Ethereum price action will break upward toward the $3,400 resistance level or experience a deeper correction. Ethereum Support Test $3400: toward $2,700.

Current market conditions reveal a complex interplay between technical indicators, on-chain metrics, and broader market sentiment. With trading volumes fluctuating and institutional interest showing mixed signals, understanding the key price levels and market dynamics has become essential for anyone looking to navigate this critical moment in Ethereum’s price discovery process.

Current Ethereum Market Overview and Price Action

Ethereum is currently trading around $3,070, showing modest gains as the market attempts to stabilize following recent volatility. Ethereum Support Test $3400: The digital asset has experienced significant price movements over recent months, with the asset demonstrating both resilience and vulnerability at various technical levels.

After establishing a low just below $2,950, ETH is attempting to hold a recovery above the support near $3,100, which represents a crucial threshold for maintaining bullish momentum. This price level has become a focal point for market participants, as it aligns with multiple technical indicators and historical support zones.

Market analysts have observed that Ethereum’s price action has approached a decisive technical moment after defending the $2,900 region, a high-time-frame support that has historically attracted significant buying pressure. The ability of buyers to defend this zone will likely determine whether the cryptocurrency can mount a sustained recovery or faces additional downside pressure.

The blockchain network has maintained relatively stable on-chain fundamentals despite price fluctuations, with staking activity continuing to lock up substantial amounts of ETH and reduce the liquid supply available for trading. This dynamic creates an interesting backdrop for price discovery, as reduced selling pressure from staked tokens could support higher valuations if demand materializes.

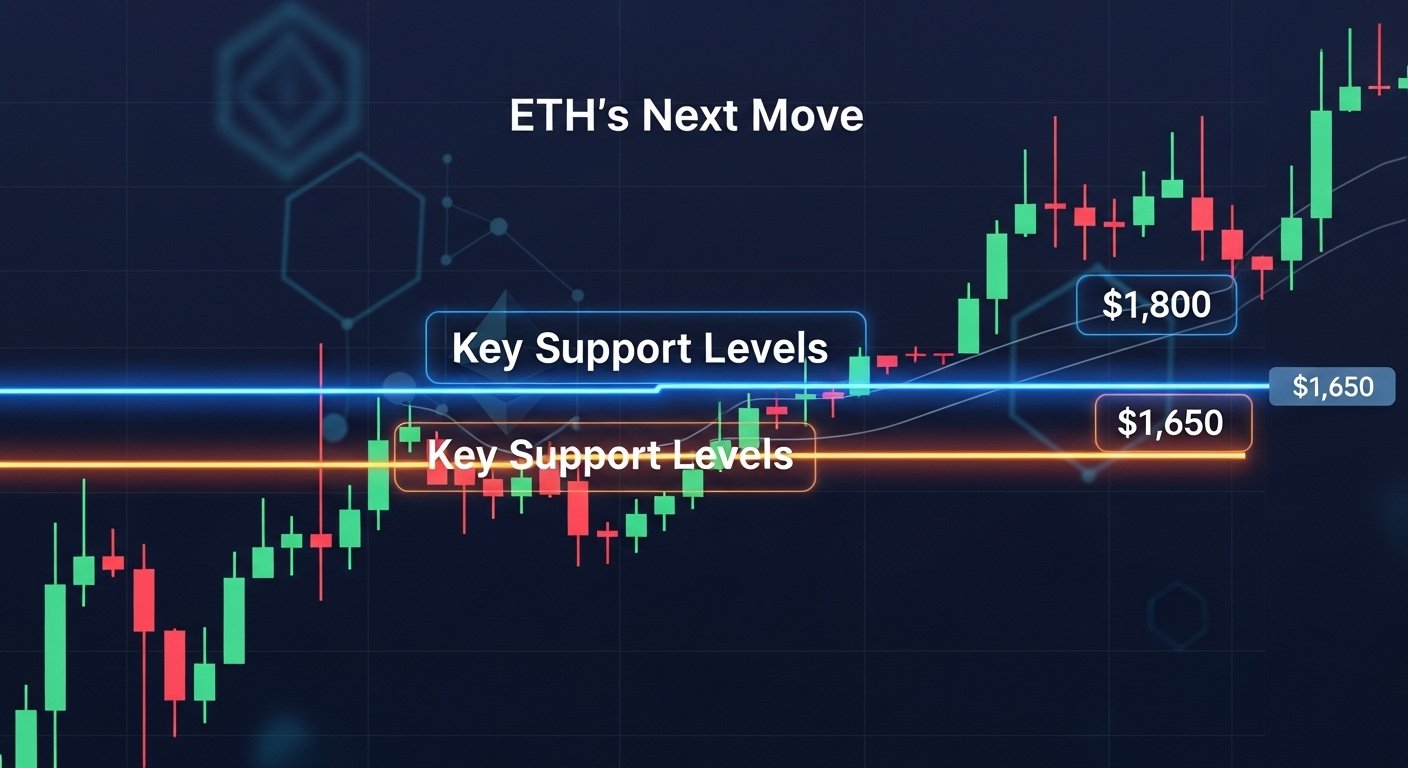

Key Support Levels That Could Define ETH’s Next Move

Several critical support zones have emerged as potential inflection points that could determine Ethereum’s near-term trajectory. Understanding these levels provides valuable context for assessing risk and potential reward scenarios.

Primary Support at $3,100

The support near $3,100 represents a key level where bulls are attempting to establish a foundation for recovery. This price point coincides with previous consolidation areas and represents a psychological level where institutional buyers may look to accumulate positions. If this level holds, it could provide the springboard for an attempt at higher resistance levels.

Secondary Support at $2,900

The $2,900 region has functioned as high-time-frame support that has historically attracted significant buying pressure. Ethereum Support Test $3400: This level represents a deeper retracement but remains within the bounds of a healthy correction in an uptrend. Many technical analysts view this zone as an attractive entry point for long-term investors seeking exposure to Ethereum.

Critical Support at $2,700

Should the market experience a more substantial correction, a pullback to $2,750 could be considered if Ethereum fails to hold above $3,000. Ethereum Support Test $3400: This deeper support level would represent a significant test of market conviction and could trigger stop-loss orders from leveraged traders. However, it would also present compelling value for strategic accumulation based on historical price patterns.

The presence of these multiple support zones creates a tiered risk management framework for traders. Each level offers potential entry points with different risk-reward profiles, Ethereum Support Test $3400: allowing market participants to scale into positions based on their individual strategies and risk tolerance.

Resistance Levels and Potential Upside Targets

While support levels define potential downside risks, resistance zones indicate where selling pressure may emerge and limit upward momentum. Understanding these barriers is crucial for setting realistic profit targets and managing position sizing.

Immediate Resistance at $3,400

The $3,400 level represents a notable resistance, as evidenced by past pivot points. This price zone has previously sparked selling interest, preventing breakouts and leading to consolidation. For bulls to regain control and establish a convincing uptrend, overcoming this resistance with strong volume will be essential.

Breaking above $3,400 would signal renewed bullish momentum and could attract additional buying interest from both retail and institutional participants. Technical analysts often look for a decisive close above resistance levels, preferably accompanied by expanding volume, to confirm that a breakout is legitimate rather than a false signal that quickly reverses.

Extended Upside Targets

If bulls defend key support levels, ETH could rise to test the resistance around $3,470, which would represent a significant advance from current levels. Beyond this immediate target, some analysts project that sustained buying pressure could eventually challenge the psychological $4,000 level, though reaching such heights would require favorable broader market conditions and strong fundamental catalysts.

The path to higher prices depends heavily on market sentiment and whether Bitcoin, which often leads broader cryptocurrency trends, can maintain its own upward trajectory. Historically, Ethereum has shown strong correlation with Bitcoin’s price movements, meaning any significant weakness in the largest cryptocurrency could limit ETH’s ability to challenge resistance levels.

Technical Indicators Signaling Potential Direction: Ethereum Support Test $3400

Technical analysis provides valuable insights into market dynamics by examining price patterns, momentum indicators, and volume characteristics. Several key indicators are offering important signals about Ethereum’s potential near-term direction.

RSI and Momentum Analysis

The Relative Strength Index (RSI) value is at 35.56, which indicates that the ETH market is in a neutral position. This reading suggests the asset is neither oversold nor overbought, leaving room for movement in either direction based on incoming catalysts. When RSI readings approach oversold territory below 30, they often indicate potential buying opportunities, while readings above 70 suggest overbought conditions that may precede corrections.

The current neutral RSI reading means that momentum could shift quickly based on market developments. Traders typically watch for divergences between price action and RSI, where the indicator moves in the opposite direction of price, as these can signal potential reversals.

Moving Average Convergence

The price is above the 20-EMA, suggesting that buyers remain very active, while the MACD remains in the positive zone, suggesting that bullish momentum can resume soon. This technical setup indicates that despite recent volatility, Ethereum Support Test $3400: the underlying trend structure remains constructive for bulls.

Moving averages serve as dynamic support and resistance levels, with price often respecting these zones during trending markets. The fact that Ethereum continues to trade above its short-term moving averages suggests that buyers are stepping in at higher levels, preventing deeper corrections.

Volume and Market Participation

In the last 24 hours, Ethereum’s trading volume has dropped 30%, suggesting that the latest price moves are occurring with less engagement from market participants. Ethereum Support Test $3400: Declining volume during price movements can indicate a lack of conviction and may suggest that current trends could reverse once participation increases.

Cryptocurrency trading often experiences cycles of high and low volume, with significant price moves typically occurring during periods of elevated participation. Monitoring volume trends helps traders assess whether price movements are likely to persist or represent temporary imbalances that will correct.

On-Chain Metrics and Institutional Activity

Beyond traditional technical analysis, on-chain data provides unique insights into Ethereum’s market dynamics by revealing actual network usage and holder behavior. These metrics offer a more complete picture of market conditions.

Exchange Flows and Whale Activity

On-chain flows show a large inflow of roughly 509,900 ETH into Binance, marking the highest level in nine months. Large deposits to exchanges often indicate potential selling pressure, as investors typically move assets to exchanges when they intend to liquidate positions. This substantial inflow represents a notable development that traders should monitor closely.

However, exchange inflows don’t automatically result in selling. Some whales move assets to exchanges for trading purposes, collateral posting, or derivatives strategies. The actual impact on price depends on whether these large holders execute sell orders or maintain their positions.

Leverage and Derivatives Risk

Ethereum’s Binance Estimated Leverage Ratio has risen to a record high near 0.5617, with elevated leverage raising the risk of liquidation-driven swings. High leverage ratios indicate that traders are using significant borrowed capital to amplify their positions, which increases systemic risk within the market.

When leverage reaches extreme levels, relatively small price movements can trigger cascading liquidations as overleveraged positions are forcibly closed. This creates the potential for sharp, rapid price swings in either direction. Understanding leverage conditions helps traders anticipate potential volatility and adjust their risk management accordingly.

Network Fundamentals

Despite price volatility, Ethereum’s underlying network metrics remain robust. Stablecoin transactions on the network reached $2.82 trillion in October 2025, indicating its increasing dominance in tokenized finance. This massive transaction volume demonstrates that Ethereum continues to serve as critical infrastructure for decentralized finance and other blockchain applications.

The smart contract platform maintains its position as the preferred choice for developers building decentralized applications, with thousands of projects utilizing Ethereum’s technology. This sustained developer and user activity provides fundamental support for long-term valuation, even as short-term price action remains volatile.

Market Sentiment and External Factors

Cryptocurrency prices don’t exist in a vacuum but respond to broader market conditions, regulatory developments, and macroeconomic factors. Understanding these influences helps contextualize current price action.

Broader Cryptocurrency Market Trends

Bitcoin is trading around $91,332, showing the broader market context in which Ethereum operates. Bitcoin’s price stability or volatility often sets the tone for altcoin markets, including Ethereum. When Bitcoin consolidates or advances, it typically creates a supportive environment for ETH price appreciation.

The correlation between Bitcoin and Ethereum means that any significant developments affecting Bitcoin—whether positive regulatory news, institutional adoption, or macroeconomic shifts—will likely influence Ethereum as well. Traders monitoring both assets can gain valuable insights into potential directional moves.

Fear and Greed Dynamics

The Fear & Greed Index is showing 15 (Extreme Fear), indicating that market participants are currently exhibiting significant pessimism. Extreme fear readings often coincide with market bottoms, as widespread negative sentiment frequently represents capitulation that precedes recoveries.

Contrarian investors often view extreme fear as a buying opportunity, reasoning that when sentiment reaches pessimistic extremes, much of the potential bad news has already been priced into the market. However, sentiment can remain negative for extended periods, so timing entries based solely on sentiment indicators requires patience.

Institutional Investment Trends

Institutional participation in cryptocurrency markets has grown substantially, with spot ETH ETFs providing traditional investors with easier access to Ethereum exposure. The total net assets of the Ethereum spot ETF have risen to $10.80 billion, worth 2.47% of the Ethereum market cap, and institutional support is gradually increasing.

This growing institutional presence brings both stability and new dynamics to Ethereum markets. Large institutional flows can drive sustained price trends, while redemptions can create selling pressure. Monitoring ETF flows provides valuable insights into whether professional investors are accumulating or distributing their Ethereum holdings.

Upcoming Catalysts and Future Outlook

Looking beyond immediate price action, several upcoming developments could influence Ethereum’s trajectory over the coming months. Understanding these potential catalysts helps investors position for future opportunities.

Network Upgrades and Protocol Improvements

The upcoming Fusaka upgrade is tentatively scheduled for November 2025, marking the next major hard fork, featuring PeerDAS with 8x data blob capacity expansion from 6 to 48 per block. This significant protocol enhancement will dramatically improve Ethereum’s scalability and reduce transaction costs, particularly for layer-2 solutions.

Protocol upgrades typically generate increased attention and can serve as catalysts for price appreciation if successfully implemented. The layer 2 solutions built on Ethereum will benefit substantially from enhanced data availability, potentially attracting more users and developers to the ecosystem.

Regulatory Developments

The regulatory landscape for cryptocurrencies continues to evolve, with potential implications for Ethereum’s price and adoption. Clearer regulatory frameworks could unlock additional institutional capital, while adverse regulatory actions might create temporary headwinds.

Market participants should monitor developments regarding cryptocurrency taxation, securities classification, and compliance requirements. Positive regulatory clarity has historically supported price appreciation by reducing uncertainty and encouraging broader adoption.

Competitive Landscape

Ethereum faces ongoing competition from alternative blockchain platforms, each claiming advantages in speed, cost, or features. However, Ethereum’s established network effects, developer community, and accumulated value locked in DeFi protocols provide substantial competitive moats that help maintain its market leadership.

The success of Ethereum’s scaling solutions and the continued innovation within its ecosystem will determine whether it can maintain its dominant position in the smart contract platform space. Strong fundamentals in these areas would support higher long-term valuations.

Conclusion

Ethereum stands at a critical technical crossroads, with price action testing important support levels that will likely determine the asset’s direction over the coming weeks. The battle between bulls defending the $3,100-$3,000 support zone and bears attempting to push prices lower creates a high-stakes environment where decisive moves could occur rapidly.

Technical indicators present a mixed picture, with neutral momentum readings suggesting that the next significant catalyst could drive price in either direction. Ethereum Support Test $3400: The presence of elevated leverage ratios and substantial exchange inflows introduces additional volatility risk that traders must consider in their risk management strategies.

For those with a bullish outlook, the key levels to watch are the $3,400 resistance for confirmation of upward momentum, with potential extended targets toward $3,700 and beyond if buying pressure intensifies. Ethereum Support Test $3400: Conversely, Ethereum Support Test $3400: bears will look for a breakdown below $3,000 to target the $2,700 support zone, which would represent a more significant correction but potentially create attractive long-term entry points.

Ultimately, whether Ethereum reaches $3,400 or $2,700 this week will depend on the complex interaction of technical factors, Ethereum Support Test $3400: market sentiment, and broader cryptocurrency market conditions. Both scenarios remain possible, making disciplined risk management and careful Ethereum Support Test $3400: monitoring of key price levels essential for navigating this volatile environment successfully.

FAQs

Q: What are the most important support levels for Ethereum right now?

The most critical support levels for Ethereum are currently at $3,100, which represents immediate support where bulls are attempting to establish a base, and $2,900, Ethereum Support Test $3400: which functions as a stronger historical support zone.

Q: How do technical indicators like RSI help predict Ethereum’s price direction?

The Relative Strength Index measures momentum by comparing the magnitude of recent gains to recent losses. An RSI around 35-40, where Ethereum currently sits, Ethereum Support Test $3400: indicates neutral momentum with room for movement in either direction.

Q: Why is exchange inflow data important for understanding Ethereum’s price outlook?

Exchange inflows reveal when large amounts of Ethereum are moved to trading platforms, which often precedes selling activity since holders typically Ethereum Support Test $3400: transfer assets to exchanges when they intend to liquidate positions.

Q: How does Bitcoin’s price movement affect Ethereum?

Ethereum and Bitcoin exhibit a strong positive correlation, meaning they tend to move in the same direction most of the time. Ethereum Support Test $3400: Bitcoin often leads broader cryptocurrency market trends, with its price movements influencing investor sentiment across all digital assets.

Q: What role do network upgrades like Fusaka play in Ethereum’s long-term value?

Protocol upgrades enhance Ethereum’s technical capabilities, making the network more scalable, efficient, and capable of handling greater transaction volume. Ethereum Support Test $3400: The upcoming Fusaka upgrade will expand data blob capacity by 8x, significantly improving performance for layer-2 solutions and reducing transaction costs.