Ethereum (ETH) is experiencing a notable decline that pushed its price below the psychologically critical $3,000 threshold. Sellers Control After $3K Loss: This downturn marks a pivotal shift in market sentiment, as sellers appear to have wrestled control away from bullish traders who had been driving the second-toward higher valuations. For investors and traders closely monitoring Ethereum price movements, understanding the factors behind this decline and what lies ahead is crucial for making informed decisions in this volatile landscape.

The breakdown below $3,000 represents more than just a numerical milestone; it signals a potential change in the market structure that could have far-reaching implications for both short-term traders and long-term holders. As Ethereum price prediction models are recalibrated in light of this bearish pressure, market participants are left questioning whether this represents a temporary correction or the beginning of a more sustained downtrend. This comprehensive analysis examines the technical indicators, market dynamics, and fundamental factors influencing Ethereum’s current trajectory while providing insights into potential price scenarios moving forward.

Ethereum’s Recent Price Action: Sellers Control After $3K Loss

The cryptocurrency community has been closely watching Ethereum’s price performance over recent weeks, as the digital asset struggled to maintain momentum above the $3,000 level. What initially appeared as a consolidation phase has now materialized into a decisive bearish breakout, with sellers overwhelming buyers and pushing prices into uncomfortable territory for those holding long positions.

The descent below $3,000 wasn’t an isolated event but rather the culmination of mounting selling pressure that had been building across multiple timeframes. Technical analysts observed warning signs in the form of weakening volume on upward price movements, combined with increasing selling volume during downward swings. This divergence between price action and volume typically suggests that bullish conviction is waning, creating an environment where sellers can more easily assert dominance.

Market participants who were anticipating a cryptocurrency rally based on Ethereum’s strong fundamentals were caught off guard by the speed and intensity of the selloff. The breach of key support levels triggered a cascade of stop-loss orders, amplifying the downward momentum and creating additional pain for leveraged traders. This phenomenon highlights the importance of risk management in crypto trading, especially during periods of heightened volatility when sentiment can shift rapidly.

Technical Analysis Key Levels and Indicators

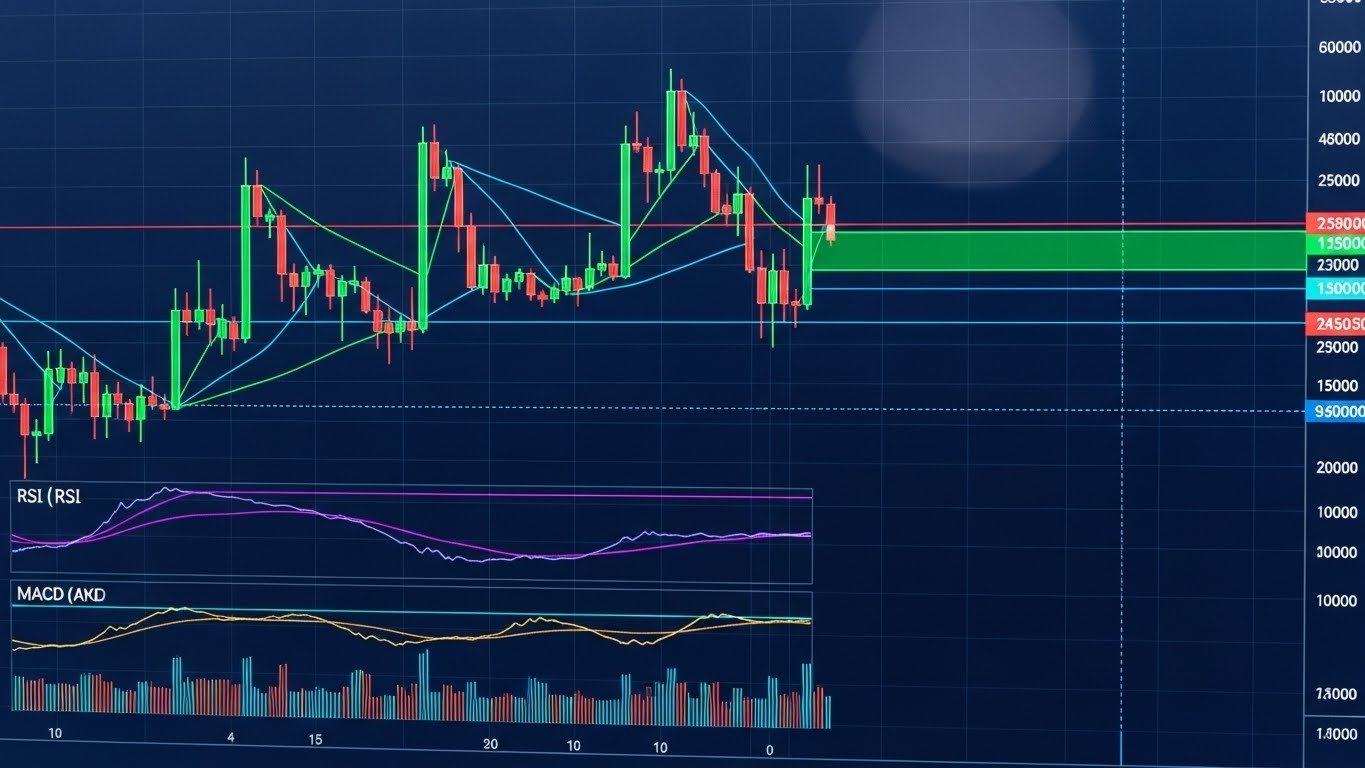

From a technical perspective, Ethereum’s chart structure has deteriorated significantly following the loss of the $3,000 support zone. This level had served as a reliable floor during previous pullbacks, making its breach particularly significant for traders relying on technical patterns to guide their decisions. The breakdown has opened the door to further downside, with the next major support zone residing around the $2,800 to $2,850 range.

The Relative Strength Index (RSI), a momentum oscillator widely used in technical analysis, has dipped into bearish territory, indicating that selling pressure currently outweighs buying interest. However, the RSI has not yet reached oversold levels, suggesting that additional downside could materialize before a meaningful bounce attempt occurs. Traders watching this indicator will be looking for signs of bullish divergence, where price makes lower lows while the RSI forms higher lows, potentially signaling an impending reversal.

Moving averages tell a similarly bearish story, with Ethereum’s price now trading below both its 50-day and 100-day moving averages. This configuration typically indicates that the intermediate-term trend has shifted to the downside, and these former support levels may now act as resistance during any recovery attempts. The death cross formation, where shorter-term moving averages cross below longer-term ones, further reinforces the bearish technical outlook for ETH in the near term.

Volume analysis provides additional confirmation of the prevailing sentiment. The selling pressure has been accompanied by above-average trading volume, indicating genuine conviction behind the move rather than a low-volume breakdown that could easily be reversed. This volume profile suggests that the Ethereum market is undergoing a legitimate repricing as participants reassess their expectations for the asset’s near-term prospects.

Fundamental Factors Influencing Ethereum’s Decline

While technical factors have certainly played a role in Ethereum’s recent weakness, fundamental considerations have also contributed to the shift in sentiment. The broader cryptocurrency market has faced headwinds from various sources, including regulatory concerns, macroeconomic uncertainty, and shifting risk appetite among institutional investors. These factors have created a challenging environment for all digital assets, with Ethereum proving no exception despite its strong technological foundation.

The relationship between Ethereum and Bitcoin remains a critical dynamic, as movements in the flagship cryptocurrency often set the tone for the entire market. Bitcoin’s own struggles to maintain higher price levels have created a ripple effect throughout the crypto ecosystem, pressuring altcoins including Ethereum. When Bitcoin falters, it typically drains liquidity from alternative cryptocurrencies as traders move to preserve capital or rotate into more stable assets.

Network activity metrics provide a mixed picture for Ethereum’s fundamental health. While the Ethereum blockchain continues to process significant transaction volumes and remains the dominant platform for decentralized applications and smart contracts, recent data shows a slight moderation in on-chain activity compared to peak levels. This cooling of network usage may reflect broader risk-off sentiment in the crypto space rather than fundamental problems with Ethereum itself, but it nonetheless factors into price discovery.

Gas fees, which represent the cost of executing transactions on the Ethereum network, have declined from previous highs, suggesting reduced network congestion. While lower fees benefit users, they can also indicate decreased demand for blockspace, which some analysts interpret as a bearish signal for short-term price action. The upcoming developments in Ethereum’s roadmap, however, continue to position the network well for long-term growth regardless of near-term price fluctuations.

Market Sentiment and Investor Psychology

The psychological impact of losing the $3,000 level cannot be understated when analyzing Ethereum price trends. Round numbers carry significant weight in financial markets, serving as anchors for investor expectations and decision-making. When such levels are decisively broken, it often triggers a cascade of emotional responses that can temporarily override rational analysis, leading to capitulation among weak hands and opportunistic positioning by more sophisticated traders.

Social media sentiment analysis reveals a notable shift in the conversation surrounding Ethereum. The optimistic narratives that dominated discussion during the run-up to $3,000 have given way to more cautious and, in some cases, bearish commentary. This change in tone reflects the reality that many recent buyers are now underwater on their positions, creating psychological pressure to either cut losses or hold through what they hope will be a temporary setback.

Fear and greed indices, which attempt to quantify market emotion, have shifted toward the fear side of the spectrum following Ethereum’s decline. Historically, such readings have sometimes marked attractive entry points for contrarian investors willing to buy when others are fearful. However, distinguishing between a genuine capitulation bottom and a falling knife scenario requires careful analysis of multiple factors beyond sentiment alone.

Institutional investor behavior provides another lens through which to view the current market dynamics. While retail sentiment appears to have soured considerably, the actions of larger players remain somewhat opaque. Some analysts suggest that institutional accumulation may be occurring at these lower levels, though definitive evidence of such activity often emerges only in retrospect through exchange flow data and wallet tracking.

Short-Term Price Outlook and Trading Scenarios

Looking ahead to the immediate future, several scenarios could unfold for Ethereum’s price trajectory. The bearish case suggests that sellers will continue to dominate, potentially driving prices toward the $2,800 support level or even lower if that zone fails to hold. This scenario would likely be accompanied by continued weakness in Bitcoin and broader risk assets, creating a challenging environment for any meaningful recovery attempt.

A neutral scenario envisions Ethereum entering a consolidation phase below $3,000, with prices choppy and directionless as bulls and bears battle for control. This sideways action could persist for several weeks as the market digests recent losses and awaits new catalysts to provide directional clarity. During such periods, range-trading strategies often prove most effective, though breakouts in either direction can occur suddenly and violently.

The bullish case, while currently appearing less probable based on technical indicators, would involve a swift reversal and reclamation of the $3,000 level. This scenario would require a significant shift in market dynamics, potentially triggered by positive news flow, a strong rally in Bitcoin, or evidence of substantial buying pressure from institutional investors. If bulls can engineer such a reversal, it could invalidate the breakdown and set the stage for a move toward previous highs.

Crypto volatility remains exceptionally high, meaning that rapid reversals in either direction should not surprise seasoned market participants. Traders positioning for any of these scenarios must employ robust risk management techniques, including appropriate position sizing and strategic stop-loss placement, to protect capital during periods of heightened uncertainty.

Long-Term Perspective: Ethereum’s Fundamental Strength

Despite the near-term technical weakness, it’s essential to maintain perspective on Ethereum’s long-term value proposition. The network continues to serve as the foundation for the vast majority of decentralized finance (DeFi) applications, non-fungible token (NFT) marketplaces, and emerging blockchain innovations. This entrenched position within the crypto ecosystem provides fundamental support that transcends short-term price fluctuations.

The ongoing development and implementation of Ethereum’s scaling solutions represent significant long-term catalysts that could drive future price appreciation. Layer 2 technologies are successfully reducing transaction costs and increasing throughput, addressing two of the main criticisms historically leveled at the Ethereum network. As these solutions mature and adoption increases, they enhance Ethereum’s competitiveness against alternative blockchain platforms.

Staking dynamics also play an increasingly important role in Ethereum’s long-term value proposition. With a substantial portion of the total ETH supply locked in staking contracts, the circulating supply available for trading is effectively reduced. This supply constraint, combined with potential demand increases from various use cases, creates a fundamental backdrop that many analysts view as supportive of higher prices over extended timeframes.

Institutional adoption of Ethereum continues to progress, albeit at a measured pace influenced by regulatory developments and market conditions. Major financial institutions are exploring blockchain technology with Ethereum often serving as a primary platform for experimentation and implementation. This institutional interest, while not always immediately reflected in price, builds a foundation for sustained demand as traditional finance increasingly intersects with cryptocurrency markets.

Potential Catalysts for Recovery

Several potential catalysts could reverse Ethereum’s current bearish momentum and spark a recovery rally. Positive developments in regulatory frameworks, particularly if they provide greater clarity and legitimacy for cryptocurrency investing, could reignite investor interest across the entire sector. Ethereum, as the second-largest cryptocurrency by market capitalization, would likely benefit substantially from any broad-based resurgence in crypto market confidence.

Technological breakthroughs or successful implementations of major network upgrades could serve as powerful positive catalysts. The Ethereum development community maintains an ambitious roadmap that includes continued improvements to scalability, security, and sustainability. Successful execution of these plans could remind investors why Ethereum commands such a dominant position within the blockchain ecosystem.

Macroeconomic factors will also play a crucial role in determining when and how strongly Ethereum might recover. A shift in monetary policy, improvements in global economic conditions, or increased concerns about traditional financial system stability could all drive capital flows into alternative assets including cryptocurrencies. Digital asset markets remain highly sensitive to these broader economic trends, and a favorable shift could quickly change the narrative.

The emergence of new use cases or applications that drive genuine demand for Ethereum’s network capabilities would represent an organic catalyst for price recovery. Whether through innovations in DeFi, the evolution of tokenized real-world assets, or entirely new applications yet to be imagined, demonstrated utility remains one of the most powerful drivers of sustainable value creation in the cryptocurrency space.

Risk Management Strategies for Current Market Conditions

Navigating the current Ethereum market conditions requires disciplined risk management and a clear understanding of one’s investment objectives and time horizon. For long-term believers in Ethereum’s fundamental value proposition, periods of price weakness can present accumulation opportunities, though attempting to catch a falling knife carries its own risks. Dollar-cost averaging strategies allow investors to build positions gradually without trying to perfectly time the market bottom.

Short-term traders must be particularly cautious in the current environment, where volatility can quickly turn profitable positions into losses. Using appropriate stop-loss orders, avoiding excessive leverage, and maintaining strict position sizing discipline are essential practices during periods of elevated uncertainty. The temptation to increase position size to recover losses must be resisted, as this approach often compounds problems rather than solving them.

Portfolio diversification remains a fundamental principle of sound investing, and this applies equally to cryptocurrency holdings. While Ethereum represents a cornerstone asset within the crypto ecosystem, concentrating too heavily in any single asset increases exposure to idiosyncratic risks. Balancing Ethereum positions with other cryptocurrencies, traditional assets, or even cash reserves provides flexibility to respond to changing market conditions.

Emotional discipline separates successful investors from those who struggle in volatile markets. The fear of missing out on a recovery or the panic induced by further declines can lead to poor decision-making. Developing and adhering to a well-defined investment plan that accounts for various scenarios helps maintain rationality when emotions run high. Regular portfolio reviews, conducted on a predetermined schedule rather than in response to every price movement, support more measured decision-making.

Comparing Ethereum to Alternative Layer-1 Blockchains

The competitive landscape for blockchain platforms continues to evolve, with numerous alternative Layer-1 networks vying for market share and developer mindshare. Ethereum’s current price weakness occurs against a backdrop of increasing competition from platforms like Solana, Cardano, and emerging contenders. Understanding how Ethereum’s value proposition compares to these alternatives provides context for evaluating its long-term investment case.

Despite intense competition, Ethereum maintains significant advantages in network effects, developer activity, and total value locked in protocols built on its platform. The extensive ecosystem of applications, tools, and infrastructure surrounding Ethereum creates switching costs that protect its dominant position. While competitors may offer superior performance metrics in isolation, the holistic ecosystem advantage remains difficult to replicate.

However, complacency would be inappropriate, as the blockchain space continues to innovate rapidly. Ethereum must execute on its technological roadmap to maintain its competitive edge. The success or failure of scaling solutions, the user experience improvements they enable, and the overall responsiveness to market needs will determine whether Ethereum can fend off challenges from more nimble competitors.

Price performance among competing platforms often diverges based on narratives, marketing efforts, and short-term enthusiasm rather than fundamental technology differences. Investors evaluating Ethereum relative to alternatives should focus on long-term sustainability factors such as decentralization, security, actual usage, and development activity rather than being swayed by short-term price movements or hype cycles that frequently characterize the crypto market.

The Role of Ethereum in a Diversified Crypto Portfolio

For investors constructing a diversified cryptocurrency portfolio, Ethereum typically plays a central role alongside Bitcoin. While Bitcoin is often characterized as digital gold or a store of value, Ethereum’s utility-focused value proposition provides complementary exposure to the transformative potential of blockchain technology. This duality makes sense for investors seeking both stability and growth potential within their crypto allocations.

The correlation between Ethereum and Bitcoin, while historically high, is not perfect, meaning that Ethereum can provide some diversification benefits even within a crypto-only portfolio. During certain market phases, Ethereum has outperformed Bitcoin substantially, particularly when excitement about DeFi or NFTs drives specific demand for the Ethereum network. Conversely, during extreme risk-off periods, Bitcoin’s relative simplicity and brand recognition sometimes provide better downside protection.

Position sizing between Bitcoin and Ethereum involves personal judgment and risk tolerance. Conservative investors might weight Bitcoin more heavily, viewing it as the more established and less technologically complex asset. More aggressive investors comfortable with higher risk might overweight Ethereum, anticipating that its broader utility and ongoing development provide greater upside potential. There is no universally correct answer, and the optimal allocation varies based on individual circumstances.

Beyond Bitcoin and Ethereum, including exposure to smaller-cap cryptocurrencies can further enhance diversification, though this also increases risk substantially. Many investors adopt a barbell strategy, concentrating the majority of crypto allocation in Bitcoin and Ethereum while taking smaller, more speculative positions in alternative projects with high-risk, high-reward profiles. This approach balances the relative stability of established assets with exposure to potentially transformative emerging technologies.

Conclusion

The loss of the $3,000 level marks a significant technical development for Ethereum, as sellers have clearly established dominance in the near-term price action. The breakdown below this psychologically important threshold has altered the market structure and introduced uncertainty about the immediate trajectory of the second-largest cryptocurrency. Technical indicators suggest that further downside may materialize before a sustained recovery can begin, particularly if broader market conditions remain challenging.

However, maintaining perspective is crucial during periods of market weakness. Ethereum’s fundamental value proposition remains intact, supported by its dominant position within the DeFi ecosystem, ongoing technological development, and the network effects that create substantial barriers to competition. While near-term price action may continue to disappoint those hoping for an immediate reversal, the long-term investment case for Ethereum rests on foundations that transcend short-term technical patterns.

For investors and traders navigating the current environment, discipline and risk management must take precedence over emotional reactions to price movements. Whether viewing this period as an accumulation opportunity or remaining cautiously on the sidelines, decisions should be guided by sound analysis and alignment with personal investment objectives rather than fear or greed. The cryptocurrency market has demonstrated its cyclical nature repeatedly, with periods of intense pessimism eventually giving way to renewed optimism as fundamentals reassert themselves.

As Ethereum works to reclaim lost ground and rebuild bullish momentum, market participants would be wise to monitor both technical developments and fundamental catalysts that could shift the prevailing narrative. The path forward may not be linear, and additional volatility should be expected, but for those with conviction in Ethereum’s long-term vision, current weakness may ultimately be remembered as an opportunity rather than a crisis.

FAQs

Q: What caused Ethereum to drop below $3,000?

Ethereum’s decline below $3,000 resulted from a combination of technical and fundamental factors. Technical selling pressure intensified as key support levels failed, triggering stop-loss orders and creating momentum to the downside. Fundamentally, broader cryptocurrency market weakness, correlation with Bitcoin’s struggles, and general risk-off sentiment in financial markets contributed to the selloff. The loss of this psychological level represents a shift in market structure that sellers exploited to push prices lower.

Q: Is now a good time to buy Ethereum after the price drop?

Whether current levels represent an attractive buying opportunity depends on your investment horizon and risk tolerance. Long-term investors who believe in Ethereum’s fundamental value proposition might view this weakness as an accumulation opportunity, potentially using dollar-cost averaging to build positions gradually. Short-term traders should be cautious, as technical indicators suggest further downside is possible before a sustained recovery begins. Always conduct your own research and never invest more than you can afford to lose in volatile assets like cryptocurrencies.

Q: How low could the Ethereum price go in the short term?

Based on technical analysis, the next major support zone for Ethereum sits around $2,800 to $2,850. If selling pressure continues and that level fails to hold, additional downside toward $2,500 could materialize. However, predicting exact price bottoms is extremely difficult, and unexpected catalysts could reverse the trend at any time. Traders and investors should prepare for multiple scenarios rather than anchoring to specific price targets, as cryptocurrency markets frequently defy predictions.

Q: What would it take for Ethereum to recover above $3,000?

A sustained move back above $3,000 would require a significant shift in market dynamics and sentiment. Potential catalysts include a strong recovery in Bitcoin, positive regulatory developments, renewed institutional buying interest, or technological breakthroughs that reignite enthusiasm for Ethereum’s ecosystem. From a technical perspective, bulls would need to demonstrate conviction through strong buying volume and the ability to reclaim key moving averages that now serve as overhead resistance. Until these conditions materialize, the path of least resistance appears to be sideways to lower.

Q: Should I sell my Ethereum holdings after this price decline?

The decision to sell depends entirely on your individual circumstances, investment thesis, and financial goals. If you purchased Ethereum as a long-term investment based on belief in its fundamental technology and use cases, short-term price movements may be less relevant to your strategy. However, if the decline has moved your position outside your risk tolerance or you need the capital for other purposes, there’s no shame in reassessing your holdings. Consider whether your original investment thesis has changed or if only the price has changed. Avoid making emotional decisions based solely on fear, and if uncertain, consulting with a financial advisor may be appropriate.