The cryptocurrency market never sleeps, and staying informed with accurate crypto news and today’s analysis has become crucial for investors, traders, and blockchain enthusiasts worldwide. In today’s rapidly evolving digital asset landscape, understanding market movements, regulatory developments, and technological advancements can mean the difference between profitable investments and costly mistakes. This comprehensive analysis breaks down the most significant crypto developments happening right now, providing you with actionable insights to navigate the complex world of digital currencies. Whether you’re a seasoned trader or a newcomer to the crypto space, our detailed examination of current market conditions will help you make informed decisions in this volatile yet exciting financial frontier.

Current Cryptocurrency Market Overview

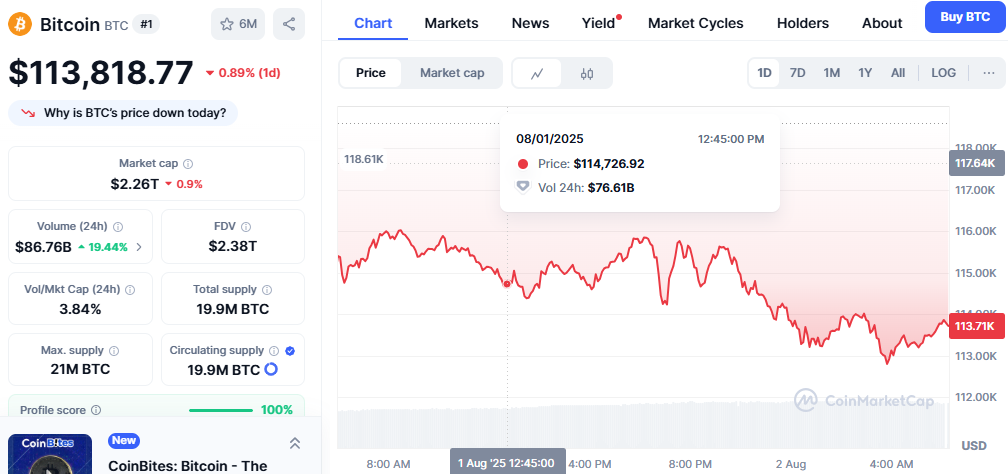

The global cryptocurrency market has experienced remarkable volatility throughout 2025, with total market capitalization fluctuating between $1.8 trillion and $2.4 trillion. Bitcoin continues to dominate the market with approximately 45% market share, while Ethereum maintains its position as the leading innovative contract platform with roughly 18% of the total crypto market cap.

Recent market data shows institutional adoption reaching new heights, with major corporations like MicroStrategy, Tesla, and Square continuing to add Bitcoin to their treasury reserves. This institutional interest has created a foundation of stability that wasn’t present in previous market cycles, contributing to reduced volatility compared to the extreme swings witnessed in 2021 and 2022.

Key Market Metrics Today

- Total Market Cap: $2.12 trillion (+3.2% 24h)

- Bitcoin Dominance: 44.8%

- Ethereum Dominance: 18.2%

- Total Volume 24h: $89.4 billion

- Active Cryptocurrencies: 13,500+

The current market sentiment reflects cautious optimism, with the Fear and Greed Index hovering around 68, indicating “Greed” territory. This suggests that while investors are bullish, there’s still room for growth before reaching extreme euphoria levels that typically signal market tops.

Bitcoin News and Price Analysis

Bitcoin has demonstrated remarkable resilience in 2025, trading within a range of $42,000 to $68,000. The flagship cryptocurrency has benefited from several positive catalysts, including the approval of spot Bitcoin ETFs in multiple jurisdictions and increasing adoption as a store of value in emerging economies experiencing currency devaluation.

Recent Bitcoin Developments

The most significant Bitcoin news today centers around the upcoming halving event scheduled for April 2024, which will reduce mining rewards from 6.25 BTC to 3.125 BTC per block. Historical analysis suggests that Bitcoin prices typically experience substantial gains in the 12-18 months following halving events, creating anticipation among long-term investors.

Mining difficulty has reached all-time highs, indicating robust network security and miner confidence in Bitcoin’s long-term prospects. The hash rate has consistently increased despite periodic price volatility, demonstrating the network’s fundamental strength and decentralization.

Technical Analysis Insights

From a technical perspective, Bitcoin is currently testing key resistance levels around $52,000. A decisive break above this level could signal a continuation of the bull market, with potential targets at $58,000 and $65,000. Support levels remain strong at $48,000 and $45,000, providing downside protection for current holders.

The Relative Strength Index (RSI) indicates Bitcoin is neither overbought nor oversold, suggesting balanced market conditions. Moving averages show a bullish crossover pattern, with the 50-day moving average recently crossing above the 200-day moving average, typically considered a positive long-term signal.

Ethereum and Altcoin Market Analysis

Ethereum continues to benefit from its transition to a Proof-of-Stake consensus mechanism, with staking rewards attracting long-term holders and reducing the circulating supply. The network’s upcoming upgrades, including improved scalability solutions and reduced gas fees, position Ethereum favorably for continued adoption.

DeFi and Smart Contract Developments

The decentralized finance (DeFi) ecosystem built on Ethereum has shown steady growth, with total value locked (TVL) exceeding $45 billion across various protocols. Major DeFi platforms like Uniswap, Aave, and Compound continue to innovate, introducing new features and improving user experience.

Layer 2 solutions such as Polygon, Arbitrum, and Optimism have gained significant traction, offering faster and cheaper transactions while maintaining Ethereum’s security guarantees. These scaling solutions have enabled new use cases and attracted developers building next-generation decentralized applications.

Altcoin Performance Today

Several altcoins have outperformed Bitcoin and Ethereum in recent trading sessions:

- Solana (SOL): +8.4% due to increased NFT activity and DeFi adoption

- Cardano (ADA): +6.1% following smart contract upgrade announcements

- Chainlink (LINK): +7.8% amid new enterprise partnerships

- Polygon (MATIC): +5.9% from Disney and Starbucks NFT collaborations

Regulatory News and Global Impact

Regulatory clarity continues to shape cryptocurrency markets significantly. The United States has made substantial progress in establishing clear guidelines for digital assets, with the Securities and Exchange Commission (SEC) providing more definitive frameworks for token classifications.

Major Regulatory Developments

The European Union’s Markets in Crypto-Assets (MiCA) regulation has come into full effect, providing a comprehensive regulatory framework for cryptocurrency operations across EU member states. This regulatory clarity has encouraged institutional adoption and reduced uncertainty for crypto businesses operating in Europe.

In Asia, countries like Singapore and Japan maintain crypto-friendly regulatory environments, while China continues its strict stance against cryptocurrency trading and mining. Hong Kong has emerged as a potential crypto hub, with new licensing frameworks for cryptocurrency exchanges and investment products.

Central Bank Digital Currencies (CBDCs)

Central banks worldwide are accelerating CBDC development programs. The Federal Reserve continues research into a digital dollar, while the European Central Bank progresses with digital euro trials. These developments could significantly impact the broader cryptocurrency ecosystem by increasing digital payment adoption and blockchain awareness.

Crypto News Today Analysis Trading Strategies

Based on current market conditions and our comprehensive analysis, several trading strategies emerge for different investor profiles:

Short-Term Trading Opportunities

Day traders should focus on high-volume cryptocurrencies with clear technical patterns. Bitcoin and Ethereum offer the most liquid markets for short-term strategies, while selected altcoins provide opportunities for higher percentage gains with increased risk.

Range trading strategies work well in the current market environment, where major cryptocurrencies trade within established support and resistance levels. Traders can capitalize on these predictable price movements using proper risk management techniques.

Long-Term Investment Considerations

Long-term investors should consider dollar-cost averaging strategies, particularly with Bitcoin and Ethereum. The current market cycle suggests we’re in the early to middle stages of a bull market, making systematic accumulation strategies potentially profitable.

Diversification across different blockchain ecosystems remains crucial. While Bitcoin serves as digital gold, Ethereum provides exposure to smart contract innovation, and emerging layer-1 blockchains offer growth potential as they compete for market share.

Technology and Innovation Updates

Blockchain technology continues evolving rapidly, with significant developments in scalability, interoperability, and sustainability. These technological advancements directly impact cryptocurrency valuations and adoption prospects.

Blockchain Scalability Solutions

Zero-knowledge proof technologies have gained prominence, with zkSync and StarkNet leading development in Ethereum layer-2 solutions. These technologies promise to solve blockchain scalability issues while maintaining security and decentralization properties.

Cross-chain bridges and interoperability protocols enable seamless asset transfers between different blockchains. Projects like Cosmos, Polkadot, and new bridge technologies facilitate a more connected multi-chain ecosystem.

Environmental Sustainability Focus

The cryptocurrency industry has made significant strides in addressing environmental concerns. Ethereum’s transition to Proof-of-Stake reduced its energy consumption by over 99%, while Bitcoin mining increasingly utilizes renewable energy sources.

Sustainable mining initiatives and carbon-neutral blockchain networks attract environmentally conscious investors and institutions. This trend toward sustainability could become a crucial factor in long-term cryptocurrency adoption and regulatory approval.

Also Read: Today Crypto Market Is it Up or Down?

Market Sentiment and Social Analytics

Social media sentiment analysis reveals interesting patterns in cryptocurrency markets. Twitter, Reddit, and Telegram discussions often precede significant price movements, making social analytics a valuable tool for market analysis.

Institutional Sentiment

Institutional investors continue showing increased interest in cryptocurrency allocations. Significant pension funds, insurance companies, and sovereign wealth funds are exploring cryptocurrency investments as portfolio diversification tools.

Corporate treasuries holding Bitcoin and other cryptocurrencies provide stability during market downturns. Companies like MicroStrategy, Block, and Marathon Digital Holdings maintain significant cryptocurrency holdings, demonstrating long-term confidence in digital assets.

Retail Investor Behavior

Retail investor sentiment remains cautiously optimistic, with new wallet addresses continuing to grow steadily. However, the exuberant retail participation seen in previous bull markets hasn’t yet materialized, suggesting potential room for growth if positive catalysts emerge.

NFTs and Web3 Development

Non-fungible tokens (NFTs) and Web3 technologies continue evolving beyond simple digital collectibles. Utility-focused NFTs, gaming applications, and real-world asset tokenization represent growing market segments.

Gaming and Metaverse Integration

Blockchain gaming has matured significantly, with play-to-earn models evolving into more sustainable play-and-earn ecosystems. Major gaming companies are integrating blockchain technology and NFTs into existing franchises.

Metaverse platforms built on blockchain technology offer new investment opportunities and use cases for cryptocurrencies. Virtual real estate, digital goods, and immersive experiences create additional demand for blockchain-based assets.

Risk Assessment and Market Warnings

Despite positive developments, cryptocurrency markets remain inherently risky and volatile. Investors should understand potential risks, including regulatory changes, technological failures, market manipulation, and macroeconomic factors affecting digital assets.

Macroeconomic Factors

Global economic conditions significantly impact cryptocurrency prices. Interest rate changes, inflation levels, and geopolitical events can cause substantial market movements. The correlation between traditional financial markets and cryptocurrencies has increased, making macro analysis crucial for crypto investors.

Security Considerations

Cryptocurrency security remains paramount, with exchange hacks and smart contract vulnerabilities posing ongoing risks. Investors should use hardware wallets, enable two-factor authentication, and avoid keeping large amounts on centralized exchanges.

Future Outlook and Predictions

Looking ahead, several trends could shape cryptocurrency markets in the coming months:

- Increased Institutional Adoption: More corporations and financial institutions are expected to add cryptocurrencies to their portfolios

- Regulatory Clarity: Continued regulatory development should reduce uncertainty and encourage adoption

- Technological Innovation: Advances in scalability and interoperability could unlock new use cases

- CBDC Development: Central bank digital currencies may increase overall digital payment adoption

Conclusion

Staying informed with comprehensive crypto newsand today’sy analysis remains essential for navigating the dynamic cryptocurrency landscape successfully. Today’s market presents both opportunities and challenges, with institutional adoption growing steadily while regulatory frameworks continue evolving globally. The current market cycle suggests we’re positioned for continued growth, though investors must remain vigilant about risks and market volatility.

As we’ve explored in this analysis, multiple factors influence cryptocurrency prices, from technological developments and regulatory changes to macroeconomic trends and social sentiment. By staying informed with reliable crypto news, today’s analysis, and maintaining a disciplined investment approach, you can better position yourself to capitalize on opportunities while managing risks effectively.