Bitcoin and Altcoins Break Out as Stock Market Momentum Slows the global financial landscape is entering a critical transition phase where traditional markets are losing momentum while digital assets are beginning to show renewed strength. Over recent months, investors have closely monitored how inflation trends, interest rate expectations, and macroeconomic uncertainty are reshaping capital flows. As stock market momentum fades after an extended period of volatility and uneven performance, Bitcoin and altcoins are emerging as attractive alternatives for both retail and institutional investors. This shift is not sudden but rather the result of evolving sentiment, technological progress, and changing risk appetite.

The Bitcoin breakout narrative has gained traction as BTC demonstrates resilience around key psychological levels. At the same time, major altcoins such as Ethereum and Solana are outperforming expectations, driven by strong fundamentals, ecosystem growth, and increasing adoption. The growing divergence between traditional equities and the crypto market is prompting analysts to reassess long-term portfolio strategies, particularly as digital assets increasingly behave as an independent asset class rather than a high-risk extension of tech stocks.

This article explores the broader market context behind the fading stock market momentum, examines why BTC, ETH, and SOL outlook remains bullish, and explains how investors are positioning themselves for the next phase of the crypto market cycle. By understanding the interplay between macro trends and blockchain innovation, readers can gain a clearer picture of where cryptocurrencies may be headed in the months ahead.

Bitcoin and Altcoins Break Out

The slowdown in stock market momentum is rooted in a combination of economic and psychological factors. After years of monetary tightening, investors are becoming increasingly cautious as growth expectations moderate and corporate earnings show mixed signals. While equity markets initially responded positively to optimism around inflation cooling, that enthusiasm has gradually waned as economic data continues to present conflicting narratives.

Rising borrowing costs have placed pressure on corporate balance sheets, reducing expansion plans and dampening investor confidence. Additionally, geopolitical tensions and global supply chain adjustments have added another layer of uncertainty. As a result, many investors are reconsidering their exposure to equities, particularly growth stocks that thrived during periods of low interest rates.

This environment has created a vacuum where alternative assets can attract attention. Cryptocurrencies, once dismissed as speculative instruments, are now increasingly viewed as hedges against systemic risk and monetary debasement. The weakening correlation between stocks and digital assets suggests that crypto markets are beginning to mature, offering diversification benefits during periods when traditional markets struggle to maintain momentum.

Why Bitcoin Is Leading the Breakout Narrative

Bitcoin remains the cornerstone of the cryptocurrency market, and its recent price action reflects growing confidence among investors. The BTC price outlook has improved significantly as Bitcoin continues to defend key support levels while pushing toward new resistance zones. This behavior signals accumulation by long-term holders rather than speculative trading.

One of the primary drivers behind the Bitcoin breakout is its fixed supply mechanism. As inflation concerns persist and fiat currencies face devaluation pressures, Bitcoin’s capped supply of 21 million coins reinforces its appeal as a digital store of value. Institutional interest has also played a crucial role, with large investors increasingly allocating capital to Bitcoin as part of diversified portfolios.

Another important factor is the improvement in market infrastructure. Enhanced custody solutions, regulated trading platforms, and growing acceptance of Bitcoin in mainstream finance have reduced barriers to entry. This maturation process has helped stabilize price movements and attract more conservative investors who were previously hesitant to engage with crypto markets.

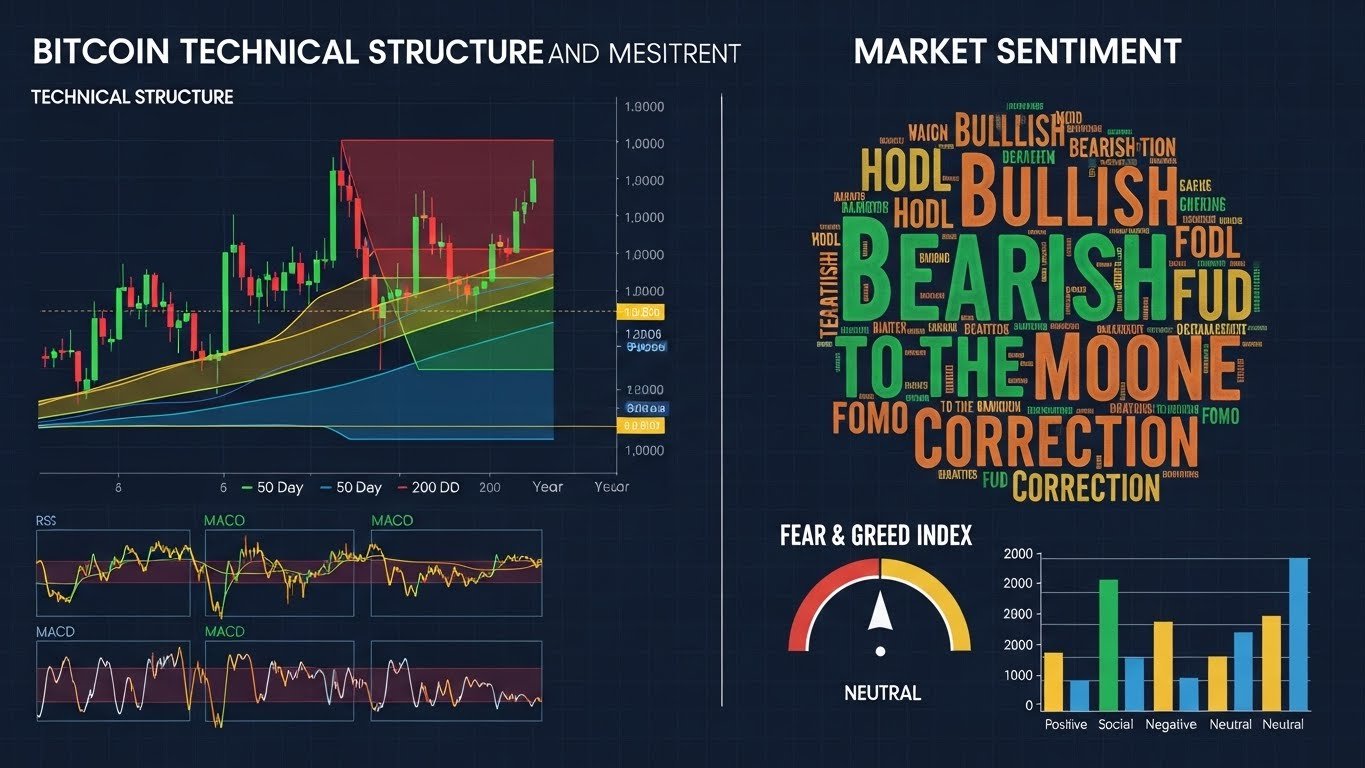

Bitcoin Technical Structure and Market Sentiment

From a technical perspective, Bitcoin’s structure suggests strength rather than exhaustion. Higher lows and sustained consolidation patterns indicate that the market is building a base for potential continuation. Unlike previous cycles characterized by extreme volatility, the current phase appears more measured, reflecting a healthier market environment.

Market sentiment around Bitcoin has also improved as on-chain data shows reduced selling pressure from long-term holders. This behavior often precedes sustained upward movements, as supply becomes constrained while demand gradually increases. The growing dominance of Bitcoin within the crypto market further underscores its leadership role during uncertain macro conditions.

As stock market momentum fades, Bitcoin’s ability to maintain stability enhances its reputation as a macro-resilient asset. While short-term corrections remain possible, the broader trend continues to favor upside potential, especially if global liquidity conditions begin to ease.

Ethereum Outlook as the Backbone of Decentralized Finance

Ethereum plays a unique role in the crypto ecosystem, serving as the foundation for decentralized finance, NFTs, and smart contract applications. The Ethereum price prediction remains optimistic due to continuous network upgrades and expanding real-world use cases. Unlike Bitcoin, which is primarily seen as a store of value, Ethereum’s value proposition is tied to its utility and innovation.

Recent improvements in Ethereum’s scalability and efficiency have significantly enhanced user experience. Lower transaction costs and faster processing times have encouraged developers to build new applications, increasing network activity. This growth directly supports ETH demand, as the token is required to pay for transactions and interact with smart contracts.

Institutional interest in Ethereum has also increased, particularly among investors seeking exposure to blockchain technology beyond digital gold narratives. Ethereum’s transition toward a more sustainable and efficient network has aligned with broader environmental and regulatory considerations, further strengthening its long-term outlook.

Ethereum’s Role in the Altcoins Breakout

The altcoins breakout narrative cannot be discussed without highlighting Ethereum’s influence. As the second-largest cryptocurrency by market capitalization, ETH often sets the tone for the broader altcoin market. When Ethereum demonstrates strength, it typically triggers renewed confidence in other blockchain projects.

Decentralized finance platforms built on Ethereum continue to attract significant capital, despite market fluctuations. This resilience suggests that users value the practical applications of blockchain technology beyond speculative trading. As traditional markets lose momentum, investors are increasingly drawn to ecosystems that offer innovation, yield opportunities, and financial autonomy.

Ethereum’s ability to adapt and evolve has allowed it to maintain relevance through multiple market cycles. This adaptability positions ETH as a key beneficiary of the ongoing shift away from traditional financial systems, particularly as global investors seek alternatives that combine technology and finance.

Solana Emerges as a High-Performance Contender

Solana has gained attention as one of the fastest-growing blockchain networks, and its recent performance supports a bullish Solana price analysis. Known for its high throughput and low transaction costs, Solana has become a preferred platform for developers building scalable applications.

The resurgence of Solana reflects renewed confidence in its ecosystem after overcoming earlier technical challenges. Improved network stability and expanding partnerships have contributed to increased user activity. As decentralized applications and digital assets continue to gain popularity, Solana’s efficiency provides a compelling advantage.

Investors are also attracted to Solana’s ability to support diverse use cases, including decentralized finance, gaming, and Web3 applications. This versatility enhances its long-term growth potential, particularly as the demand for scalable blockchain solutions continues to rise.

Solana’s Position Within the Broader Crypto Market

Within the context of crypto market trends, Solana represents a new generation of blockchains designed to address the limitations of earlier networks. Its growing adoption highlights the market’s preference for platforms that balance speed, cost, and decentralization.

As Bitcoin and Ethereum lead the market, Solana benefits from increased capital rotation into promising altcoins. This pattern is common during periods when investors seek higher returns after establishing positions in major cryptocurrencies. Solana’s strong fundamentals make it a natural candidate for such capital flows.

The broader altcoins breakout scenario depends on sustained innovation and user engagement. Solana’s ability to attract developers and users positions it well to capitalize on this trend, especially as traditional markets struggle to offer comparable growth opportunities.

Macro Trends Supporting Crypto Market Growth

Several macroeconomic trends are aligning in favor of cryptocurrencies. Declining confidence in traditional financial systems, concerns over currency debasement, and the digitization of global finance are all contributing to increased interest in digital assets. As stock market momentum fades, these factors become more pronounced.

Central banks around the world are facing difficult policy decisions, balancing inflation control with economic growth. This uncertainty has encouraged investors to explore decentralized alternatives that operate independently of government policies. Cryptocurrencies, by design, offer transparency and predictability that appeal during times of economic stress.

Technological adoption is another powerful driver. As blockchain technology becomes more accessible, its integration into everyday financial activities accelerates. This adoption reinforces the long-term viability of crypto markets, supporting sustained growth beyond short-term speculation.

Investor Sentiment and the Shift Toward Digital Assets

Investor psychology plays a critical role in market transitions. As equities lose momentum, sentiment naturally shifts toward assets perceived as offering better risk-reward profiles. Bitcoin and altcoins benefit from this shift, particularly as their narratives evolve from speculative bets to strategic investments.

Younger investors, in particular, are more inclined to embrace digital assets as part of their financial planning. This generational shift is gradually reshaping market dynamics, increasing liquidity and participation in crypto markets. Over time, this trend could further reduce volatility and enhance stability.

Institutional adoption also reinforces confidence. As large financial players enter the crypto space, they bring credibility and capital, encouraging broader participation. This growing acceptance suggests that digital assets are becoming a permanent fixture in global financial markets.

Risks and Considerations in the Current Crypto Landscape

Despite the optimistic outlook, risks remain. Regulatory uncertainty continues to influence market sentiment, and sudden policy changes could impact prices. Additionally, macroeconomic shocks could temporarily disrupt crypto markets, even if long-term fundamentals remain strong.

Market volatility is another factor investors must consider. While the current environment appears favorable, cryptocurrencies are still subject to rapid price fluctuations. Understanding these risks is essential for making informed decisions and managing exposure effectively.

However, the ability of Bitcoin, Ethereum, and Solana to recover from past challenges demonstrates resilience. This resilience suggests that while short-term risks exist, the broader trajectory remains constructive.

Conclusion

As stock market momentum fades, the spotlight is increasingly shifting toward digital assets. The ongoing Bitcoin and altcoins breakout reflects a broader transformation in how investors perceive value, risk, and innovation. Bitcoin continues to assert its role as a digital store of value, Ethereum strengthens its position as the backbone of decentralized finance, and Solana emerges as a high-performance alternative driving the next wave of blockchain adoption.

This evolving landscape highlights the growing independence of crypto markets from traditional financial systems. While challenges remain, the alignment of macroeconomic trends, technological progress, and investor sentiment supports a positive outlook for BTC, ETH, and SOL. For those seeking to understand the future of finance, the current phase represents a pivotal moment where digital assets are no longer peripheral but central to global market discussions.

FAQs

Q: How does fading stock market momentum impact Bitcoin and altcoins?

When stock market momentum fades, investors often look for alternative assets that can offer diversification and potential growth. Bitcoin and altcoins benefit from this shift as they are increasingly viewed as independent asset classes with unique value propositions, attracting capital during periods of equity market uncertainty.

Q: Why is Bitcoin considered a leader during crypto market breakouts?

Bitcoin is considered a leader because it has the largest market capitalization, the most secure network, and a fixed supply. These characteristics make it a benchmark for the entire crypto market, and its price movements often influence investor confidence and capital flows into altcoins.

Q: What makes Ethereum’s outlook strong compared to other cryptocurrencies?

Ethereum’s strength lies in its utility and ecosystem. As the foundation for decentralized finance and smart contracts, Ethereum benefits from continuous development and real-world applications, which support long-term demand for ETH beyond speculative trading.

Q: Why is Solana gaining attention in the current market cycle?

Solana is gaining attention due to its high transaction speed, low costs, and expanding ecosystem. These features make it attractive for developers and users, positioning Solana as a scalable solution within the broader blockchain landscape and a key player in the altcoins breakout.

Q: Are cryptocurrencies becoming less correlated with traditional markets?

Yes, cryptocurrencies are gradually showing reduced correlation with traditional markets. As adoption grows and use cases expand, digital assets are increasingly influenced by their own market dynamics rather than purely following equity market trends, enhancing their role as diversification tools.