Bitcoin price above $90K sparks altcoin rally and drives significant upward momentum across the market. Today’s surge in the digital asset ecosystem reflects renewed bullish sentiment and heightened investor activity, drawing attention from traders, analysts, and crypto enthusiasts alike. For months leading up to this point, the market has experienced fluctuating trends and periods of consolidation, but this latest upswing signals that confidence may be returning to the sector.

The flagship cryptocurrency, has long been seen as a bellwether for overall market performance. When Bitcoin shows strength, it often sets the stage for a broader crypto market rally, lifting the value of altcoins such as Ethereum, Solana, Ripple, and others. With Bitcoin hovering above the psychologically significant $90,000 mark, traders are keenly watching whether this level can be maintained and whether the altcoin market can sustain its upward trajectory.

Understanding why the crypto market is up today requires a deep look at the interplay of technical indicators, macroeconomic forces, investor psychology, and fundamental developments. This article breaks down the key drivers behind this price movement and explores how Bitcoin’s resurgence is influencing the broader crypto ecosystem. In doing so, we’ll touch on technical patterns, institutional involvement, regulatory impacts, and future outlooks that help explain the current rally.

Bitcoin’s Role as Market Leader

Bitcoin has historically acted as the anchor for the broader cryptocurrency market, often setting the tone for price action among digital assets. Today’s rally, marked by Bitcoin price above $90K, is a major psychological milestone that many investors view as a sign of renewed strength and resilience. When Bitcoin breaks through such key levels, it often instills confidence across the market and encourages renewed buying interest from both retail and institutional players.

The significance of staying above $90,000 cannot be overstated. In technical analysis, key price levels often act as support or resistance; crossing and holding above a major threshold can shift market sentiment and trigger buying momentum. For many traders, this breakout indicates that the market may be poised for further gains, prompting them to enter or increase positions in both Bitcoin and altcoins.

Technical Indicators and Market Strength

Technical indicators such as trading volume, moving averages, and momentum oscillators play a critical role in signaling market direction. In the current environment, rising trading volumes and improving momentum metrics suggest that the market is not merely experiencing a short-lived spike but may be forming a more sustainable uptrend. These technical signals often attract more participants, which raises liquidity and further supports price growth.

Analysts often look for patterns such as trend reversals or consolidations breaking into new upward movements. When Bitcoin sustains levels above important resistance like $90K, it may draw in algorithmic trading strategies and potentially trigger long-term strategic positioning from larger holders, creating ripple effects across cryptocurrency markets.

Broader Economic Context

Global economic conditions always play a role in shaping crypto markets, as digital assets are increasingly viewed through the lens of risk appetite, inflation expectations, and monetary policy. As investors cross between traditional financial markets and crypto assets, shifts in macro trends can influence demand. For example, expectations regarding interest rate decisions or shifts in fiscal policy sometimes prompt investors to reposition capital, which can impact both traditional and digital markets.

In addition, geopolitical developments and trade tensions have historically prompted capital flows into alternative investment assets like Bitcoin. These macro forces can contribute to periods of volatility or rally, especially when investors seek to hedge against inflation or currency instability.

Regulatory Developments and Institutional Confidence

Regulatory clarity and institutional involvement are pivotal in determining the direction of the crypto market. In recent years, efforts to establish clearer regulatory frameworks have helped reduce uncertainty and attract more participation from institutional investors. Spot Bitcoin ETFs and other regulated products have made it easier for traditional financial institutions to engage with digital assets, which in turn can help stabilize and drive demand.

Although regulatory landscapes vary by jurisdiction, positive developments, such as favorable rulings on exchange operations and the integration of digital assets within institutional portfolios, have supported an environment where price appreciation becomes more feasible. As regulatory clarity improves, institutions may feel more secure about deploying capital into Bitcoin and other cryptocurrencies, contributing to market rallies.

Ethereum and Smart Contract Platforms

Bitcoin’s push above $90,000 has been accompanied by positive price movements among leading altcoins. Ethereum, the largest smart contract platform, has maintained strength above $3,000—a key psychological level for many traders—and its performance often serves as an indicator of broader ecosystem health.

Ethereum’s resilience reflects its fundamental importance in decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized applications (dApps). As Bitcoin gains momentum, capital flows into Ethereum and other high-cap altcoins increase, creating a well-rounded crypto market rally.

Broader Altcoin Market Dynamics

Beyond Ethereum, various altcoins have shown notable gains in recent sessions. Increased liquidity and speculative interest have driven prices upward, with some smaller tokens experiencing even more pronounced rallies. These movements often occur when market sentiment shifts from fear to optimism, and traders are willing to diversify holdings beyond Bitcoin.

The dynamics of the broader altcoin market illustrate how interconnected cryptocurrency markets have become. Bitcoin’s performance frequently influences broader risk sentiment, encouraging movement in altcoins as traders chase higher returns or hedge against Bitcoin’s volatility.

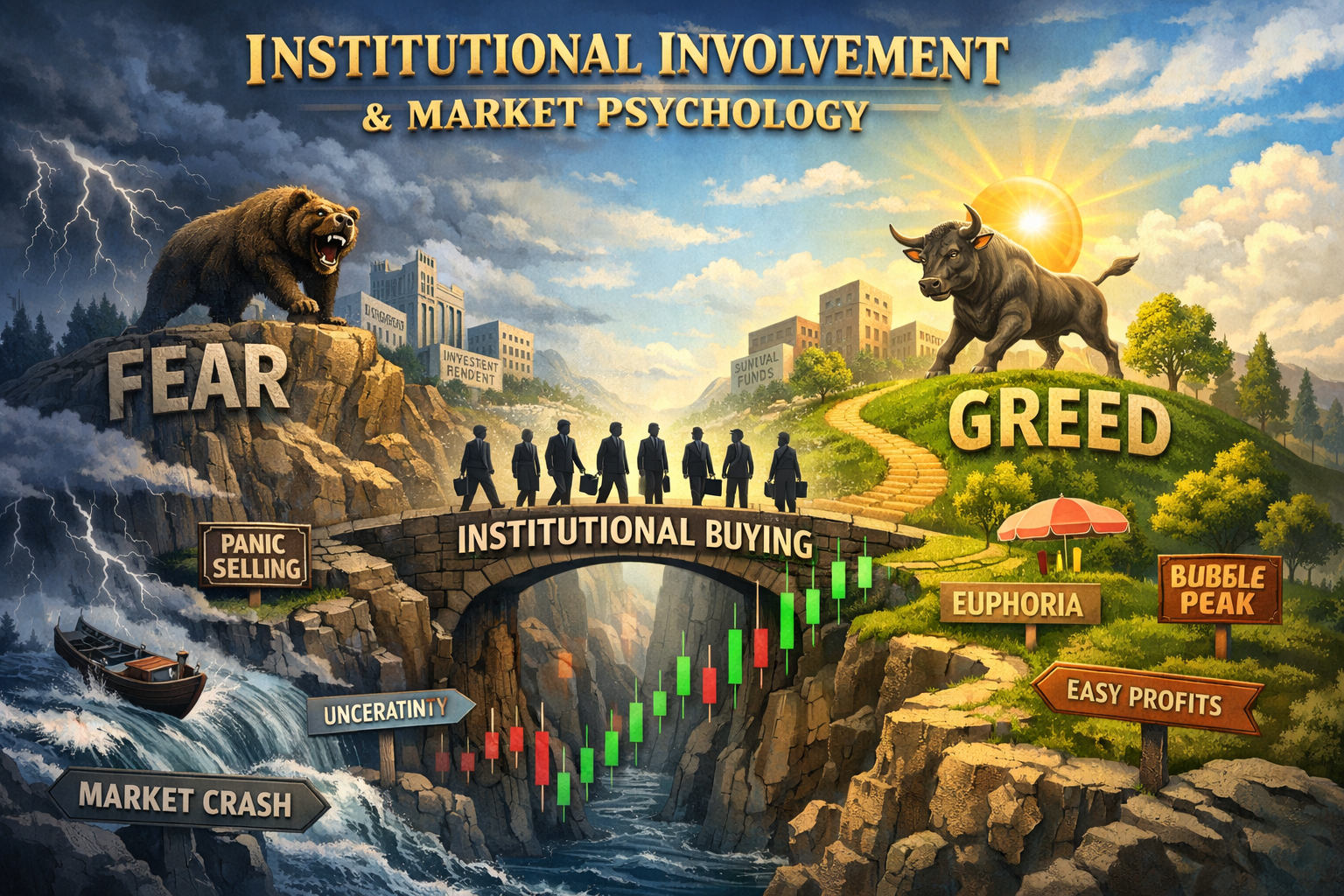

Institutional Involvement and Market Psychology

Institutional Investment Trends

One of the defining themes in the evolution of the crypto market over the past several years has been the growing involvement of institutional investors. Entities such as hedge funds, corporate treasuries, and investment vehicles have increasingly added Bitcoin to their portfolios, helping support price floors and adding liquidity. According to recent data, large institutional holders have resumed accumulation activities after certain pauses, indicating continued long-term confidence in Bitcoin’s prospects.

Such moves generally strengthen market resilience because institutions often have significant capital reserves and are better positioned to weather volatility compared to retail participants. When these investors demonstrate renewed accumulation or allocation increases, it can signal broader confidence and encourage other market participants to enter.

Investor Psychology and Market Sentiment

Market sentiment plays a crucial role in cryptocurrency price moves. The psychology of investors—how they perceive risk and opportunity—can amplify trends. When prices rise, fear of missing out (FOMO) can drive additional buying, further pushing prices higher. Conversely, fear and panic can accelerate sell-offs.

Recent shifts in sentiment suggest that traders are increasingly optimistic, perhaps buoyed by Bitcoin’s strength and the potential for a broader uptrend. Even amid mixed macroeconomic indicators and historical volatility, positive momentum can create a self-reinforcing cycle as more buyers enter the market.

Consolidation Phases and Price Volatility

Despite the rally in Bitcoin and altcoins, markets are not without risks. Price movements often involve consolidation phases where the asset trades within a range before making a decisive break up or down. Recent market data indicates that Bitcoin has experienced periods of sideways trading around the $90,000 level, which is characteristic of a market digesting recent gains and waiting for clearer direction.

Consolidation is a natural component of price cycles in financial markets. It reflects a balance between buyers and sellers and often precedes significant directional moves. For traders and long-term investors alike, recognizing consolidation as part of market structure can help inform strategy and risk management.

Speculative Bubbles and Macro Concerns

While rallies can be exciting, it’s also important to consider the potential for speculative bubbles—a phenomenon where prices inflate beyond underlying economic value due to exuberant demand. Historical observations of cryptocurrency cycles have shown boom-and-bust patterns, highlighting the importance of disciplined investment strategies and cautious optimism in turbulent markets.

Macroeconomic pressures, regulatory shifts, and broader financial market conditions can also influence cryptocurrency markets, underscoring the need for contextual awareness when evaluating price movements and market health.

Signals for 2026 and Beyond

The current crypto market upswing, marked by Bitcoin price above $90K sparks altcoin rally, may serve as an early indicator of broader market cycles shaping up in 2026. Analysts and price predictions suggest that if Bitcoin can maintain support above key levels and attract continued institutional and retail participation, further upside could be possible. Short-term forecasts hint at potential price targets that extend beyond current levels, reflecting optimistic scenarios where momentum builds into the new year.

However, as the market evolves, vigilance and careful planning remain essential for participants of all types. Continued monitoring of regulatory developments, macroeconomic conditions, and on-chain metrics can help shape more informed views of where the market may be headed next.

The Role of Innovation and Adoption

Beyond price action analytics, innovation within the crypto space—such as advancements in DeFi, layer-2 scaling solutions, and broader blockchain adoption—plays a significant role in shaping long-term value. As these technologies mature and find real-world use cases, they contribute to overall market confidence and growth potential.

The evolving landscape of digital assets continues to attract developers, entrepreneurs, and investors who are building infrastructure that supports decentralized finance and tokenized economies. These developments, alongside price movements, reflect an ecosystem that is both dynamic and increasingly integrated into broader financial systems.

Conclusion

The question of why the crypto market is up today finds its answer in a combination of factors that include Bitcoin price above $90K, growing investor optimism, improved technical indicators, and increased altcoin participation. Bitcoin’s resurgence signals renewed confidence in digital assets and often sets the tone for broader market momentum. While risks and consolidation phases remain part of market behavior, the current rally reflects a strong interplay of technical, psychological, and macroeconomic influences that are shaping market sentiment.

Understanding these dynamics helps both new and experienced investors contextualize price movements and anticipate future trends within the ever-evolving cryptocurrency ecosystem. As the market moves forward, continued analysis, strategic planning, and awareness of broader economic conditions will be key to navigating the opportunities and challenges that lie ahead.

FAQs

Q. Why is the crypto market up today?

The crypto market is up today largely because Bitcoin price above $90K sparks altcoin rally, boosting investor sentiment and encouraging increased trading across various digital assets.

Q. Does Bitcoin’s price movement impact altcoins?

Yes. Bitcoin’s price movement often leads broader market trends; when Bitcoin gains momentum, it tends to lift altcoins as traders diversify their positions.

Q. Are macroeconomic factors influencing today’s crypto rally?

Yes. Macroeconomic conditions and evolving regulatory environments can impact investor confidence and contribute to market movements, including rallies.

Q. Is the rally sustainable?

While short-term rallies can be driven by sentiment and technical factors, sustainability depends on continued participation, institutional investment, and broader adoption trends.

Q. What should investors watch next?

Investors should monitor Bitcoin support levels, trading volume trends, and regulatory developments, as these factors significantly influence future price direction.