The cryptocurrency market continues to captivate investors worldwide, with Bitcoin price predictions becoming increasingly bullish as we progress through 2025. Leading financial analysts and blockchain experts are now suggesting that BTC could reach $200,000 within the current year, marking a potential 150% increase from current levels. This unprecedented Bitcoin price forecast is backed by a confluence of factors, including institutional adoption, regulatory clarity, and evolving market dynamics.

The digital asset landscape has undergone significant transformation since Bitcoin’s inception, evolving from a niche technological experiment to a legitimate store of value recognised by major corporations and governments. Current market analysis indicates that Bitcoin is positioned for another substantial rally, driven by both fundamental improvements in the ecosystem and technical indicators that suggest strong upward momentum.

Understanding the mechanics behind this $200K Bitcoin prediction requires examining multiple variables, including supply and demand dynamics, macroeconomic factors, and the growing integration of cryptocurrency into traditional financial systems. This comprehensive analysis explores the key drivers supporting this ambitious price target and evaluates the likelihood of Bitcoin achieving this milestone within the specified timeframe.

Current Bitcoin Market Analysis and Performance Metrics

Bitcoin Recent Price Action and Market Sentiment

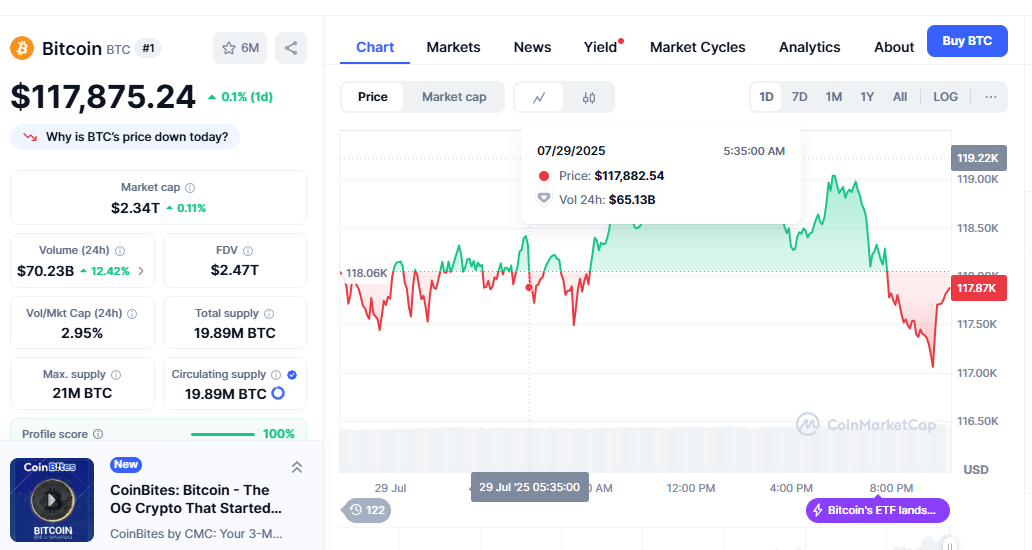

Bitcoin’s current trading patterns reveal strong institutional interest and retail investor confidence. The cryptocurrency has demonstrated remarkable resilience despite market volatility, maintaining support levels that suggest underlying strength. Technical indicators point to accumulation phases among long-term holders, creating a foundation for potential price appreciation.

The BTC market cap continues to grow, reflecting increased adoption and recognition as a legitimate asset class. Trading volumes across major exchanges indicate sustained interest from both retail and institutional participants, with derivatives markets showing predominantly bullish positioning.

Institutional Adoption Driving Price Discovery

Major corporations and investment funds have significantly increased their Bitcoin holdings, creating substantial buying pressure. This institutional embrace of digital assets represents a paradigm shift from previous market cycles, where retail investors primarily drove price action. Corporate treasuries now view Bitcoin as a hedge against inflation and currency debasement, fundamentally altering demand dynamics.

The introduction of Bitcoin ETFs has further streamlined institutional access, allowing traditional investors to gain exposure without directly holding the cryptocurrency. This development has opened Bitcoin to a broader investor base, contributing to the bullish price prediction scenarios.

Technical Analysis Supporting the $200K Target

Chart Patterns and Key Resistance Levels

Technical analysis of Bitcoin’s long-term charts reveals several bullish patterns that support the $200,000 price target. The formation of higher lows and ascending triangles suggests accumulation phases that typically precede significant price movements. Key resistance levels have been consistently broken, indicating strong momentum continuation.

Fibonacci retracement levels and Elliott Wave analysis provide additional confirmation for the bullish Bitcoin forecast. These technical tools suggest that Bitcoin is in the early stages of a primary impulse wave that could drive prices to unprecedented levels.

Volume Analysis and Market Structure

Trading volume patterns indicate firm conviction among market participants, with buying volume consistently exceeding selling pressure during pullbacks. This market structure suggests that any price declines are being viewed as accumulation opportunities rather than distribution phases.

The cryptocurrency market depth has improved significantly, reducing the impact of large trades on price volatility. This enhanced liquidity provides a more stable foundation for sustained price appreciation toward the $200K target.

Also Read: How Does Bitcoin News Affect Price The Complete 2025 Analysis

Fundamental Factors Driving Bitcoin’s Bullish Trajectory

Macroeconomic Environment and Monetary Policy

The current macroeconomic landscape strongly favors Bitcoin adoption as central banks continue expansionary monetary policies. Concerns about currency debasement and inflation have driven investors toward alternative stores of value, with Bitcoin emerging as a preferred choice for portfolio diversification.

Global debt levels and fiscal spending patterns suggest continued monetary expansion, creating an environment where scarce assets like BTC become increasingly valuable. This macroeconomic backdrop provides fundamental support for bullish price predictions.

Regulatory Clarity and Legal Framework Development

Recent regulatory developments have provided much-needed clarity for cryptocurrency operations, reducing uncertainty that previously hindered institutional adoption. Clear regulatory frameworks allow financial institutions to integrate Bitcoin into their service offerings with greater confidence.

The establishment of Bitcoin as legal tender in several jurisdictions demonstrates growing governmental acceptance, further legitimizing the digital asset and supporting long-term price appreciation scenarios.

Supply and Demand Dynamics Influencing Price

Bitcoin Halving Cycles and Scarcity Effects

Bitcoin’s halving mechanism continues to reduce new supply issuance, creating inherent scarcity that supports price appreciation. Historical analysis of previous halving cycles shows consistent price increases in the 12-18 months following these events, suggesting similar patterns may drive the current bullish forecast.

The decreasing rate of new Bitcoin creation, combined with increasing demand from institutional investors, creates a supply-demand imbalance that favors higher prices. This fundamental dynamic provides strong support for the $200K prediction.

On-Chain Metrics and Holder Behavior

On-chain analysis reveals that long-term holders continue accumulating Bitcoin, reducing the circulating supply available for trading. This “hodling” behavior among committed investors creates additional scarcity pressure that supports higher price targets.

Network activity metrics show increasing transaction volumes and active addresses, indicating growing cryptocurrency adoption and usage. These fundamental improvements in network utilization provide additional support for bullish price forecasts.

Expert Opinions and Institutional Forecasts

Wall Street Analysts and Their Projections

Leading financial institutions have published research reports supporting ambitious Bitcoin price targets. Central investment banks cite the cryptocurrency’s growing role as digital gold and its potential to capture a portion of the global store-of-value market as key factors supporting higher valuations.

Quantitative models developed by institutional research teams suggest that Bitcoin could reach $200,000 based on adoption curves and network effects similar to other transformative technologies. These sophisticated analytical frameworks provide credibility to the bullish price prediction.

Blockchain Industry Leaders and Their Insights

Prominent figures in the cryptocurrency space have expressed confidence in Bitcoin’s long-term trajectory, citing technological improvements and growing institutional acceptance. Their insights, based on deep industry knowledge and market experience, contribute to the optimistic Bitcoin forecast.

The consensus among blockchain experts suggests that current BTC valuations remain below fair value when considering the asset’s unique properties and growing utility in the global financial system.

Risk Factors and Potential Challenges

Market Volatility and External Pressures

Despite bullish price predictions, Bitcoin remains subject to significant volatility that could impact the timeline for reaching $200,000. External factors such as regulatory changes, technological issues, or macroeconomic shifts could influence the cryptocurrency’s price trajectory.

Market participants should consider these risk factors when evaluating the likelihood of achieving ambitious price targets within specific timeframes.

Competition from Alternative Cryptocurrencies

The digital asset space continues evolving, with alternative cryptocurrencies potentially capturing market share from Bitcoin. While Bitcoin maintains its position as the leading cryptocurrency, competition could impact its price appreciation potential.

However, Bitcoin’s first-mover advantage and established network effects provide strong competitive moats that support its continued dominance in the crypto market.

Timeline and Probability Assessment

Short-term Catalysts and Market Events

Several potential catalysts could accelerate Bitcoin’s progress toward the $200K target, including additional institutional adoption announcements, regulatory approvals, or macroeconomic developments that favor alternative assets.

The timing of these catalysts will likely influence whether Bitcoin achieves this ambitious price level within 2025 or requires additional time to reach such valuations.

Long-term Adoption Trends and Market Maturation

The cryptocurrency market’s continued maturation supports long-term price appreciation scenarios, even if short-term volatility creates temporary setbacks. Growing integration with traditional financial systems provides a foundation for sustained growth in Bitcoin valuations.

Market development trends suggest that $200,000 Bitcoin represents a realistic long-term target, even if the specific timeline remains uncertain.

Conclusion

I support the Bitcoin price prediction suggesting BTC will reach $200,000 in 2025. Multiple converging factors, including institutional adoption, technical analysis, and fundamental market dynamics, support this prediction. While cryptocurrency markets remain inherently volatile and unpredictable, the underlying trends supporting this bullish forecast appear robust and sustainable.

Investors considering exposure to Bitcoin should conduct thorough research and consider their risk tolerance before making investment decisions. The potential for significant returns exists alongside the possibility of substantial losses, as is characteristic of all digital asset investments.