The cryptocurrency market is holding its collective breath as Bitcoin navigates one of its most pivotal trading zones in recent history. With the world’s leading digital asset hovering near critical price levels, traders and investors are closely monitoring whether BTC will surge past the $112,000 resistance barrier to establish a new all-time high or succumb to selling pressure that could trigger a sharp decline toward $103,000. This comprehensive analysis explores the technical landscape, market sentiment, and strategic trading opportunities that define Bitcoin’s current trajectory in what could be a defining moment for the broader crypto ecosystem.

Bitcoin’s price action has consistently demonstrated its ability to captivate global financial markets, and the current setup presents both extraordinary opportunities and significant risks. Understanding the key technical levels, volume dynamics, and macroeconomic factors influencing BTC becomes essential for anyone looking to navigate these turbulent waters successfully. Whether you’re a seasoned trader seeking optimal entry and exit points or a long-term investor evaluating portfolio allocations, the coming days could prove instrumental in shaping Bitcoin’s medium-term direction.

Current Bitcoin Price Structure and Market Context

The Bitcoin price has exhibited remarkable resilience throughout recent trading sessions, maintaining a consolidation pattern that suggests accumulation by sophisticated market participants. After establishing a local bottom near the $103,000 psychological support zone, BTC has gradually climbed higher, testing resistance levels and building momentum for what traders anticipate could be a decisive breakout move. The current price structure reflects a classic compression pattern where volatility contracts before an explosive directional move unfolds.

Market participants have observed decreasing selling pressure at higher price levels, indicating potential exhaustion among bears who have attempted to push prices lower. Simultaneously, buying interest has materialised consistently near support zones, creating a floor that has held firm despite multiple retests. This dynamic establishes a trading range that has narrowed considerably, with the $112,000 overhead resistance and $103,000 underlying support forming the boundaries of what technical analysts call a decision zone.

The broader context surrounding Bitcoin’s price action includes institutional adoption continuing at an accelerated pace, regulatory clarity emerging in major jurisdictions, and macroeconomic conditions that increasingly favour alternative assets as hedges against traditional financial system vulnerabilities. These fundamental factors provide a supportive backdrop for bullish price action, though short-term technical considerations remain paramount for traders operating on compressed timeframes.

The $112,000 Resistance Level: Gateway to New All-Time Highs

Breaking decisively above $112,000 represents far more than a simple numeric milestone for Bitcoin. This price level has emerged as a formidable technical barrier where previous rallies have stalled, creating a concentration of sell orders and profit-taking that must be absorbed before higher prices become accessible. The psychological significance of this threshold cannot be overstated, as surpassing it would likely trigger substantial momentum-based buying from algorithmic trading systems and momentum traders waiting for confirmation of the uptrend’s continuation.

Technical analysis reveals that the $112,000 zone coincides with multiple resistance factors that compound its significance. Historical price action shows this area previously served as support during earlier bull phases, and the principle of polarity suggests former support often transforms into formidable resistance upon retesting from below. Additionally, Fibonacci extension levels calculated from recent swing points align closely with this price, adding another layer of technical importance that attracts the attention of chart-oriented traders worldwide.

Volume analysis becomes particularly crucial when evaluating the probability of a successful breakout above this resistance. Bitcoin Price Alert $112K: A genuine breakthrough requires substantial buying volume that demonstrates authentic demand rather than merely stop-loss hunting by market makers. Traders should watch for sustained closes above $112,000 accompanied by expanding volume metrics, ideally occurring across multiple consecutive daily candles to confirm the move’s legitimacy. Such confirmation would open the path toward the next resistance zone in the $118,000 to $120,000 range, where new all-time highs could materialise.

The $103,000 Support Zone: Critical Floor or Breakdown Risk?

While optimism surrounds potential upside scenarios, prudent risk management demands equal attention to downside possibilities. The $103,000 support level has demonstrated remarkable resilience during recent price corrections, functioning as a reliable floor that has attracted aggressive buying from various market participant categories. This zone encompasses not just a single price point but rather a support band extending from approximately $102,500 to $103,500, where buying interest has consistently emerged to absorb selling pressure.

Bitcoin Price Alert $112K The technical importance of this support derives from multiple converging factors that create what analysts call confluence—the simultaneous alignment of various technical indicators at similar price levels. Moving averages on higher timeframes, notably the 50-day and 100-day exponential moving averages, currently reside near this zone, providing dynamic support that strengthens the static horizontal support visible on price charts. Furthermore, volume profile analysis reveals a high-volume node at these levels, indicating substantial historical trading activity that tends to attract price action back to these areas.

However, traders must recognise that even robust support levels eventually fail when selling pressure becomes overwhelming. A decisive break below $103,000, particularly on elevated volume, would constitute a significant technical development that could trigger cascading stop-loss orders positioned just beneath this level. Such a scenario would likely produce a rapid decline toward the next major support zone near $98,000 to $100,000, representing a sweep of recent lows that would shake out leveraged long positions and reset market sentiment from optimistic to cautious.

Technical Indicators Providing Trading Signals

Sophisticated traders rely on multiple technical indicators to validate price action and generate high-probability trading signals. The Relative Strength Index (RSI), a momentum oscillator measuring the speed and magnitude of price changes, currently displays neutral readings that suggest neither overbought nor oversold conditions. This positioning indicates room for movement in either direction, with the indicator’s trajectory providing early warnings of momentum shifts that often precede actual price movements.

The Moving Average Convergence Divergence (MACD) indicator offers additional insights into momentum dynamics and potential trend changes. Recent MACD behaviour shows converging lines that hint at building momentum, though the direction of the subsequent crossover will prove critical in determining whether bulls or bears gain the upper hand. Traders watching for a bullish MACD crossover above the signal line would interpret such a development as confirmation of strengthening upward momentum supporting a move toward $112,000 and beyond.

Bollinger Bands, which measure price volatility and identify potential reversal points, have contracted significantly in recent sessions—a phenomenon often preceding explosive moves known as Bollinger Band squeezes. The current squeeze suggests that Bitcoin’s period of consolidation is approaching its end, with a violent breakout or breakdown becoming increasingly probable. Directional clues emerge from observing which band price ultimately breaks through and whether volume accompanies the move, providing traders with actionable signals for position entry.

Volume Analysis and Market Participation Patterns

Volume serves as the lifeblood of technical analysis, validating or contradicting price movements and revealing the conviction behind market participants’ actions. Recent trading volume patterns in Bitcoin display interesting characteristics that merit careful examination. During upward price movements, volume has remained moderate rather than explosive, suggesting some hesitancy among buyers to commit capital aggressively at current levels. This volume profile raises questions about whether sufficient buying pressure exists to overcome the formidable resistance at $112,000.

Conversely, selling waves have also occurred on relatively subdued volume, indicating that bears similarly lack the conviction to push prices substantially lower. This equilibrium creates the consolidation pattern currently observable on price charts, with neither bulls nor bears commanding sufficient force to establish decisive control. Such conditions typically persist until a catalyst—either technical or fundamental—shifts the balance decisively in favour of one side.

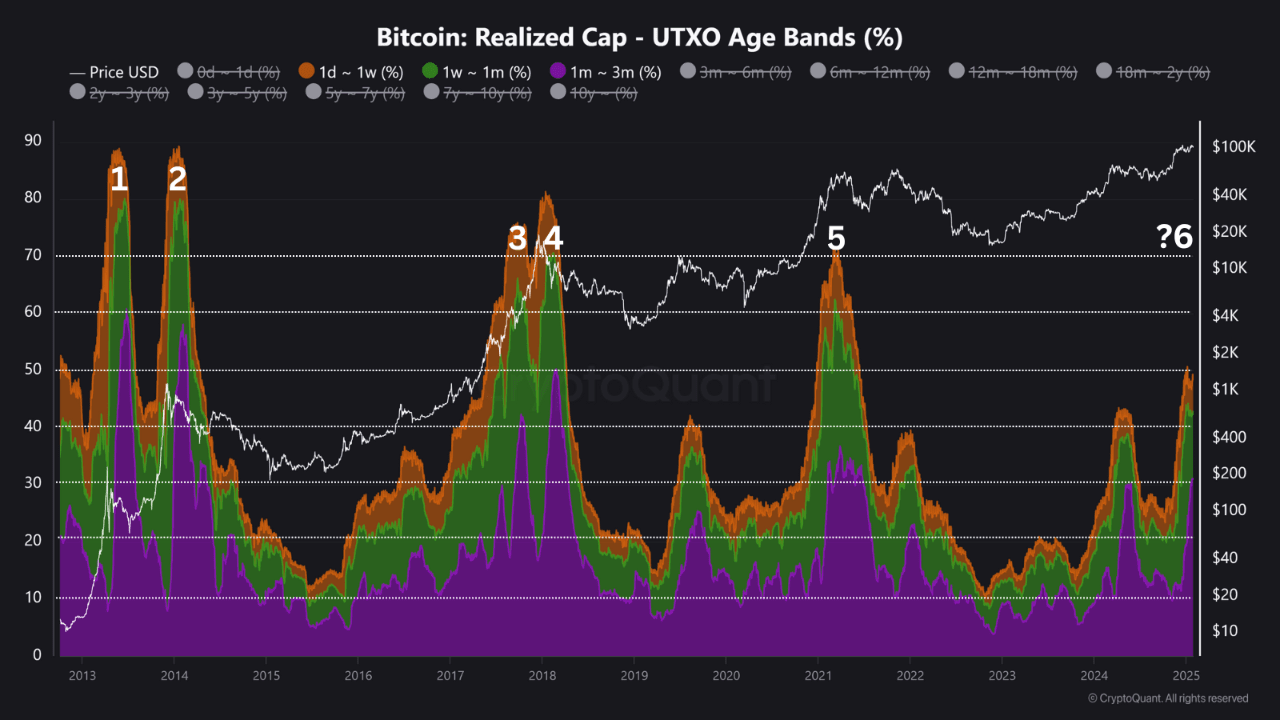

On-chain metrics provide additional perspective beyond traditional exchange volume data. Metrics tracking Bitcoin movement to and from exchanges reveal net outflows in recent weeks, suggesting accumulation by entities preferring cold storage over keeping assets on trading platforms. This behaviour typically correlates with bullish sentiment, as it indicates participants expect higher prices and prefer securing their holdings rather than maintaining positions ready for immediate sale. Combined with decreasing exchange balances, these patterns support constructive medium-term price outlooks despite short-term uncertainty.

Strategic Trading Approaches for Current Market Conditions

Navigating Bitcoin’s current price structure requires carefully constructed trading strategies that account for both breakout and breakdown scenarios. Conservative traders might adopt a wait-and-see approach, remaining sidelined until price action confirms a decisive move beyond the established range boundaries. This strategy sacrifices early entry opportunities in exchange for higher-probability setups with clearer directional conviction, appealing to risk-averse participants prioritising capital preservation.

More aggressive traders might implement range-trading strategies, buying near the $103,000 support with tight stop-losses positioned below key structural levels, then taking profits near the $112,000 resistance. This approach capitalises on the oscillating nature of consolidation patterns but requires disciplined execution and willingness to accept small losses when the range eventually breaks. Position sizing becomes critical with this strategy, as the inevitable range breakdown could produce outsized losses for traders caught on the wrong side.

Breakout traders prepare contingency plans for either directional scenario, establishing parameters for entries above $112,000 with targets at $118,000 and beyond, while simultaneously preparing short positions should price collapse through $103,000 support with targets near $98,000. This dual preparation ensures readiness regardless of which scenario materialises, though it demands constant market monitoring and rapid execution capabilities when breakout signals trigger.

Macroeconomic Factors Influencing Bitcoin’s Trajectory

Bitcoin’s price movements never occur in isolation from broader financial market dynamics and macroeconomic developments. Bitcoin Price Alert $112K: Current global economic conditions present a mixed picture for cryptocurrency markets, with various factors pulling in different directions. Persistent inflation concerns continue driving institutional interest in Bitcoin as a potential inflation hedge and portfolio diversification tool, lending fundamental support to bullish price scenarios.

Monetary policy decisions by major central banks, particularly the Federal Reserve, Bitcoin Price Alert $112K: exert substantial influence on risk asset performance generally and cryptocurrencies specifically. Recent signals suggesting potential dovishness in policy approaches have supported crypto market sentiment, Bitcoin Price Alert $112K: as looser monetary conditions typically favour speculative assets by reducing opportunity costs of capital allocation toward higher-risk investments. Any shifts in this policy stance could rapidly alter the landscape for Bitcoin’s price prospects.

Geopolitical tensions and banking system instabilities have historically driven capital flows toward decentralised assets like Bitcoin during periods of heightened uncertainty. Bitcoin Price Alert $112K: The ongoing evolution of international financial architectures and currency dynamics continues to provide tailwinds for Bitcoin adoption narratives, supporting the longer-term investment thesis even while short-term price action remains volatile and technically driven.

Risk Management Considerations for Bitcoin Traders

Successful Bitcoin trading depends as much on effective risk management as on accurate directional forecasts. Given the cryptocurrency’s volatility, Bitcoin Price Alert $112K: position sizing assumes paramount importance, with experienced traders typically risking only small percentages of total capital on individual trades. This approach ensures that inevitable losing trades don’t produce catastrophic portfolio damage, allowing traders to remain in the game long enough for winning positions to materialise.

Stop-loss placement requires careful consideration of both technical factors and individual risk tolerance. Stops positioned too tightly may result in premature exits from positions that ultimately prove profitable, while stops placed too loosely expose traders to larger-than-acceptable losses. Bitcoin Price Alert $112K: The current market structure suggests logical stop-loss levels just beyond the range boundaries—slightly below $102,500 for long positions and above $112,500 for short positions—providing reasonable breathing room while protecting against adverse scenarios.

Leverage usage demands particular caution in current conditions where directional uncertainty remains elevated. While leverage can amplify profits during favourable moves, it equally magnifies losses when positions move adversely. Bitcoin Price Alert $112K: Conservative leverage ratios or even spot-only trading might prove prudent until clearer directional signals emerge, particularly for traders without extensive experience managing leveraged positions through volatile market conditions.

Conclusion

Bitcoin stands at a crucial crossroads that will likely define its trajectory for weeks or months ahead. The technical structure formed between $103,000 support and $112,000 resistance creates a compressed trading range where explosive moves become increasingly probable as consolidation extends. Traders possessing the discipline to wait for confirmation before committing capital, Bitcoin Price Alert $112K: the flexibility to adapt strategies as conditions evolve, Bitcoin Price Alert $112K: and the risk management protocols to protect against adverse scenarios will find themselves best positioned to capitalise on opportunities this environment presents.

The confluence of technical factors, Bitcoin Price Alert $112K: evolving fundamentals, and macroeconomic conditions creates a complex landscape requiring nuanced analysis rather than simplistic predictions. Bitcoin Price Alert $112K: Whether Bitcoin breaks higher to establish new all-time highs or breaks lower to retest deeper support levels, Bitcoin Price Alert $112K: the coming sessions promise significant volatility and trading opportunities for those prepared to act decisively while managing risk prudently. As always in cryptocurrency markets, Bitcoin Price Alert $112K: staying informed, remaining disciplined, Bitcoin Price Alert $112K: and adapting to changing conditions separates successful traders from those left behind by rapidly evolving market dynamics.

FAQs

Q1: What happens if Bitcoin breaks above $112,000?

A decisive break above $112,000 on strong Bitcoin Price Alert $112K: volume would likely trigger momentum-based buying from algorithmic systems and traders waiting for confirmation, Bitcoin Price Alert $112K: potentially driving prices toward $118,000-$120,000 in the near term.

Q2: How low could Bitcoin fall if $103,000 support fails?

If Bitcoin loses the $103,000 support zone on elevated selling volume, Bitcoin Price Alert $112K: the next major support level resides near $98,000-$100,000, representing the previous consolidation range. Bitcoin Price Alert $112K: A breakdown scenario could trigger cascading stop-losses and force liquidation of leveraged long positions, potentially producing a rapid decline toward these targets.

Q3: What technical indicators should I monitor for trading signals?

Focus on RSI for momentum readings, Bitcoin Price Alert $112K: MACD for trend strength and crossovers, and Bollinger Bands for volatility and potential breakout signals. Bitcoin Price Alert $112K: Additionally, monitoring volume patterns becomes crucial, as genuine breakouts require strong volume confirmation.

Q4: Is now a good time to buy Bitcoin, or should I wait?

The answer depends on your risk tolerance and trading timeframe. Bitcoin Price Alert $112K: Conservative approaches suggest waiting for confirmed breakouts above $112,000 or breakdowns below $103,000 before committing capital, Bitcoin Price Alert $112K: sacrificing early entry for higher-probability setups.

Q5: How does current market sentiment affect Bitcoin’s price outlook?

Current sentiment reflects cautious optimism, with neither extreme fear nor greed dominating market psychology. Bitcoin Price Alert $112K: This neutral positioning creates potential for sharp moves in either direction, depending on which technical level breaks first. Bitcoin Price Alert $112K: Monitoring sentiment indicators like the Crypto Fear & Greed Index alongside technical analysis provides a more complete picture of market conditions.