Altcoins From Solana to Dogecoin Sink to Multi-Year Lows the cryptocurrency market has always been known for its extreme volatility, but the recent downturn has taken many investors by surprise. Altcoins from Solana to Dogecoin sink to levels not seen in years, reflecting a broader shift in sentiment across the digital asset landscape. After periods of explosive growth and bullish momentum, the market has entered a phase where risk appetite is declining, liquidity is tightening, and confidence is fading among retail and institutional participants alike.

In past cycles, altcoins have often followed Bitcoin’s lead, rising sharply during bullish phases and falling even harder during corrections. This time, however, the decline in several major crypto assets has pushed prices back to levels last seen during previous bear markets. Tokens that once dominated headlines for their meteoric gains are now struggling to maintain support zones.

The fact that altcoins from Solana to Dogecoin sink to levels not seen in years highlights the cyclical nature of the cryptocurrency market. While some investors view this as a warning sign, others see it as a potential opportunity to accumulate undervalued projects before the next market rebound.

Understanding why these declines are happening requires a closer look at macroeconomic conditions, market structure, investor behavior, and the unique dynamics of each major altcoin. From layer-1 blockchains to meme coins, the entire altcoin sector is experiencing pressure.

Altcoins From Solana to Dogecoin

The current downturn is not the result of a single factor. Instead, it is a combination of economic, technical, and psychological influences affecting the broader cryptocurrency market.

Macroeconomic Pressure on Risk Assets

Global financial conditions have shifted significantly. Rising interest rates, inflation concerns, and tighter liquidity have pushed investors toward safer assets. As a result, speculative sectors like digital currencies and crypto tokens have faced heavy selling pressure.

In previous cycles, easy money fueled speculative investments. Now, with capital becoming more expensive, many investors are reducing exposure to volatile assets. This shift explains why altcoins from Solana to Dogecoin sink to levels not seen in years, as smaller projects are often the first to suffer during risk-off environments.

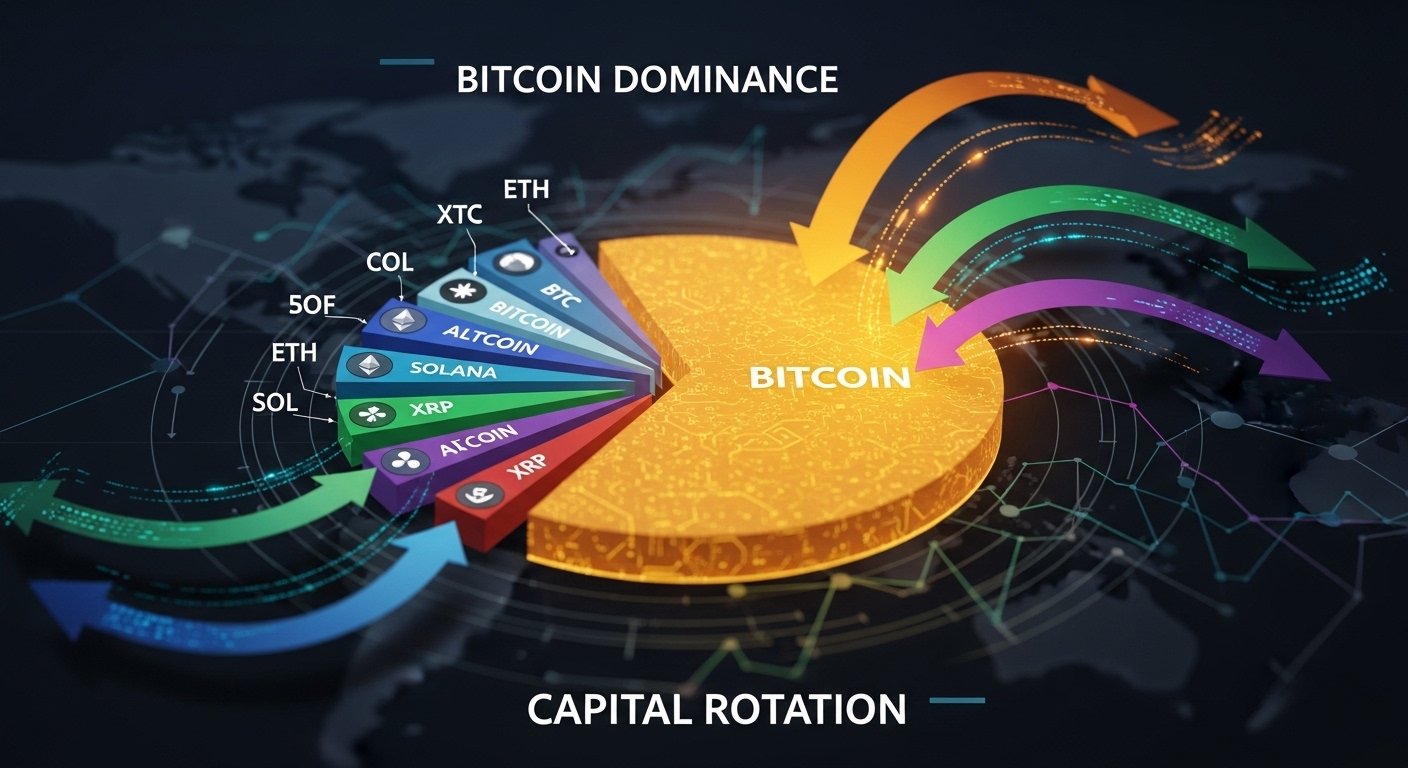

Bitcoin Dominance and Capital Rotation

Another key factor is the rise in Bitcoin dominance. During uncertain market conditions, investors tend to move funds from altcoins into Bitcoin, which is perceived as the most established and secure cryptocurrency.

This capital rotation reduces liquidity in the altcoin market, accelerating price declines. As funds flow toward Bitcoin, altcoins struggle to maintain upward momentum, leading to deeper corrections across the sector.

The Case of Solana: From High-Speed Darling to Deep Correction

Solana once stood as one of the fastest-growing blockchain networks, praised for its high throughput and low transaction fees. It attracted developers, NFT creators, and DeFi platforms at an impressive pace.

Market Expectations and Reality

During its peak, Solana was often described as an Ethereum competitor. However, as the market cooled and liquidity dried up, speculative capital exited the ecosystem. This caused a sharp decline in token value and ecosystem activity.

The fact that altcoins from Solana to Dogecoin sink to levels not seen in years is partly due to overextended valuations during the previous bull run. Many investors bought into the hype, pushing prices beyond sustainable levels.

Ecosystem Challenges

Solana also faced technical and ecosystem challenges, including network outages and shifts in developer attention. While the project continues to evolve, these issues contributed to declining investor confidence.

Despite the correction, some analysts argue that the network’s strong developer base and growing decentralized finance ecosystem could support a long-term recovery.

Dogecoin and the Meme Coin Downturn

Unlike Solana, Dogecoin represents a completely different category of altcoins. It began as a joke but later became one of the most recognizable meme coins in the crypto world.

The Role of Social Sentiment

Dogecoin’s price movements have historically been driven by social media trends, celebrity endorsements, and retail enthusiasm. During the last bull cycle, this momentum pushed the coin to extraordinary heights.

However, when sentiment shifts, meme coins often fall faster than fundamentally driven projects. This explains why altcoins from Solana to Dogecoin sink to levels not seen in years, as speculative enthusiasm fades.

Declining Retail Participation

Retail investors play a major role in meme coin rallies. As market confidence weakens and new investors stay on the sidelines, demand for these tokens declines significantly.

Without strong fundamental drivers, meme coins struggle to maintain long-term value, making them particularly vulnerable during bear markets.

How the Altcoin Market Structure Amplifies Downturns

The altcoin market behaves differently from traditional financial markets. Its structure makes it more susceptible to sharp corrections.

Lower Liquidity and Higher Volatility

Most altcoins have significantly lower liquidity compared to Bitcoin. This means that even moderate selling pressure can lead to steep price drops. When altcoins from Solana to Dogecoin sink to levels not seen in years, it often reflects the impact of thin order books and sudden capital outflows.

Leveraged Trading and Liquidations

Another factor is the prevalence of crypto derivatives and leveraged trading. When prices begin to fall, leveraged positions get liquidated, accelerating the downward trend. This cascading effect creates a cycle where falling prices trigger liquidations, which in turn cause further price declines.

Investor Psychology During Altcoin Bear Markets

Market sentiment plays a crucial role in price movements. During bullish phases, optimism drives prices higher. During downturns, fear and uncertainty take over.

The Shift From Greed to Fear

In bull markets, investors often chase high-risk, high-reward opportunities. Altcoins become the primary focus because of their potential for exponential gains. However, when prices begin to fall, the same investors quickly shift toward safer assets. This psychological shift is a major reason why altcoins from Solana to Dogecoin sink to levels not seen in years.

Capitulation and Market Bottoms

Historically, deep altcoin declines often occur near market bottoms. When investors give up hope and sell at losses, it signals a phase known as capitulation. While painful, these periods often create the foundation for the next market cycle.

The Role of Regulation and Institutional Behavior

Regulatory uncertainty has also played a role in the recent altcoin downturn.

Increased Scrutiny on Altcoins

Authorities in various countries have increased scrutiny on crypto projects, especially those involving tokens that may be classified as securities. This uncertainty discourages institutional investment in altcoins, contributing to declining prices across the sector.

Institutional Preference for Bitcoin and Ethereum

Large investors tend to focus on established assets like Bitcoin and Ethereum. This leaves smaller altcoins with less institutional support, making them more vulnerable during downturns.

As a result, altcoins from Solana to Dogecoin sink to levels not seen in years while major cryptocurrencies experience comparatively smaller declines.

Are These Multi-Year Lows a Buying Opportunity

One of the most debated questions in the crypto community is whether deep corrections represent buying opportunities.

Historical Patterns in Crypto Cycles

In previous cycles, altcoins that survived bear markets often delivered strong returns in the next bull run. Projects with active development, strong communities, and real-world use cases tended to recover faster. This historical pattern encourages some investors to accumulate during periods when altcoins from Solana to Dogecoin sink to levels not seen in years.

The Importance of Project Fundamentals

Not all altcoins recover after major downturns. Many projects fade into obscurity due to lack of adoption or poor development.

Investors are increasingly focusing on fundamentals such as network activity, developer engagement, and real-world utility when evaluating potential opportunities.

What Could Trigger an Altcoin Recovery

While the market currently appears bearish, several factors could reverse the trend.

Improved Macroeconomic Conditions

If global economic conditions improve and liquidity returns to financial markets, risk assets like altcoins could benefit. Lower interest rates and increased investment activity would likely drive renewed interest in crypto assets.

Technological Developments and Adoption

Major technological breakthroughs, new use cases, and increased adoption could also drive altcoin growth. Projects that deliver meaningful innovations in smart contracts, scalability, and decentralized applications may lead the next rally.

Conclusion

The fact that altcoins from Solana to Dogecoin sink to levels not seen in years underscores the cyclical and highly volatile nature of the cryptocurrency market. While the current downturn reflects macroeconomic pressure, shifting investor sentiment, and structural market factors, it also follows patterns seen in previous cycles. Altcoins have historically experienced deeper declines than Bitcoin during bear markets, but they have also delivered some of the strongest gains during recoveries. Whether the current multi-year lows represent a warning sign or a long-term opportunity depends largely on individual project fundamentals and broader economic conditions.

For investors, the key takeaway is the importance of research, risk management, and long-term perspective. The crypto market will likely continue to experience cycles of boom and bust, and understanding these patterns is essential for navigating the evolving landscape.

FAQs

Q: Why are altcoins falling more than Bitcoin in the current market cycle?

Altcoins tend to be more volatile than Bitcoin because they have lower liquidity, smaller market caps, and less institutional support. When market sentiment turns negative, investors often move funds into Bitcoin as a safer option within the crypto space. This capital rotation leads to sharper declines in altcoins, which explains why many of them have dropped to multi-year lows while Bitcoin has shown relatively more resilience.

Q: Does the fact that altcoins are at multi-year lows mean the market has reached the bottom?

Not necessarily. Multi-year lows can indicate that the market is approaching a bottom, but it does not guarantee it. Crypto markets are influenced by macroeconomic conditions, investor sentiment, and technological developments. A true market bottom is usually confirmed only after a sustained period of price stability and renewed buying interest.

Q: Are meme coins like Dogecoin more risky than other altcoins?

Meme coins are generally considered riskier because they often rely heavily on social sentiment and speculation rather than strong fundamentals or utility. While they can experience rapid price increases during bullish periods, they also tend to decline faster when market sentiment weakens.

Q: What should investors look for when evaluating altcoins during a bear market?

During a bear market, investors typically focus on fundamentals such as active development, strong communities, real-world use cases, and consistent network activity. Projects that continue building and innovating during downturns are more likely to recover when the market improves.

Q: How long do altcoin bear markets usually last?

Altcoin bear markets do not follow a fixed timeline. In previous cycles, they have lasted anywhere from several months to a few years, depending on broader economic conditions and the pace of innovation in the crypto industry. Recovery usually begins when investor confidence returns and liquidity flows back into the market.