ADGM Launches Consultation Over New Crypto Mining Regulations, it sends a clear signal that digital asset oversight in the Middle East is entering a more mature and structured phase. Abu Dhabi Global Market has long positioned itself as a forward-thinking financial free zone, particularly in the blockchain and digital asset space. This latest consultation reflects ADGM’s intention to balance innovation with responsibility, ensuring that crypto mining activities align with regulatory clarity, environmental considerations, and long-term economic goals.

Crypto mining has grown from a niche technical activity into a large-scale industrial operation that consumes energy, attracts global capital, and raises regulatory questions. As jurisdictions worldwide reassess how to regulate mining, ADGM’s move places it among regulators seeking proactive engagement with industry stakeholders rather than reactive enforcement. The consultation process allows policymakers, miners, investors, and technology providers to shape a regulatory framework that is both practical and future-ready.

We will explores what it means that ADGM launches consultation over new crypto mining regulations, why this step matters, how it could impact the global crypto ecosystem, and what opportunities and challenges lie ahead for miners and investors operating within or alongside ADGM’s jurisdiction.

ADGM Launches Consultation Over New Crypto Mining

Abu Dhabi Global Market has established itself as a leading international financial center with a strong emphasis on digital asset regulation and innovation. Unlike many jurisdictions that struggle to keep pace with technological change, ADGM has consistently taken a structured and consultative approach to crypto oversight.

When ADGM launches consultation over new crypto mining regulations, it builds on an existing regulatory foundation that already covers digital asset exchanges, custodians, and blockchain-based financial services. This holistic approach recognizes that crypto mining is not isolated from the broader ecosystem. Mining affects network security, transaction validation, and token economics, all of which have systemic implications.

ADGM’s regulatory philosophy emphasizes transparency, risk management, and market integrity. By consulting publicly, it demonstrates an understanding that effective regulation must involve industry expertise and real-world operational insights rather than theoretical assumptions.

Why Crypto Mining Regulations Are Gaining Global Attention

Crypto mining has become a focal point for regulators worldwide due to its scale and impact. Mining operations now rival traditional industries in terms of energy consumption, infrastructure needs, and capital investment. As a result, governments and regulators are increasingly concerned with sustainability, grid stability, and financial oversight.

When ADGM launches consultation over new crypto mining regulations, it reflects this global trend. Regulators are no longer asking whether crypto mining should be addressed but how it can be regulated without stifling innovation. The consultation suggests that ADGM aims to understand the operational realities of mining, including hardware requirements, energy sourcing, and risk exposure.

This growing attention also stems from the recognition that mining operations can bring economic benefits such as job creation, technology transfer, and foreign investment. A well-designed regulatory framework can help maximize these benefits while minimizing environmental and financial risks.

Key Objectives Behind ADGM’s Crypto Mining Consultation

The consultation process is not merely a formality. Its core objective is to gather feedback that will shape practical and enforceable rules. When ADGM launches consultation over new crypto mining regulations, it is signaling several underlying goals.

One major objective is clarity. Clear rules reduce uncertainty for businesses considering setting up mining operations within ADGM’s jurisdiction. Regulatory certainty encourages long-term investment and discourages speculative or non-compliant actors.

Another objective is sustainability. Crypto mining’s environmental footprint has become a critical concern. ADGM is likely exploring how regulations can encourage efficient energy use and responsible growth without outright restricting mining activity.

Risk management is also central. Mining involves financial, operational, and cybersecurity risks. By consulting with stakeholders, ADGM can design safeguards that protect the broader financial system while allowing innovation to flourish.

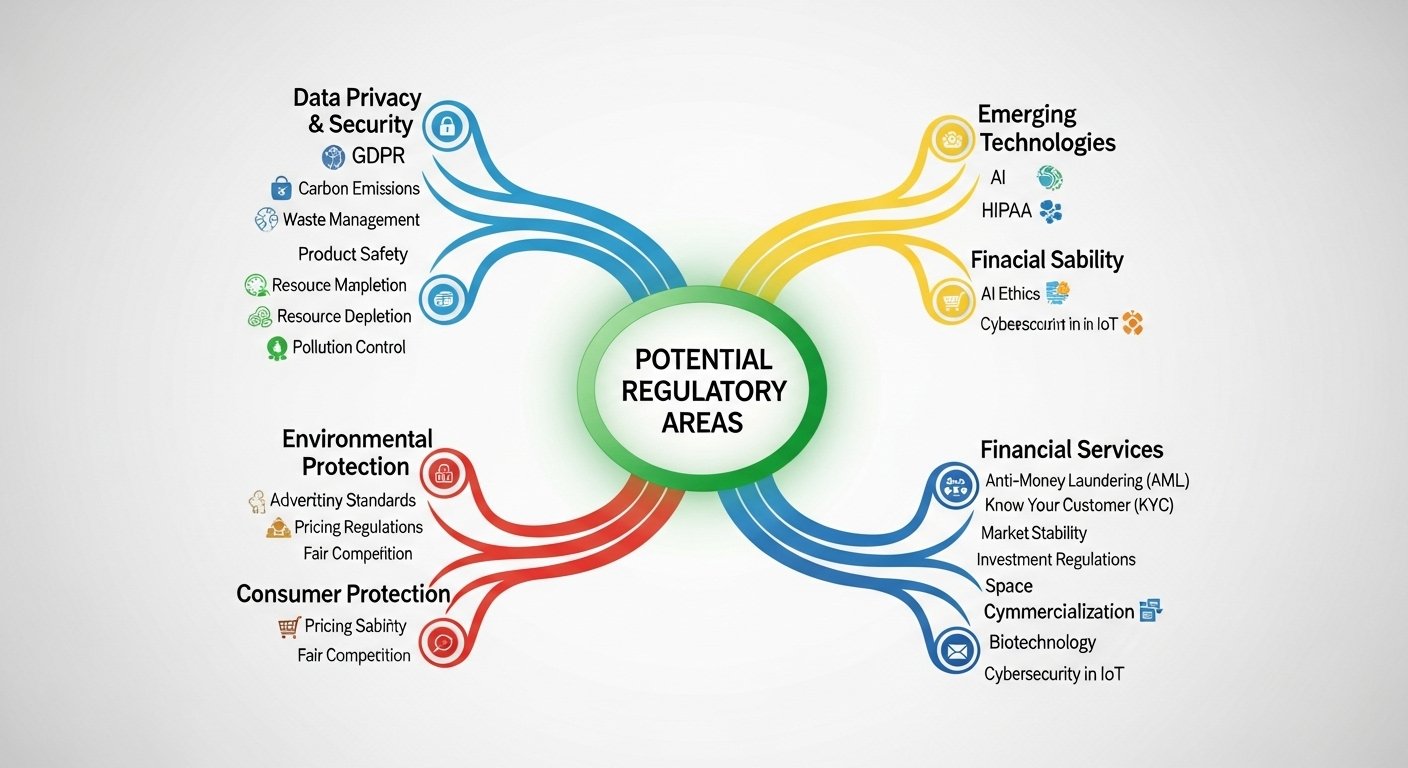

Potential Regulatory Areas Under Consideration

Although the final framework will emerge after the consultation, several regulatory areas are likely under discussion. When ADGM launches consultation over new crypto mining regulations, it opens the door to addressing licensing, operational standards, and compliance requirements.

Energy usage is a prominent issue. Regulators worldwide are examining how mining operations source power and whether renewable energy incentives should be built into regulatory frameworks. ADGM’s consultation may explore ways to align mining with regional sustainability goals.

Operational transparency is another likely focus. Requirements around reporting, governance, and technical standards can help regulators monitor risks without interfering in day-to-day operations.

Financial oversight may also be addressed. Mining involves significant capital flows, and clear rules around accounting, taxation, and anti-money laundering controls are essential for maintaining trust in the system.

Impact on Crypto Miners Operating in ADGM

For miners already operating within ADGM or considering entry, the consultation represents both opportunity and adjustment. When ADGM launches consultation over new crypto mining regulations, it creates a pathway for miners to voice concerns and influence policy outcomes.

Well-capitalized and professionally managed mining operations may welcome clearer rules, as regulation can legitimize their activities and improve access to banking and institutional partnerships. Regulatory clarity often reduces operational friction and reputational risk.

Smaller or less structured operators may face higher compliance costs, but the long-term benefits of operating in a regulated environment often outweigh short-term challenges. A transparent framework can help level the playing field and discourage unfair competition.

Implications for Investors and the Broader Crypto Market

Investors closely watch regulatory developments, and when ADGM launches consultation over new crypto mining regulations, it sends a strong signal to the market. Regulation is often perceived as a sign of maturity rather than restriction, particularly when implemented through consultation rather than enforcement.

Clear mining regulations can enhance investor confidence by reducing uncertainty around operational risks and legal exposure. This is especially relevant for institutional investors who require regulatory assurance before committing capital.

The broader crypto market may also benefit from improved governance. Mining plays a crucial role in network security and decentralization. Well-regulated mining environments can contribute to healthier blockchain ecosystems and more stable cryptocurrency markets.

ADGM’s Approach Compared to Other Jurisdictions

Globally, regulatory responses to crypto mining vary widely. Some jurisdictions impose outright bans, while others offer incentives to attract miners. When ADGM launches consultation over new crypto mining regulations, it distinguishes itself through engagement rather than exclusion.

This approach positions ADGM as a competitive hub for responsible crypto innovation. By seeking input rather than dictating rules unilaterally, ADGM increases the likelihood that its framework will be both effective and attractive to global participants.

Comparatively, jurisdictions that rush into restrictive measures often drive mining activity underground or offshore, reducing oversight and economic benefit. ADGM’s consultative stance reflects a more nuanced understanding of the industry’s dynamics.

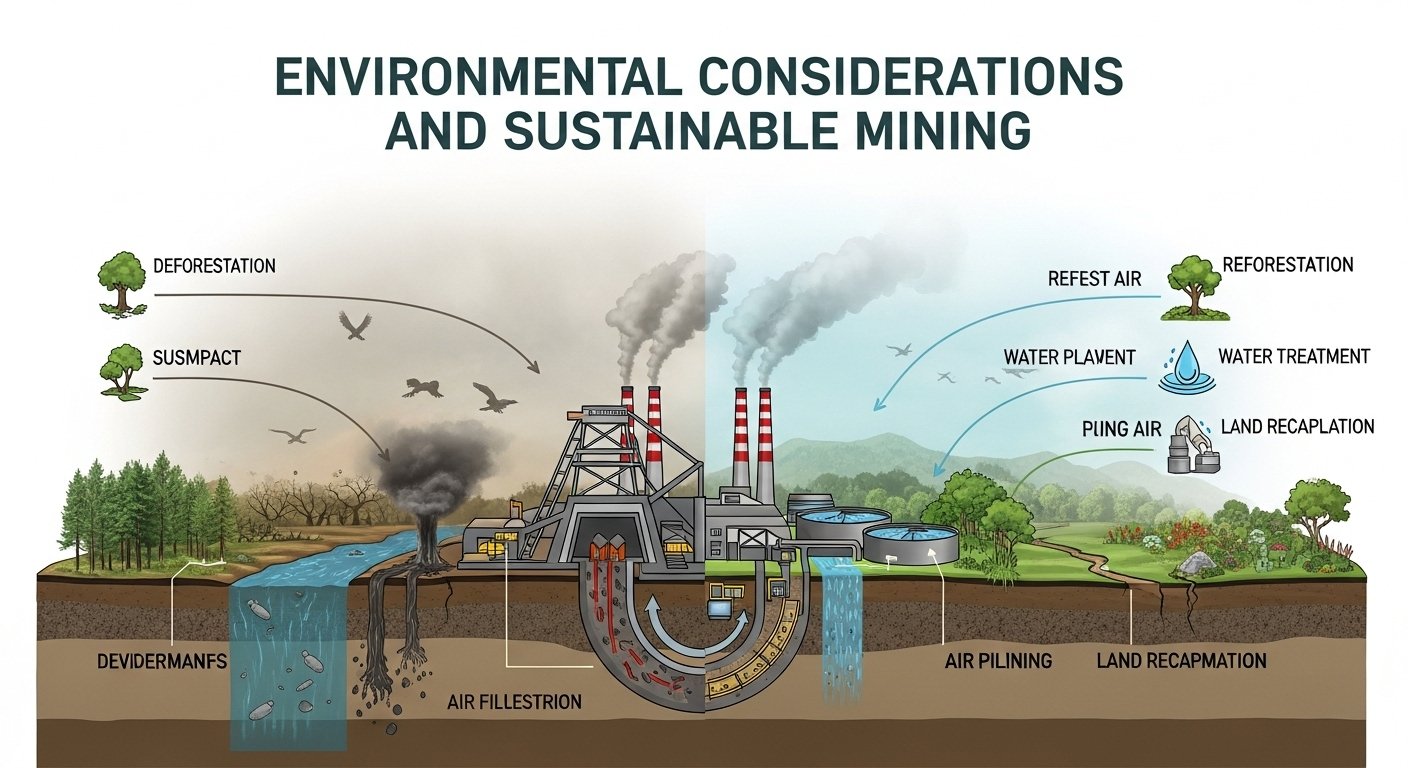

Environmental Considerations and Sustainable Mining

Sustainability is impossible to ignore in any discussion about crypto mining. When ADGM launches consultation over new crypto mining regulations, environmental impact is likely a central theme.

Mining’s energy consumption has drawn criticism, but it has also driven innovation in renewable energy usage and efficiency. Regulators now have an opportunity to guide this evolution by encouraging responsible practices rather than imposing blanket restrictions.

ADGM’s consultation may explore frameworks that promote transparency in energy sourcing and incentivize greener operations. Such measures can align mining activity with broader sustainability goals while preserving economic competitiveness.

Long-Term Strategic Vision Behind the Consultation

Beyond immediate regulatory outcomes, the consultation reflects a long-term strategic vision. When ADGM launches consultation over new crypto mining regulations, it signals an ambition to integrate mining into a regulated digital economy rather than treating it as an external or problematic activity.

This vision aligns with ADGM’s broader goals of becoming a global hub for blockchain innovation, fintech development, and digital finance. Mining, when properly regulated, can support these goals by strengthening network infrastructure and attracting technological expertise.

A well-crafted framework can also serve as a model for other jurisdictions, enhancing ADGM’s influence in shaping global crypto regulation standards.

Challenges and Criticisms Surrounding Crypto Mining Regulation

Despite its benefits, regulation is not without challenges. When ADGM launches consultation over new crypto mining regulations, some industry participants may worry about overregulation or increased operational costs.

Striking the right balance is crucial. Excessive requirements could discourage innovation or push miners to less regulated regions. Insufficient oversight, on the other hand, could undermine market integrity and public trust.

The consultation process itself helps address these concerns by allowing stakeholders to highlight practical challenges and propose workable solutions. This collaborative approach increases the chances of a balanced outcome.

Conclusion

The decision that ADGM launches consultation over new crypto mining regulations marks a significant step in the evolution of digital asset governance. Rather than reacting to industry growth, ADGM is proactively engaging with stakeholders to shape a framework that balances innovation, sustainability, and risk management.

For miners, investors, and the broader crypto ecosystem, this consultation represents an opportunity to influence policy, gain regulatory clarity, and operate within a more stable environment. While challenges remain, the consultative approach increases confidence that the resulting regulations will be practical and forward-looking.

As crypto mining continues to evolve, initiatives like this demonstrate how thoughtful regulation can support long-term growth rather than hinder it.

FAQs

Q: What does it mean when ADGM launches consultation over new crypto mining regulations?

When ADGM launches consultation over new crypto mining regulations, it means the regulator is seeking feedback from industry participants and the public before finalizing rules, ensuring the framework is informed and practical.

Q: How could ADGM’s crypto mining regulations affect existing miners?

Existing miners may need to adapt to new compliance standards, but clearer regulations can also provide legal certainty, improved access to financial services, and greater investor confidence over the long term.

Q: Why is ADGM focusing on crypto mining now?

Crypto mining has grown significantly in scale and impact. ADGM is addressing it now to ensure sustainable growth, manage risks, and integrate mining into a well-regulated digital asset ecosystem.

Q: Will ADGM’s consultation discourage crypto mining activities?

The consultation itself is not meant to discourage mining but to understand it better. Thoughtful regulation can actually attract responsible miners by offering clarity and a stable operating environment.

Q: How does this consultation position ADGM globally in crypto regulation?

By choosing a consultative and transparent approach, ADGM strengthens its reputation as a progressive and innovation-friendly financial center, potentially setting standards that influence other jurisdictions.