Bitcoin Price Falls as BTC Struggles Above $70,000 the latest Bitcoin price falls narrative has captured the attention of traders and investors worldwide as the cryptocurrency struggles to break back above the crucial $70,000 level. After a period of strong rallies and renewed optimism, the market has entered a phase of consolidation marked by volatility, hesitation, and shifting sentiment. The inability of Bitcoin to sustain momentum above this psychological threshold has sparked debates about whether the current trend is merely a temporary pause or a sign of deeper structural weakness.

Bitcoin has long been known for its cyclical price movements, characterized by sharp rallies followed by corrections and consolidation phases. In this environment, key resistance levels often play a decisive role in shaping market sentiment. The $70,000 mark has emerged as a critical barrier, acting as both a psychological and technical threshold that the market has struggled to overcome.

As the crypto market evolves, multiple factors influence Bitcoin’s trajectory. These include macroeconomic trends, institutional participation, regulatory developments, and on-chain metrics. Understanding the reasons behind the Bitcoin price falls narrative requires a closer look at both technical indicators and fundamental drivers.

Bitcoin Price Falls as BTC Struggles

The current Bitcoin price falls scenario revolves around the market’s repeated failure to reclaim the $70,000 level. This price zone has become a significant resistance level, where selling pressure increases and bullish momentum weakens.

From a technical perspective, resistance occurs when traders begin taking profits or opening short positions at specific price levels. In Bitcoin’s case, the $70,000 range represents a psychologically important milestone. Whenever the price approaches this zone, market participants tend to lock in gains, creating downward pressure.

Additionally, the presence of overbought conditions in previous rallies has contributed to the recent decline. Technical indicators such as momentum oscillators suggested that Bitcoin was due for a period of consolidation, which is now playing out.

Technical Analysis of the Current Bitcoin Structure

Technical analysis provides deeper insights into why the Bitcoin price falls and struggles to regain higher levels.

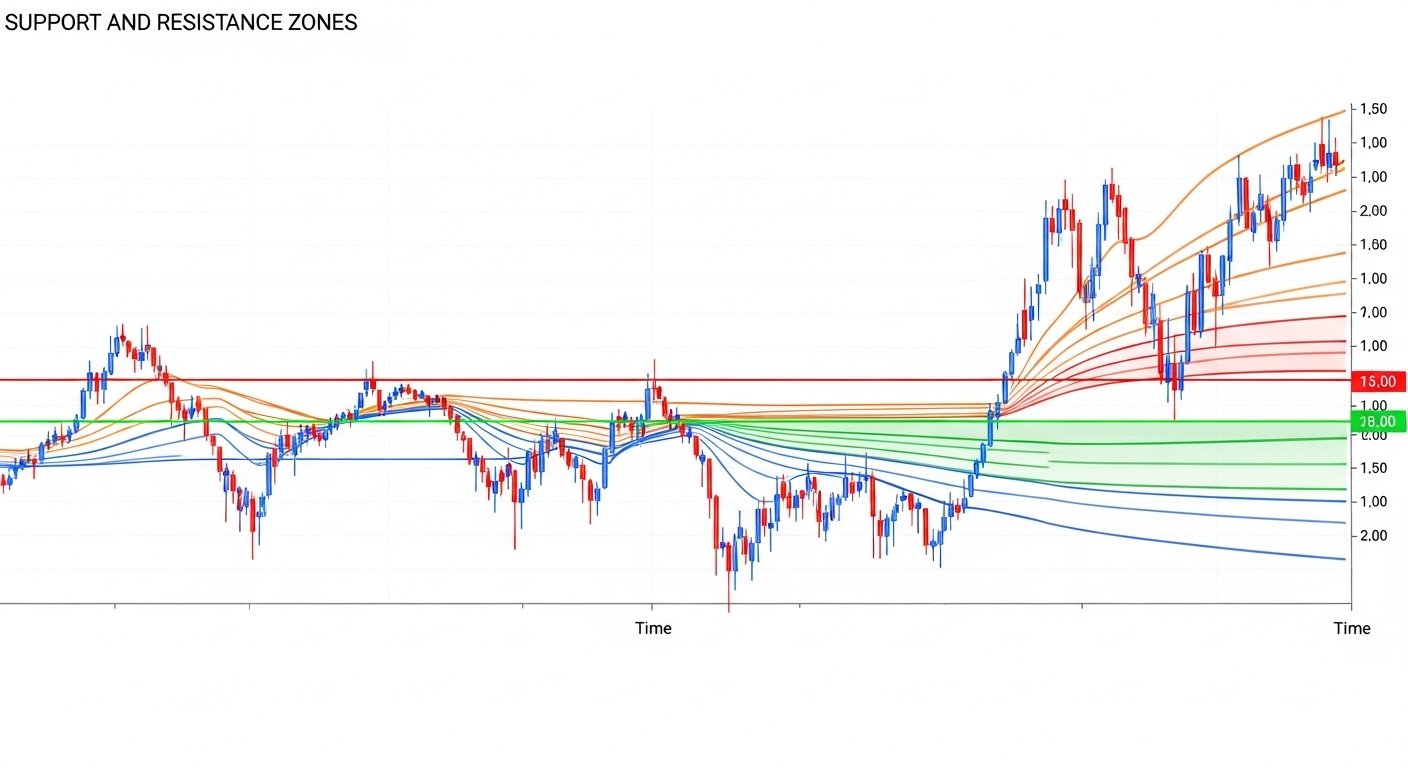

Support and Resistance Zones

The $70,000 level has acted as a strong technical resistance. Each attempt to break above it has faced selling pressure, preventing sustained upward movement. Below this level, the $65,000–$67,000 range has emerged as a key support zone.

This support area represents a region where buying interest typically increases. If Bitcoin holds above this range, the broader bullish structure may remain intact. However, a breakdown below support could trigger further downside.

Trend Indicators and Momentum

Long-term trend indicators still suggest that Bitcoin remains within a broader upward cycle. However, short-term momentum has weakened, leading to the current consolidation phase.

Moving averages, relative strength indicators, and volume trends all point toward reduced bullish momentum. This does not necessarily signal a reversal, but rather a cooling-off period after strong gains.

Macroeconomic Pressures on Bitcoin

Beyond technical factors, macroeconomic conditions are playing a significant role in the Bitcoin price falls narrative.

Interest Rates and Monetary Policy

Central bank policies have a direct impact on risk assets, including cryptocurrencies. Decisions by institutions such as the Federal Reserve influence liquidity conditions across global markets.

When interest rates remain high, investors often shift capital toward safer assets that offer stable returns. This reduces demand for riskier assets like Bitcoin. Conversely, when rates decline, cryptocurrencies tend to benefit from increased liquidity and investor appetite for growth assets. The current macro environment, marked by cautious central bank policies, has contributed to the hesitation around the $70,000 level.

Strength of the U.S. Dollar

The strength of the U.S. dollar also plays a crucial role in Bitcoin’s price action. A stronger dollar often correlates with weaker performance in cryptocurrencies, as investors seek stability in traditional financial assets.

In recent weeks, fluctuations in the dollar index have added pressure to Bitcoin, reinforcing the market volatility seen around key resistance levels.

Role of Institutional Investors

Institutional participation has become one of the most influential factors in Bitcoin’s price movements. Large funds, asset managers, and corporations now hold significant amounts of Bitcoin, making their actions critical to market trends.

Profit-Taking by Large Holders

After strong rallies, institutional investors often engage in profit-taking. This creates temporary selling pressure, especially near major resistance levels like $70,000.

Large sell orders from institutions can influence market sentiment, triggering additional selling from retail traders and short-term speculators.

Long-Term Institutional Outlook

Despite short-term selling, many institutions still maintain a long-term bullish outlook on Bitcoin. The asset is increasingly viewed as a digital store of value and a hedge against inflation.

Institutional demand remains a key pillar supporting the broader market structure, even as short-term corrections occur.

On-Chain Data and Market Sentiment

On-chain metrics provide valuable insights into the behavior of Bitcoin holders and the overall health of the network.

Exchange Flows and Supply Trends

One notable trend is the movement of Bitcoin between exchanges and private wallets. When coins leave exchanges, it often signals long-term holding behavior. Conversely, increased exchange inflows can indicate potential selling pressure.

Recent data shows mixed signals, with some investors moving coins to exchanges while others continue accumulating. This reflects a period of uncertainty and consolidation.

Sentiment Indicators

Market sentiment has cooled slightly after the failure to break above $70,000. Fear and greed indices, social media trends, and trading volumes all suggest a more cautious outlook among traders. However, sentiment shifts quickly in the crypto market. A successful breakout above resistance could rapidly restore bullish confidence.

The Psychological Barrier of $70,000

Round numbers play a powerful role in financial markets, and the $70,000 level is no exception. Such levels often act as psychological resistance, influencing trader behavior.

When Bitcoin approaches $70,000, many investors perceive it as a natural point to take profits. This creates increased selling pressure and makes it harder for the price to break through. Once a psychological barrier is convincingly broken, it often turns into a support level. If Bitcoin manages to hold above $70,000, it could pave the way for further gains.

Short-Term Outlook for Bitcoin

In the short term, the Bitcoin price falls scenario may continue if resistance remains intact. Consolidation around the mid-$60,000 range appears likely as the market searches for direction.

Short-term traders may focus on support levels and momentum indicators to gauge the next move. A break below key support could trigger further corrections, while a strong rebound could lead to another attempt at the $70,000 level.

Long-Term Outlook and Market Cycles

Despite short-term weakness, the long-term outlook for Bitcoin remains positive according to many analysts. Bitcoin operates in cyclical patterns, often tied to its halving events and broader macroeconomic conditions. Historically, consolidation phases have preceded major rallies.

Long-term investors often view corrections as opportunities to accumulate, reinforcing the bullish market cycle over time.

Risks That Could Push Bitcoin Lower

Several factors could extend the Bitcoin price falls narrative. Regulatory developments remain one of the most significant risks. Changes in government policies or restrictions on cryptocurrency trading could impact market confidence.

Macroeconomic uncertainty is another risk factor. If interest rates remain high or economic conditions deteriorate, risk assets like Bitcoin could face additional pressure. Market sentiment also plays a critical role. Negative news, large liquidations, or sudden shifts in investor behavior can trigger rapid price declines.

Potential Catalysts for a Break Above $70,000

While Bitcoin currently struggles at resistance, several factors could drive a breakout. Increased institutional inflows, favorable macroeconomic conditions, or positive regulatory developments could all support higher prices. Technically, a surge in trading volume and strong momentum could push Bitcoin above the $70,000 level. Once this barrier is cleared, it may open the door to new all-time highs.

Conclusion

The current Bitcoin price falls narrative reflects a period of consolidation rather than a definitive trend reversal. The cryptocurrency’s struggle to break above $70,000 highlights the importance of psychological resistance, macroeconomic influences, and shifting market sentiment.

While short-term pressure remains, the broader structure of the market continues to show signs of resilience. Institutional demand, long-term adoption trends, and historical market cycles all suggest that Bitcoin’s long-term outlook remains positive. As the market evolves, the $70,000 level will remain a critical threshold. A successful breakout could reignite bullish momentum, while continued resistance may lead to further consolidation.

FAQs

Q: Why is the Bitcoin price falling near the $70,000 level?

The Bitcoin price is falling near $70,000 primarily due to strong resistance at that psychological and technical level. Traders often take profits near round numbers, and institutional selling can add pressure. Combined with macroeconomic uncertainty and reduced momentum, these factors have contributed to the recent price weakness.

Q: Is the current Bitcoin decline a sign of a long-term bearish trend?

Not necessarily. Many analysts view the current decline as a consolidation phase within a broader bullish cycle. Bitcoin has historically experienced corrections after strong rallies, and these periods often precede new upward trends. Long-term indicators still suggest a positive outlook.

Q: How do macroeconomic factors influence Bitcoin’s price?

Macroeconomic factors such as interest rates, inflation, and currency strength directly impact investor behavior. Higher interest rates often reduce demand for risk assets like Bitcoin, while lower rates and increased liquidity tend to support cryptocurrency prices.

Q: What role do institutional investors play in Bitcoin’s price movements?

Institutional investors hold large amounts of Bitcoin and can influence market trends through their buying and selling decisions. Profit-taking by institutions can create short-term price declines, while long-term accumulation can support sustained growth.

Q: What could help Bitcoin break above the $70,000 resistance?

A combination of strong trading volume, positive macroeconomic conditions, institutional inflows, and improved market sentiment could help Bitcoin break above $70,000. Once this level is surpassed and held as support, it may lead to further upward momentum.