Avalanche blockchain crypto treasury strategy takes center stage. The Avalanche Foundation aims to raise $1 billion to create two crypto treasury companies holding millions of AVAX tokens, marking one of the most significant institutional moves in the blockchain ecosystem. This ambitious initiative represents a pivotal moment for digital asset management and showcases how established blockchain networks are evolving their approach to market penetration and institutional adoption.

The Avalanche blockchain has consistently positioned itself as a leader in the decentralized finance space, and this latest funding initiative demonstrates the network’s commitment to bridging traditional finance with cutting-edge blockchain technology. By establishing dedicated treasury vehicles, Avalanche is creating new pathways for institutional investors to gain exposure to its native AVAX token while providing enhanced liquidity and market stability.

Avalanche’s $1 Billion Treasury Strategy

The Core Structure of Avalanche’s Crypto Treasury Initiative

The Avalanche Foundation is pursuing deals to raise approximately $1 billion through two cryptocurrency treasury companies in the United States, targeting institutional investors seeking exposure to its AVAX token. This sophisticated approach involves creating specialized vehicles designed to accumulate and manage AVAX tokens at scale, providing institutional-grade infrastructure for cryptocurrency investment.

The blockchain treasury companies being established represent a new model for how cryptocurrency foundations can interact with traditional capital markets. Rather than relying solely on open market purchases, these treasury vehicles will enable more structured, long-term accumulation strategies that benefit both the Avalanche ecosystem and participating investors.

Key Players and Strategic Partnerships

The deals are set to close by October 2025, with support from Hivemind Capital and Dragonfly Capital. Crypto investor and former White House press secretary Anthony Scaramucci is rumored to be advising one of the deals. This high-profile backing underscores the institutional legitimacy and market confidence surrounding the Avalanche blockchain crypto treasury initiative.

The involvement of established crypto investment firms like Hivemind Capital and Dragonfly Capital brings significant expertise and credibility to the project. These firms have extensive experience in blockchain investments and understand the nuances of cryptocurrency treasury management, making them ideal partners for this ambitious undertaking.

How the AVAX Token Acquisition Model Works

Discounted Token Purchase Mechanism

The firms are expected to use the funds to buy AVAX directly from the foundation at a discounted rate. Hivemind and Dragonfly are expected to purchase AVAX tokens from the Avalanche Foundation at a discounted price. This innovative approach allows the foundation to secure committed capital while providing investors with attractive entry points into AVAX token positions.

The discount mechanism serves multiple purposes within the Avalanche blockchain ecosystem. It ensures price stability by providing predictable demand, reduces market volatility through large block trades executed off-market, and creates long-term alignment between the foundation’s interests and those of major stakeholders.

Scale and Market Impact Analysis

At today’s prices, $1 billion would translate into 34.7 million AVAX, or around 8% of 422.3 million Avalanche tokens in circulation. This substantial token allocation represents a significant portion of the circulating supply, highlighting the scale and potential market impact of the treasury initiative.

The acquisition of such a large percentage of circulating AVAX tokens through institutional treasury vehicles could significantly influence market dynamics. This concentrated ownership structure may lead to increased price stability and reduced volatility, while also demonstrating strong institutional confidence in the long-term prospects of the Avalanche blockchain.

Institutional Adoption and Traditional Finance Integration

Building Bridges to Wall Street

The fundraising effort comes as Avalanche positions itself as a preferred blockchain for traditional finance applications. Major investment firms, including BlackRock, Apollo, and Wellington Asset Management, have tested tokenized fund versions on the network. This institutional interest from major financial players validates Avalanche’s strategy of creating crypto treasury companies specifically designed for traditional finance integration.

The Avalanche blockchain has emerged as a preferred platform for tokenization projects, offering the speed, security, and scalability that traditional financial institutions require. By establishing dedicated treasury vehicles, Avalanche is creating additional infrastructure to support this growing institutional adoption trend.

Competitive Positioning in the Treasury Space

Companies have raised more than $16 billion in 2025 to purchase crypto assets. Treasury activity is concentrated in top-tier digital assets, while smaller altcoins see negligible corporate accumulation. Avalanche’s plan is significant in scope compared to most altcoin treasury activities. This context emphasizes how Avalanche’s $1 billion initiative stands out in the current market environment.

The Avalanche Foundation is positioning itself among the top tier of blockchain projects by pursuing this large-scale treasury strategy. While many smaller projects struggle to attract meaningful institutional investment, Avalanche’s approach demonstrates the maturity and market confidence that comes with being an established layer-1 blockchain platform.

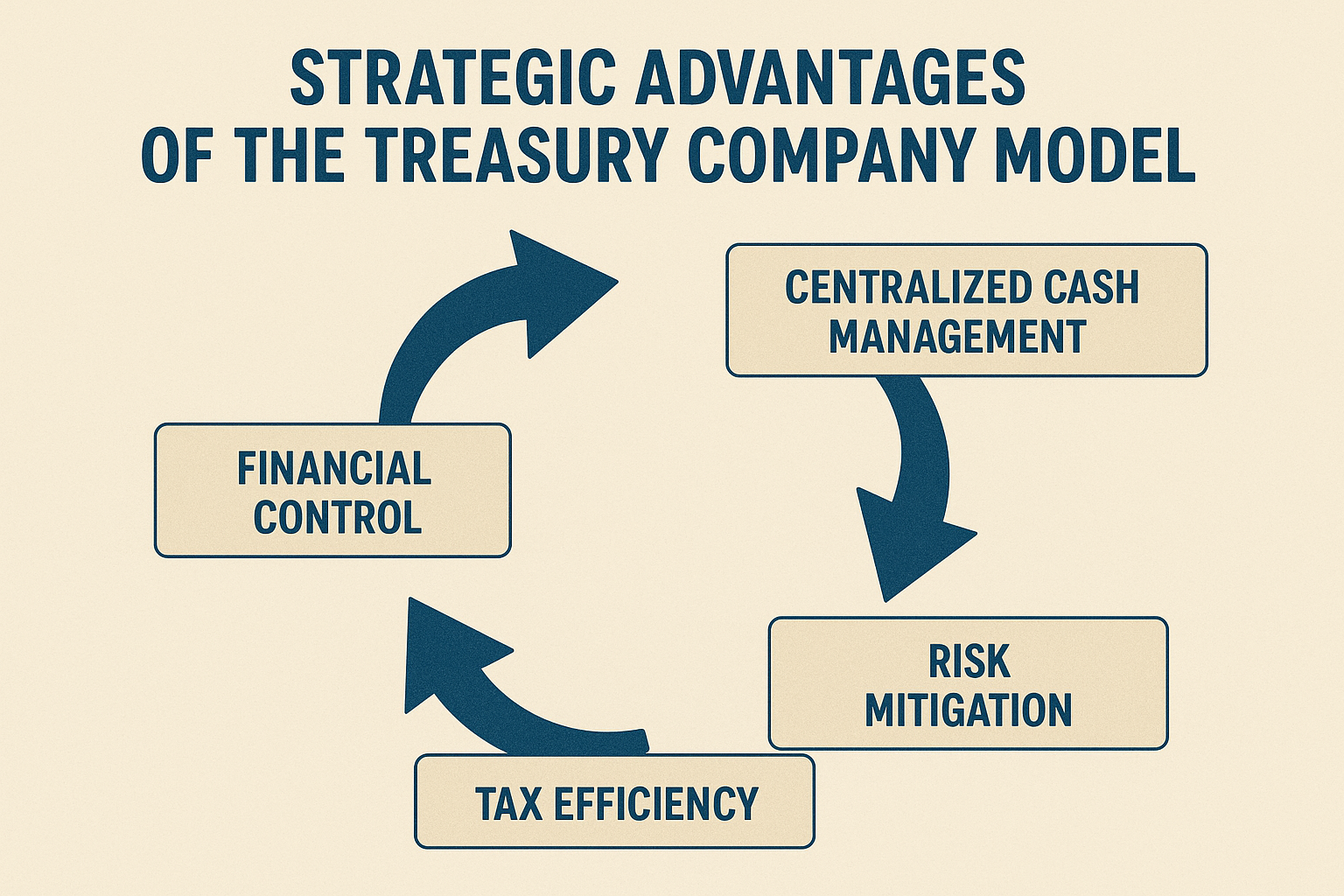

Strategic Advantages of the Treasury Company Model

Enhanced Market Liquidity and Stability

The establishment of dedicated blockchain treasury companies provides several strategic advantages for the Avalanche ecosystem. These vehicles create more predictable demand for AVAX tokens, which can help stabilize price movements and reduce the volatility that often concerns institutional investors. By concentrating large holdings in professional management structures, the treasury model also enables more sophisticated trading strategies and risk management approaches.

Professional treasury management brings institutional-grade compliance, reporting, and governance standards to cryptocurrency holdings. This level of operational sophistication is crucial for attracting traditional finance institutions that require robust internal controls and regulatory compliance frameworks.

Long-term Network Security and Decentralization

The Avalanche blockchain crypto treasury strategy also supports network security and decentralization goals. By distributing large token holdings across multiple professional treasury vehicles, Avalanche reduces concentration risk while ensuring that significant stakeholders have aligned interests with the network’s long-term success. This distributed ownership model can enhance network governance and decision-making processes.

The treasury companies are expected to participate actively in network validation and governance, contributing to the overall security and decentralization of the Avalanche blockchain. This alignment between token holdings and network participation creates positive feedback loops that strengthen the entire ecosystem.

Market Context and Industry Trends

The Rise of Corporate Crypto Treasury Management

The emergence of specialized crypto treasury companies reflects a broader trend toward institutional cryptocurrency adoption. As digital assets become increasingly accepted as legitimate investments, organizations are seeking professional management solutions that combine traditional treasury practices with blockchain-native strategies.

This evolution in cryptocurrency treasury management addresses several key challenges that institutional investors face when considering digital asset allocations. Professional treasury vehicles provide regulatory clarity, operational expertise, and risk management capabilities that many institutions lack internally.

Regulatory Considerations and Compliance Framework

The focus on establishing these treasury vehicles in the United States demonstrates Avalanche’s commitment to operating within established regulatory frameworks. By working with experienced partners and focusing on US-based structures, the Avalanche Foundation is positioning itself to benefit from evolving cryptocurrency regulations while maintaining compliance with existing requirements.

This regulatory-first approach sets a precedent for how major blockchain projects can scale their operations while working constructively with regulatory authorities. The success of this initiative could pave the way for similar treasury strategies across the broader cryptocurrency industry.

Technical Infrastructure Supporting Treasury Operations

Blockchain Scalability and Enterprise Features

The Avalanche blockchain provides the technical infrastructure necessary to support large-scale treasury operations. With its high throughput, low latency, and enterprise-grade features, Avalanche can handle the transaction volumes and complexity required by institutional treasury management. This technical capability is essential for the success of the $1 billion treasury initiative.

The platform’s consensus mechanism and subnet architecture provide the flexibility and performance characteristics that institutional investors expect. These technical advantages support the crypto treasury companies in executing sophisticated trading strategies and managing large token positions efficiently.

Integration with Traditional Financial Systems

Avalanche’s compatibility with traditional financial infrastructure makes it an ideal platform for treasury operations that need to interface with existing banking and settlement systems. The blockchain’s support for various financial instruments and its growing ecosystem of institutional-grade applications provide the foundation for professional treasury management services.

Future Implications for the Cryptocurrency Industry

Setting Precedents for Institutional Engagement

The success of Avalanche’s blockchain treasury companies initiative could establish new templates for how cryptocurrency projects engage with institutional capital markets. This model demonstrates how blockchain foundations can create structured investment opportunities that appeal to traditional finance while supporting network growth and development.

Other major blockchain projects are likely to observe this initiative closely, potentially adopting similar treasury strategies if the Avalanche model proves successful. This could lead to a new wave of institutional-focused cryptocurrency treasury vehicles across the industry.

Impact on Market Maturation

The establishment of professional treasury management for AVAX tokens represents another step toward cryptocurrency market maturation. As more projects adopt sophisticated treasury strategies and institutional-grade operational standards, the entire digital asset ecosystem benefits from increased credibility and professional management practices.

This evolution toward institutional-grade treasury management could accelerate the adoption of cryptocurrencies in traditional finance portfolios. By demonstrating that digital assets can be managed with the same rigor and professionalism as traditional assets, initiatives like Avalanche’s treasury companies help legitimize the entire sector.

Investment Considerations and Risk Assessment

Evaluating the Treasury Investment Proposition

Potential investors in the Avalanche blockchain crypto treasury companies must consider various factors, including token price dynamics, regulatory environment, and operational execution risks. The discounted purchase mechanism provides attractive entry points, but investors must also evaluate the long-term prospects of the Avalanche ecosystem and its competitive positioning.

The involvement of experienced firms like Hivemind Capital and Dragonfly Capital provides some assurance regarding due diligence and risk management. However, cryptocurrency investments inherently carry significant risks that must be carefully evaluated within the context of broader investment portfolios.

Long-term Value Creation Strategies

The treasury companies are expected to pursue strategies that create long-term value for both token holders and the broader Avalanche ecosystem. This includes participating in network governance, supporting ecosystem development, and implementing sophisticated trading and risk management strategies that optimize returns while maintaining appropriate risk levels.

The alignment between treasury operations and network development creates opportunities for value creation that go beyond simple token appreciation. By actively participating in ecosystem growth, the crypto treasury companies can contribute to fundamental value creation within the Avalanche blockchain network.

Competitive Analysis and Market Positioning

Comparing Treasury Strategies Across Blockchain Projects

While many blockchain projects have pursued various funding and treasury strategies, Avalanche’s approach of creating dedicated US-based treasury companies represents a unique model in the industry. This structured approach to institutional engagement sets Avalanche apart from projects that rely primarily on direct foundation sales or open market operations.

The Avalanche Foundation has chosen a path that emphasizes professional management, regulatory compliance, and long-term institutional relationships. This contrasts with more speculative or retail-focused approaches adopted by some other blockchain projects, positioning Avalanche as a mature platform suitable for institutional adoption.

Advantages Over Traditional Crypto Investment Vehicles

The specialized nature of these blockchain treasury companies provides several advantages over traditional crypto investment options. The dedicated focus on AVAX tokens, combined with direct relationships with the Avalanche Foundation, creates opportunities for strategic insights and preferential access that generic crypto funds cannot provide.

Additionally, the scale of the $1 billion initiative provides negotiating power and market influence that smaller investment vehicles lack. This scale advantage can translate into better execution, lower trading costs, and enhanced ability to influence positive network developments.

Conclusion

The Avalanche blockchain crypto treasury initiative represents a watershed moment in the evolution of cryptocurrency institutional adoption. By raising $1 billion through dedicated treasury companies, Avalanche is not only securing significant capital for ecosystem development but also establishing new standards for how blockchain projects can engage with institutional investors.

This innovative approach to cryptocurrency treasury management demonstrates the maturation of the digital asset industry and the growing sophistication of blockchain project strategies. The success of this initiative could inspire similar approaches across the industry, potentially accelerating the institutional adoption of cryptocurrencies more broadly.