Bitcoin Ethereum Dogecoin and Cardano Are Under Pressure the cryptocurrency market is experiencing renewed selling pressure, and major digital assets are feeling the strain. Bitcoin, Ethereum, Dogecoin, and Cardano are all under pressure today, prompting investors to reassess short-term expectations and risk exposure. While crypto markets are no strangers to volatility, synchronized weakness across leading coins often signals deeper forces at play beyond isolated project-specific issues.

This downturn is unfolding against a backdrop of shifting macroeconomic expectations, cautious investor sentiment, and evolving market structure. Bitcoin, which typically anchors the market, has struggled to maintain key levels, while Ethereum, Dogecoin, and Cardano have followed suit with increased downside momentum. For many market participants, the key question is not just why prices are falling today, but whether this pressure represents a temporary correction or the early stages of a broader pullback.

In this comprehensive analysis, we examine the top reasons why Bitcoin, Ethereum, Dogecoin, and Cardano are under pressure today. By exploring macroeconomic influences, technical factors, liquidity dynamics, and investor psychology, this article provides a clear and balanced perspective on the current crypto market weakness and what it could mean moving forward.

Bitcoin Ethereum Dogecoin and Cardano

One of the primary reasons why Bitcoin, Ethereum, Dogecoin, and Cardano are under pressure today is a broader shift toward risk-off sentiment across financial markets. When investors become more cautious, they tend to reduce exposure to volatile assets, including cryptocurrencies. This behavior is often triggered by uncertainty around economic growth, monetary policy, or geopolitical developments.

Cryptocurrencies are still largely viewed as high-risk assets. As a result, they are among the first to be sold when confidence weakens. The current environment reflects a reassessment of risk, with investors prioritizing capital preservation over speculative returns.

Correlation With Traditional Markets

Over time, crypto markets have shown increasing correlation with traditional risk assets such as equities. When stock markets experience volatility or downward pressure, cryptocurrencies often follow. Today’s weakness in Bitcoin and major altcoins mirrors this pattern, suggesting that external market forces are playing a significant role.

This correlation reinforces the idea that crypto is no longer isolated from global financial trends. Instead, it responds to the same macro signals that influence broader investment decisions.

Bitcoin Under Pressure as Market Anchor Weakens

Bitcoin Price Action and Technical Breakdown

Bitcoin’s role as the market leader means its weakness often cascades into the rest of the crypto ecosystem. Today, Bitcoin is under pressure after failing to sustain key support levels. Technical traders closely watch these levels, and when they break, selling can accelerate as stop-loss orders are triggered.

This technical breakdown has undermined short-term confidence. While Bitcoin’s long-term narrative remains intact, near-term price action suggests that buyers are stepping back, allowing sellers to regain control.

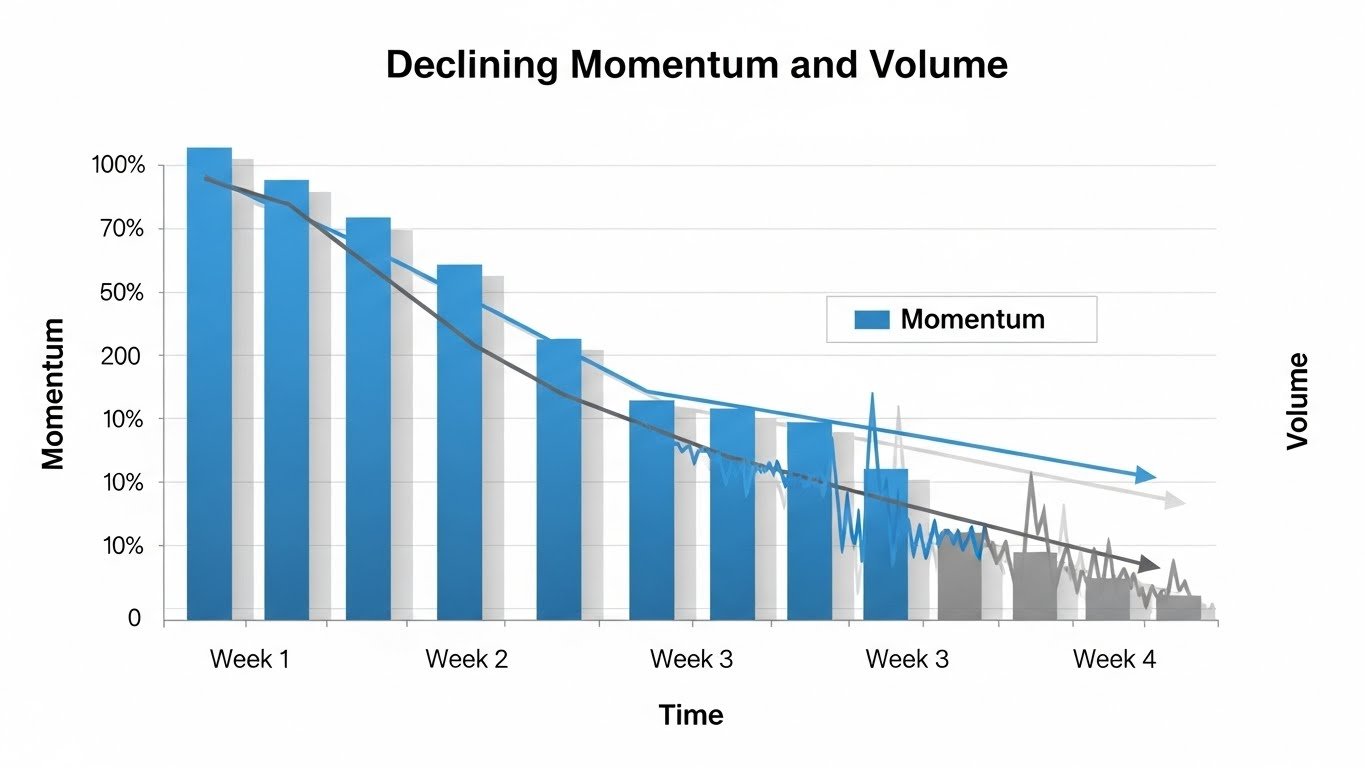

Declining Momentum and Volume

Another factor contributing to Bitcoin’s weakness is declining momentum. Trading volume has not shown strong buying interest at current levels, indicating hesitation among market participants. Without sufficient demand, prices can drift lower even in the absence of major negative news.

This lack of conviction often characterizes corrective phases. Bitcoin’s struggle to attract aggressive buyers reinforces why it is under pressure today and why other cryptocurrencies are following its lead.

Ethereum Facing Pressure From Multiple Angles

Ethereum Price Struggles and Network Expectations

Ethereum is also under pressure today, influenced by both market-wide dynamics and network-specific expectations. As the second-largest cryptocurrency, Ethereum often mirrors Bitcoin’s direction but can experience amplified moves due to its broader use cases and investor base.

Recent price weakness suggests that traders are reassessing near-term growth expectations. While Ethereum’s long-term fundamentals remain strong, short-term sentiment has softened as investors await clearer catalysts.

Fee Dynamics and User Activity Concerns

Ethereum’s ecosystem relies heavily on network activity, including decentralized finance and smart contract usage. Periods of reduced on-chain activity can affect sentiment, even if the broader roadmap remains unchanged. When usage metrics cool, it can create uncertainty about short-term demand for ETH.

This uncertainty contributes to selling pressure, especially in an environment where investors are already cautious. As a result, Ethereum joins Bitcoin in facing notable downside pressure today.

Dogecoin Under Pressure as Speculative Interest Fades

Dogecoin’s Dependence on Market Sentiment

Dogecoin’s price is heavily influenced by sentiment and speculative enthusiasm rather than fundamental utility. This makes it particularly vulnerable during periods of market-wide caution. When risk appetite declines, speculative assets like Dogecoin are often sold more aggressively.

Today’s pressure on Dogecoin reflects this dynamic. As traders reduce exposure to higher-risk assets, Dogecoin tends to underperform compared to more established cryptocurrencies.

Reduced Retail Participation

Dogecoin has historically benefited from strong retail participation. However, when markets turn cautious, retail traders often retreat, leading to lower liquidity and increased volatility. Reduced participation makes Dogecoin more susceptible to sharp declines.

This drop in speculative interest helps explain why Dogecoin is under pressure today alongside broader market weakness.

Cardano Struggling Amid Market Uncertainty

Cardano Price Action and Investor Patience

Cardano is under pressure today as investors grow more impatient with slower-moving narratives. While Cardano emphasizes long-term development and academic rigor, these strengths do not always translate into short-term price momentum.

In risk-off environments, investors tend to favor assets with immediate catalysts or strong momentum. Cardano’s more measured progress can be viewed as less attractive in such conditions, contributing to selling pressure.

Ecosystem Growth Versus Market Expectations

Although Cardano continues to build its ecosystem, market expectations often outpace reality. When progress does not immediately reflect in price performance, traders may rotate capital elsewhere. This rotation can weigh on ADA during broader market pullbacks.

As a result, Cardano’s price weakness today reflects both market-wide caution and project-specific sentiment dynamics.

Liquidity Conditions and Capital Rotation

Reduced Liquidity Across Crypto Markets

Liquidity plays a critical role in sustaining price levels. When liquidity dries up, even modest selling can have an outsized impact. Today’s pressure on Bitcoin, Ethereum, Dogecoin, and Cardano is partly due to reduced liquidity as traders step aside.

Lower liquidity amplifies volatility and accelerates downside moves. This environment makes it more difficult for prices to stabilize quickly, reinforcing the current bearish tone.

Capital Rotating Out of Altcoins

Another factor is capital rotation. During uncertain periods, investors often move funds out of altcoins and into perceived safer assets or stable positions. This rotation disproportionately affects assets like Dogecoin and Cardano, which rely more on speculative capital.

Even Ethereum, despite its strong fundamentals, can be impacted by this rotation when investors reduce overall crypto exposure.

Macroeconomic Pressures Weighing on Crypto

Interest Rate Expectations and Monetary Policy

Macroeconomic conditions are a major reason why Bitcoin, Ethereum, Dogecoin, and Cardano are under pressure today. Shifts in interest rate expectations influence risk assets globally. When markets anticipate tighter monetary conditions, speculative investments often suffer.

Higher yields in traditional markets can reduce the appeal of non-yielding or volatile assets like cryptocurrencies. This macro backdrop contributes to selling pressure across the crypto market.

Inflation Data and Economic Signals

Mixed economic data adds to uncertainty. When inflation signals are unclear, investors may hesitate to take on additional risk.

This caution spills over into crypto markets, where clarity and confidence are essential for sustained rallies. Until macroeconomic signals become more supportive, cryptocurrencies may continue to face headwinds.

Technical Factors and Market Structure

Breakdown of Key Support Levels

Technical analysis plays a significant role in crypto trading. The breakdown of key support levels across Bitcoin, Ethereum, Dogecoin, and Cardano has triggered algorithmic selling and stop-loss orders. This mechanical selling can intensify downward moves.

Once these levels are breached, markets often need time to establish new support zones. This process can involve further volatility and testing of lower levels.

Overextension From Previous Rallies

In some cases, recent weakness reflects natural corrections after earlier rallies. Markets rarely move in straight lines, and pullbacks are a normal part of price discovery. The current pressure may therefore represent consolidation rather than a structural breakdown.

Understanding this context helps explain why multiple assets are under pressure simultaneously.

Investor Psychology and Market Fear

Fear Vs Long-Term Conviction

Investor psychology is a powerful force in crypto markets. Fear can spread quickly, leading to herd behavior and rapid sell-offs. Today’s pressure reflects a short-term dominance of fear over long-term conviction.

Even investors who remain bullish long term may reduce exposure temporarily to manage risk. This collective behavior contributes to synchronized declines across major assets.

The Role of Uncertainty in Selling Pressure

Uncertainty often drives selling more than negative news itself. When market participants lack clarity on future conditions, they may choose to exit positions rather than wait. This uncertainty is evident in today’s market action.

As clarity returns, sentiment can shift just as quickly. For now, uncertainty remains a key driver of pressure.

Is This a Temporary Correction or a Deeper Move?

Arguments for a Short-Term Pullback

There are reasons to believe that the current pressure could be temporary. Long-term fundamentals for Bitcoin and Ethereum remain strong, and development across ecosystems continues. Corrections often reset market structure and prepare the ground for future rallies.

If macro conditions stabilize and technical support holds, prices could recover over time.

Risks of Extended Weakness

However, risks remain. Prolonged macro uncertainty or further breakdowns in technical structure could extend the downturn. Investors should remain aware that recovery may take time, especially if confidence remains fragile.

Balancing optimism with caution is essential in navigating this phase.

Conclusion

Bitcoin, Ethereum, Dogecoin, and Cardano are under pressure today due to a combination of market-wide risk-off sentiment, macroeconomic uncertainty, technical breakdowns, and shifting investor psychology. Bitcoin’s weakness as the market anchor has amplified selling across altcoins, while reduced liquidity and capital rotation have further intensified downside pressure.

While the current environment is challenging, it is not unprecedented. Crypto markets have historically experienced periods of synchronized weakness followed by recovery as conditions improve. Understanding the reasons behind today’s pressure allows investors to make more informed decisions, manage risk effectively, and maintain perspective amid volatility.

FAQs

Q: Why are Bitcoin, Ethereum, Dogecoin, and Cardano all falling at the same time?

They are falling together due to broad market risk-off sentiment, macroeconomic uncertainty, and Bitcoin’s role as a market leader. When confidence weakens, selling often spreads across major cryptocurrencies simultaneously.

Q: Is today’s pressure caused by negative news specific to these coins?

Not necessarily. The pressure is largely driven by macroeconomic factors, technical breakdowns, and reduced risk appetite rather than major negative developments unique to Bitcoin, Ethereum, Dogecoin, or Cardano.

Q: Does this mean the long-term outlook for crypto has changed?

Short-term pressure does not automatically change the long-term outlook. Many long-term fundamentals remain intact, but markets may need time to stabilize before confidence returns.

Q: Why is Dogecoin under more pressure than some other cryptocurrencies?

Dogecoin relies heavily on speculative interest and retail participation. During risk-off periods, speculative assets tend to see sharper declines as traders reduce exposure.

Q: What should investors watch next in the crypto market?

Investors should monitor macroeconomic developments, interest rate expectations, Bitcoin’s ability to hold key support levels, and overall market liquidity. These factors will help determine whether the current pressure eases or continues.