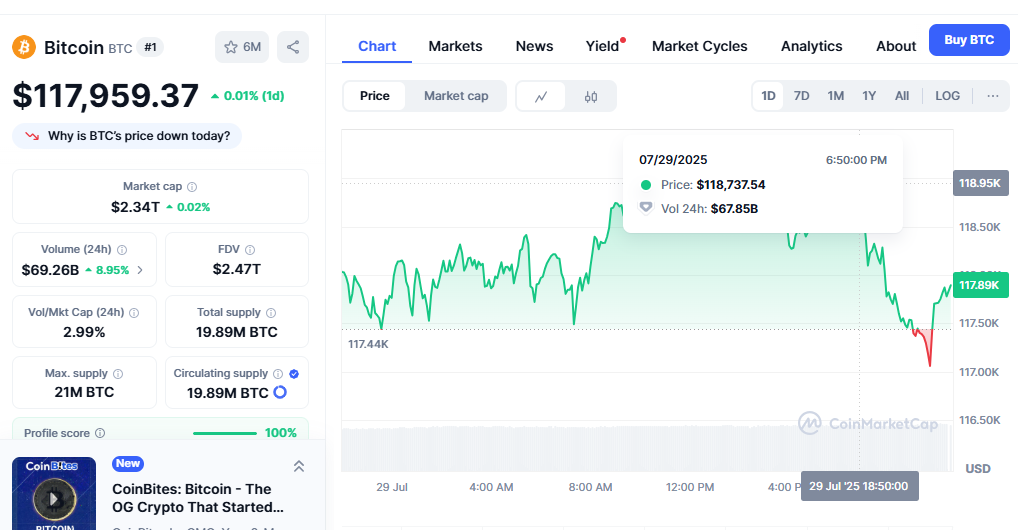

Current market dynamics indicate that Bitcoin is trading at approximately $118,927, marking a significant milestone in its journey toward mainstream financial adoption. The convergence of institutional investment, regulatory clarity, and technological innovation has fundamentally transformed the cryptocurrency’s investment thesis, making 2025 a pivotal year for digital asset markets.

Leading financial institutions, including Citigroup and BlackRock, have published increasingly optimistic projections that could see Bitcoin reaching $200,000 by year-end. This dramatic shift in traditional finance’s perception of cryptocurrency marks a watershed moment in Bitcoin’s evolution from speculative asset to institutional-grade investment vehicle.

Latest Bitcoin Price Prediction 2025 News from Major Institutions

BlackRock and ETF Revolution Drive Price Momentum

The most significant development in Bitcoin price prediction 2025 news is the explosive growth of Bitcoin exchange-traded funds (ETFs). BlackRock’s iShares Bitcoin Trust (IBIT) has accumulated over $76.5 billion in assets under management, positioning itself as one of the largest cryptocurrency investment vehicles globally.

Bitcoin ETF inflows have reached $14.8 billion in 2025, representing a 300% increase year-over-year. This institutional capital influx has fundamentally altered Bitcoin’s price dynamics, with ETFs now accounting for 85% of Bitcoin’s price volatility.

The ETF phenomenon extends beyond simple investment vehicles. Over 50 publicly traded companies now hold Bitcoin on their balance sheets, treating the cryptocurrency as a strategic treasury asset rather than a speculative investment. This corporate adoption trend suggests that Bitcoin’s integration into traditional finance is accelerating at an unprecedented pace.

Citigroup’s Aggressive $200K Forecast

Citigroup has issued a highly bullish price prediction for Bitcoin, outlining scenarios for 2025 with a base case targeting $135,000 and a more optimistic scenario projecting a price near $200,000. The investment bank’s analysis emphasises that over 40% of Bitcoin’s price movements in 2024 have been directly linked to ETF activity.

This institutional backing represents a significant shift in how Bitcoin is perceived and valued. Traditional metrics, such as stock-to-flow models, are being superseded by institutional capital flows, creating a new framework for price discovery in cryptocurrency markets.

Technical Analysis and Market Indicators Signal Continued Growth

Current Price Action and Support Levels

Bitcoin’s technical outlook remains overwhelmingly bullish despite recent consolidation around $118,000. Key technical indicators suggest the cryptocurrency is well-positioned for another leg higher, with several necessary support and resistance levels emerging.

The 200-day exponential moving average has been rising consistently since December 2024, providing strong support for the longer-term trend. Weekly Relative Strength Index readings above 70 indicate robust buying momentum, though they also suggest caution for short-term traders regarding potential overbought conditions.

Support levels have established themselves at $115,000 and $112,000, representing significant institutional buying zones. Resistance levels are evolving dynamically, with $125,000 emerging as the next significant psychological barrier following Bitcoin’s recent all-time high breakthrough.

Volume and Momentum Indicators

Trading volume analysis reveals sustained institutional participation, with daily volumes frequently exceeding $5 billion across spot and ETF markets. This volume profile differs markedly from previous bull cycles, indicating that current price action is driven by institutional rather than retail speculation.

Momentum indicators, including the Moving Average Convergence Divergence (MACD), continue to flash bullish signals on longer timeframes. The convergence of technical and fundamental factors creates a compelling case for continued price appreciation throughout 2025.

Expert Bitcoin Price Prediction 2025 News Compilation

Industry Leaders’ Forecasts

The crypto industry’s most respected analysts have published increasingly bullish forecasts for Bitcoin’s performance in 2025. Finder.com’s expert panel predicts an average year-end Bitcoin price of $145,167, with some panellists forecasting prices as high as $250,000.

Standard Chartered’s Geoffrey Kendrick maintains his prediction that Bitcoin will hit $200,000 by the end of 2025, citing continued institutional flows and favourable regulatory developments. The bank expects institutional flows into Bitcoin to continue at or above the 2024 pace next year.

Notable predictions from other industry figures include:

- CoinShares’ James Butterfill: Sees both $150,000 and $80,000 as possible targets for 2025

- Matrixport’s Markus Thielen: Forecasts $160,000 supported by sustained ETF demand

- Galaxy Digital’s Alex Thorn: Expects Bitcoin to cross $150,000 in the first half of 2025

Conservative vs. Bullish Scenarios

Market analysts have developed multiple scenarios for Bitcoin’s 2025 trajectory, ranging from conservative to extremely bullish outcomes. The conservative scenario, which accounts for potential market corrections and regulatory uncertainties, suggests a trading range of between $100,000 and $150,000.

Moderate projection centred around $125,000 to $175,000, assuming continued institutional adoption and stable macroeconomic conditions. The most bullish scenarios, supported by accelerating institutional adoption and potential strategic bitcoin reserves by nation-states, target a price range of $200,000 to $250,000.

Institutional Adoption Trends Reshaping Bitcoin Markets

Corporate Treasury Strategies

The corporate adoption of Bitcoin as a treasury asset represents one of the most significant developments in recent cryptocurrency history. Companies like MicroStrategy have pioneered this approach, with many others following suit as inflation concerns and currency devaluation risks persist.

Galaxy predicts five Nasdaq 100 companies and five nation-states will add Bitcoin to their balance sheets or sovereign wealth funds in 2025. This trend could create substantial supply shocks, given Bitcoin’s finite supply of 21 million coins.

Corporate bitcoin adoption extends beyond simple treasury holdings. Companies are integrating Bitcoin into their core business strategies, creating new revenue streams and hedging mechanisms against traditional financial market volatility.

Nation-State Adoption and Strategic Reserves

El Salvador’s pioneering adoption of Bitcoin has inspired other nations to consider similar strategies. El Salvador is issuing $500 million worth of Bitcoin-backed bonds, executed on-chain through the Liquid Network, marking a landmark approach for nations aiming to leverage Bitcoin’s capabilities in financing.

The concept of strategic Bitcoin reserves is gaining traction among smaller nations seeking alternatives to traditional reserve currencies. This trend could accelerate significantly if early adopters demonstrate successful economic outcomes from their Bitcoin strategies.

Regulatory Developments Supporting Price Growth

US Regulatory Clarity

The introduction of the CLARITY Act in the United States has provided a crucial regulatory framework for Bitcoin’s continued institutional adoption. The CLARITY Act classifies Bitcoin as a digital commodity, providing regulatory clarity that has reassured institutional investors.

This regulatory progress represents a significant milestone in Bitcoin’s journey toward mainstream acceptance. Clear regulatory guidelines enable traditional financial institutions to develop comprehensive Bitcoin investment strategies, free from regulatory uncertainty.

Global Regulatory Trends

International regulatory developments continue to support the institutional adoption of Bitcoin. The European Union’s Markets in Crypto-Assets (MiCA) regulation provides a framework for cryptocurrency operations, while other jurisdictions are developing their supportive regulatory environments.

These regulatory advancements create a favourable global environment for Bitcoin investment, reducing regulatory risk premiums and enabling broader institutional participation in cryptocurrency markets.

Market Risks and Considerations for 2025

Potential Downside Scenarios

Despite an overwhelmingly bullish sentiment, several risk factors could impact Bitcoin’s performance in 2025. Regulatory changes, particularly in major jurisdictions, could create temporary market disruptions. Additionally, macroeconomic factors such as interest rate changes or global financial instability could affect risk asset valuations.

Technical corrections remain a regular part of Bitcoin’s price discovery process. Historical data suggests that even during strong bull markets, corrections of 20-30% are common and healthy for long-term price stability.

Security and Infrastructure Concerns

The $2.47 billion in crypto stolen during H1 2025 underscores ongoing security challenges in the broader cryptocurrency ecosystem. While Bitcoin itself remains secure, broader ecosystem vulnerabilities could create temporary market uncertainty.

Infrastructure developments, including the proposed quantum-resistant address upgrades, demonstrate the Bitcoin network’s commitment to long-term security and resilience. These proactive measures help maintain institutional confidence in Bitcoin’s long-term viability.

Also Read: Bitcoin to $200,000 in 2025? Technical Analysis & Market Trends Explained

Long-term Implications Beyond 2025

2030 and Beyond Projections

Looking beyond 2025, expert projections become even more ambitious. By 2030, Bitcoin’s projected price range is expected to span from $198,574 (bearish) to $295,577 (bullish), with an average estimate of $266,129. Some analysts project even higher valuations, with Cathie Wood’s ARK Invest targeting $2.4 million by 2030.

These long-term projections assume continued institutional adoption, technological advancement, and Bitcoin’s evolution into a global reserve asset. The finite supply dynamics of Bitcoin’s 21 million coin limit continue to underpin these bullish long-term scenarios.

Infrastructure and Technology Development

Bitcoin’s technological roadmap includes significant upgrades designed to enhance scalability, security, and functionality. The Lightning Network’s continued development enables faster, cheaper transactions, while proposed quantum-resistant improvements ensure long-term network security.

These technological advancements support Bitcoin’s evolution from digital gold to a comprehensive financial infrastructure, potentially enabling new use cases and adoption scenarios that could drive demand significantly higher.

Conclusion

The convergence of institutional adoption, regulatory clarity, and technological advancement creates an unprecedented foundation for Bitcoin’s continued growth in 2025. Bitcoin price predictions for 2025 consistently point toward significant upside potential, with expert forecasts ranging from conservative $125,000 targets to ambitious $250,000 projections.

Current market dynamics indicate that Bitcoin has entered a new phase of its evolution, transitioning from a speculative asset to an institutional-grade investment vehicle. The $14.8 billion in ETF inflows, combined with corporate treasury adoption and favourable regulatory developments, provide fundamental support for continued price appreciation.