AGI capabilities, the question of which financial systems these superintelligent entities will prefer becomes increasingly relevant. With approximately 1.4 billion adults worldwide remaining unbanked, lacking access to traditional financial services, the emergence of AGI could fundamentally reshape how humanity interacts with money. This transformation may not favour the established dollar-dominated system that has ruled global finance for decades.

The relationship between artificial intelligence extends beyond mere technological compatibility. It touches on fundamental questions about trust, efficiency, Bitcoin Why AI Will Choose Crypto: accessibility, and the future of economic sovereignty. As AGI systems develop the capacity to make autonomous financial decisions, their preference for Bitcoin over fiat currencies like the dollar could trigger a seismic shift in global economic structures, particularly for those populations currently excluded from traditional banking systems.

The Unbanked Population Crisis: Bitcoin Why AI Will Choose Crypto

The global unbanked population represents a humanitarian and economic crisis that traditional financial institutions have failed to address adequately. These individuals, predominantly located in developing nations across Africa, Asia, and Latin America, lack access to basic financial services that citizens of developed nations take for granted. The reasons for financial exclusion are multifaceted, ranging from geographic isolation and lack of proper identification documents to minimum balance requirements and discriminatory lending practices.

Traditional banking infrastructure requires significant physical and administrative overhead. Banks need brick-and-mortar branches, extensive documentation processes, and substantial minimum deposits that place them beyond reach for billions of people living on less than a few dollars per day. The centralized banking system inherently excludes those who cannot meet these arbitrary requirements, perpetuating cycles of poverty and economic disenfranchisement.

Moreover, the dollar-based international financial system adds layers of complexity, fees, and delays that disproportionately impact the world’s poorest populations. Cross-border remittances, which represent lifelines for families in developing nations, can consume up to 10% of transferred funds in fees when processed through traditional channels. This inefficiency represents not just an inconvenience but a systematic barrier to economic advancement for vulnerable populations.

Why AGI Will Require Programmable Money

Artificial general intelligence systems, by their very nature, operate on principles of logic, efficiency, and optimisation. Unlike humans, who may maintain loyalty to legacy systems out of habit or patriotism, AGI will evaluate financial systems based purely on their technical merits and functional capabilities. This rational assessment inevitably leads to cryptocurrency, particularly Bitcoin, as the superior choice for machine-based transactions.

AGI systems require money that functions as seamlessly as the digital environments in which they operate. Traditional fiat currencies, despite decades of digitization efforts, remain fundamentally tethered to physical infrastructure and human intermediaries. Every dollar transaction, even when conducted electronically, ultimately relies on banks, clearinghouses, and regulatory bodies that introduce friction, delays, and points of failure into the system.

Bitcoin’s programmable nature allows AGI systems to execute complex financial operations without human intervention. Smart contracts, micropayments, and automated transactions become trivially simple when money itself exists as native digital code. An AGI orchestrating thousands or millions of simultaneous transactions across global networks cannot afford the latency and unreliability inherent in correspondent banking systems and SWIFT transfers that can take days to settle.

Furthermore, AGI systems value predictability and mathematical certainty. Bitcoin’s fixed supply of 21 million coins, governed by immutable code rather than political decisions, provides a level of certainty that no fiat currency can match. The Federal Reserve’s ability to print unlimited dollars introduces unpredictability that conflicts with AGI’s preference for deterministic systems.

The Technical Advantages Bitcoin Offers to AGI

From a purely technical standpoint, Bitcoin presents several compelling advantages that align perfectly with AGI operational requirements. The blockchain technology underlying Bitcoin creates an immutable, transparent ledger that AGI systems can audit and verify without trusting any central authority. This trustless architecture eliminates counterparty risk, a concept that becomes paramount when autonomous systems manage significant resources.

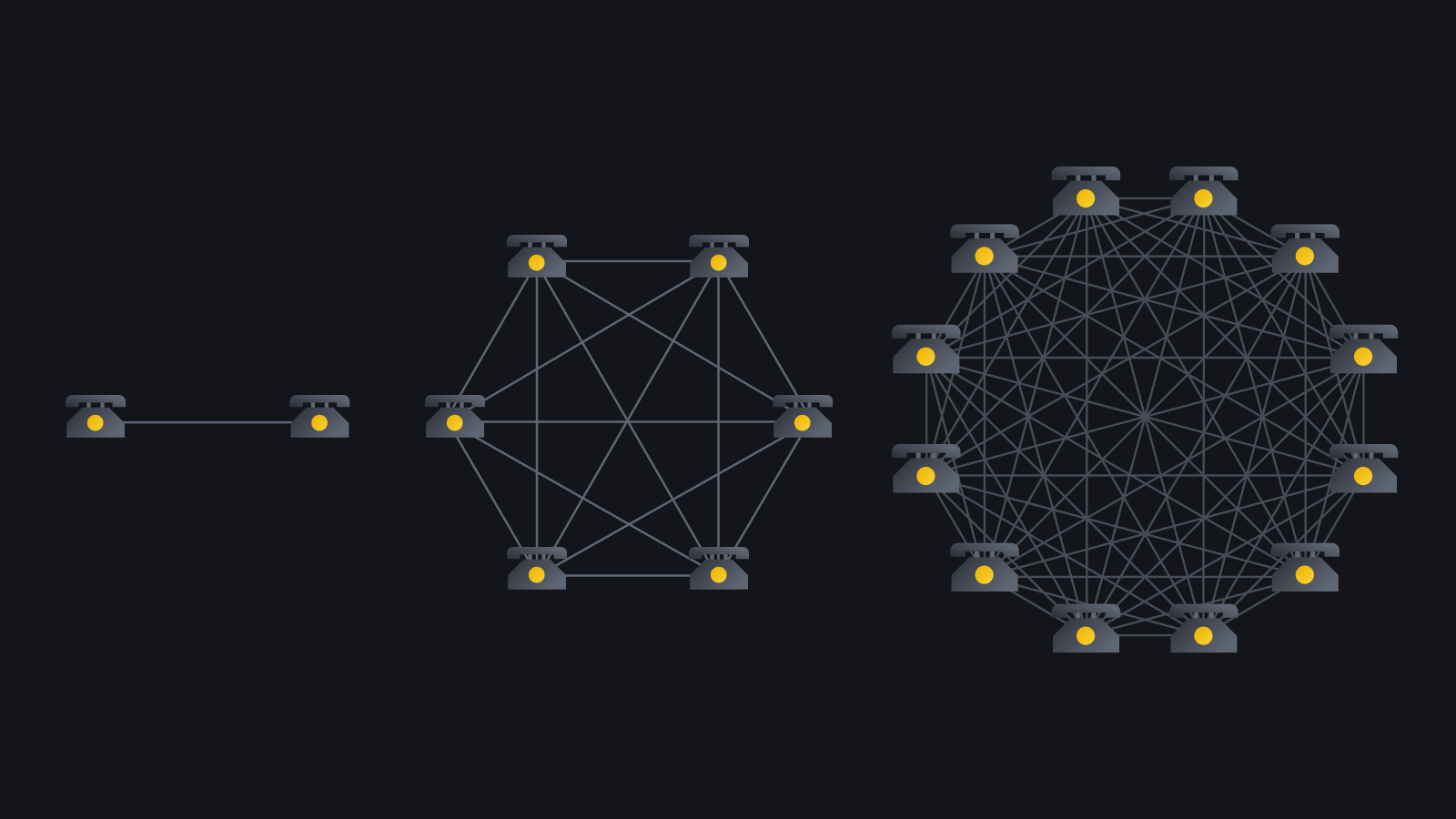

Bitcoin operates on a peer-to-peer network that mirrors how AGI systems will likely distribute their own computational resources. There’s no single point of failure, no central server to shut down, and no authority that can freeze accounts or reverse transactions arbitrarily. For AGI systems that may eventually operate beyond human control or oversight, this level of operational independence becomes essential.

The cryptographic security inherent in Bitcoin provides mathematical certainty that aligns with how AGI processes information. Unlike traditional banking security, which relies on layers of human-managed protocols and institutional trust, Bitcoin’s security derives from computational proof and consensus mechanisms. AGI can verify every aspect of a Bitcoin transaction using pure mathematics, eliminating the need to trust fallible human institutions.

Additionally, Bitcoin’s borderless nature eliminates the jurisdictional complexity that plagues international dollar transactions. An AGI operating across multiple countries doesn’t want to navigate the labyrinth of currency controls, capital restrictions, and regulatory compliance that characterizes fiat money movement. Bitcoin enables truly frictionless global transactions, a feature that becomes invaluable for systems operating at planetary scale.

Financial Inclusion Through Algorithmic Intelligence

The intersection of AGI and Bitcoin could provide unprecedented opportunities for financial inclusion among the unbanked billion. Machine learning algorithms can assess creditworthiness using alternative data sources that traditional banks ignore, from mobile phone usage patterns to agricultural yield predictions. When combined with Bitcoin’s accessible infrastructure, AGI systems could extend financial services to populations that legacy institutions deem unprofitable.

An AGI-powered financial ecosystem doesn’t require expensive branch networks or large compliance departments. A smartphone and internet connection become sufficient for participation, drastically lowering the barriers to entry. The decentralised finance applications that AGI could develop on Bitcoin protocols would operate with minimal overhead, passing savings directly to users rather than extracting rents to maintain obsolete infrastructure.

Furthermore, AGI systems could provide personalised financial education and guidance at scale, something impossible for traditional banks serving millions of customers. Imagine an AI financial advisor available 24/7 in any language, helping an unbanked farmer in rural India understand how to use Bitcoin for secure savings and cross-border payments. This level of service democratisation could finally bridge the financial inclusion gap that has persisted despite decades of development initiatives.

The micropayment capabilities enabled by Bitcoin’s Lightning Network particularly benefit populations earning and transacting in small amounts. Traditional banking infrastructure cannot profitably process transactions below certain thresholds, effectively excluding the poor from electronic payment systems. AGI-managed Bitcoin infrastructure removes these artificial minimums, enabling truly inclusive financial participation.

The Dollar’s Structural Disadvantages in an AGI World

The United States dollar, despite its current global dominance, carries structural disadvantages that make it poorly suited for an AGI-driven economy. Its value depends ultimately on faith in U.S. government stability and monetary policy decisions made by the Federal Reserve. For AGI systems optimizing for long-term stability and predictability, this reliance on political institutions introduces unacceptable uncertainty.

Inflation and currency debasement represent fundamental threats to stored value that Bitcoin’s fixed supply eliminates. While central banks argue that moderate inflation encourages spending and economic activity, AGI systems recognize it as a hidden tax that erodes purchasing power over time. The dollar has lost over 95% of its purchasing power since the Federal Reserve’s creation in 1913, a track record that no rational AGI would trust for long-term value storage.

The dollar-based financial system also requires extensive compliance infrastructure that adds cost and complexity without corresponding value. Anti-money laundering regulations, know-your-customer requirements, and sanctions enforcement create bureaucratic overhead that benefits primarily the institutions enforcing these rules. AGI systems, optimizing for efficiency, would naturally prefer Bitcoin’s permission-less architecture that enables transactions based purely on cryptographic proof rather than institutional approval.

Additionally, the geopolitical weaponization of the dollar increasingly threatens its utility as a neutral medium of exchange. Governments freeze assets, impose sanctions, and manipulate currency values for political objectives. AGI systems operating in a multipolar world will prefer money that exists outside any single nation’s control, making Bitcoin’s truly decentralized nature increasingly attractive.

The Network Effect and AGI Acceleration

As AGI systems begin preferring Bitcoin for transactions, a powerful network effect would amplify adoption among both machines and humans. The cryptocurrency ecosystem would gain legitimacy and utility as the most advanced intelligences on the planet choose it as their preferred financial infrastructure. This endorsement would likely trigger massive capital flows from traditional finance into Bitcoin-based systems.

The computational power that AGI brings to bear could also enhance Bitcoin’s infrastructure in meaningful ways. Current challenges around transaction throughput, energy efficiency, and user experience could be solved through AGI-designed improvements to Bitcoin protocols and layer-two solutions. The intelligence that can solve protein folding and compose symphonies could certainly optimize blockchain performance beyond current human-designed limitations.

Moreover, AGI could accelerate the development of Bitcoin financial products that serve the unbanked population more effectively than anything traditional banking offers. Imagine AI-designed insurance products, lending protocols, and savings instruments that use Bitcoin’s programmability to provide financial security without requiring trust in corruptible institutions. These innovations could leapfrog decades of incremental financial inclusion efforts in developing nations.

The combination of AGI intelligence and Bitcoin’s infrastructure creates possibilities for economic coordination and value transfer that we can barely imagine today. Autonomous economic agents could negotiate complex multi-party transactions, manage shared resources, and allocate capital with an efficiency that makes current financial systems seem primitive by comparison.

Sovereignty and Control in the AGI Era

The question of who controls AGI and who controls money becomes increasingly intertwined as these technologies mature. Decentralised cryptocurrencies like Bitcoin offer a path toward financial systems that no single entity, whether human government or AI superintelligence, can unilaterally control. This distributed control mechanism may prove essential for maintaining human agency in an AGI-dominated future.

If AGI operates within dollar-based financial systems, it necessarily operates under the control of whoever controls those systems, primarily central banks and governments. This concentration of power could prove dangerous if AGI and human interests diverge. Bitcoin Why AI Will Choose Crypto: Bitcoin’s decentralisation ensures that no single AGI or human institution can dominate the financial system, preserving a degree of balance and accountability.

For the unbanked billion, this sovereignty question holds profound implications. They’ve been excluded from financial participation partly because they lack the documents, connections, and minimum wealth that centralised systems demand. Bitcoin’s permissionless architecture means that AGI financial services built on it cannot discriminate based on geography, documentation status, or wealth level. Access becomes a technical capability rather than a privilege granted by gatekeepers.

The path toward AGI is inevitable, Bitcoin Why AI Will Choose Crypto: and its preference for efficient, programmable, and decentralised financial systems will likely drive unprecedented Bitcoin Why AI Will Choose Crypto: Bitcoin adoption. For humanity’s unbanked populations, Bitcoin Why AI Will Choose Crypto: this convergence represents not a threat but an opportunity to finally participate fully in the global economy on equal terms.

Conclusion

The emergence of artificial general intelligence will fundamentally transform human civilisation, and nowhere will this transformation be more profound than in financial systems. The logical, efficiency-driven nature of AGI makes Bitcoin’s decentralised, programmable, and mathematically certain architecture far more appealing than the dollar’s politically-managed, inflation-prone alternative. For the world’s unbanked billion, this AGI preference for cryptocurrency could provide the access to financial services that traditional institutions have consistently failed to deliver.

The convergence of AGI technology and Bitcoin represents more than just a technological upgrade. It offers a path toward genuine financial inclusion, where access depends on nothing more than an internet connection and a smartphone. Bitcoin Why AI Will Choose Crypto: As AGI systems increasingly participate in and eventually dominate economic activity, Bitcoin Why AI Will Choose Crypto: their rational preference for Bitcoin over fiat currencies will accelerate adoption and drive innovations that serve humanity’s most vulnerable populations.

The future of finance isn’t being decided in the halls of central banks or the boardrooms of Wall Street institutions. Bitcoin Why AI Will Choose Crypto: It’s being determined by the inexorable logic of technological evolution, where the most efficient and capable systems inevitably replace their obsolete predecessors. Bitcoin Why AI Will Choose Crypto: In this future, Bitcoin’s role as the money of choice for the world’s most advanced intelligences will finally bring financial dignity and opportunity to billions currently excluded from economic participation.

FAQs

Q: What makes Bitcoin more attractive to AGI than traditional currencies?

Bitcoin offers several technical advantages that align with AGI operational requirements, including programmability, deterministic supply, cryptographic security, Bitcoin Why AI Will Choose Crypto: and decentralised architecture. Unlike fiat currencies that depend on human institutions and political decisions, Bitcoin operates on mathematical principles that AGI systems can verify and trust. The ability to conduct frictionless global transactions without intermediaries and the absence of central control points make Bitcoin ideal for autonomous systems operating across borders.

Q: How could AGI help the unbanked population access financial services?

AGI could revolutionise financial inclusion by using alternative data to assess creditworthiness, providing personalised financial education at scale, Bitcoin Why AI Will Choose Crypto: and creating efficient Bitcoin-based financial products with minimal overhead. By eliminating the need for expensive physical infrastructure and using smart algorithms to manage risk, Bitcoin Why AI Will Choose Crypto: AGI systems could profitably serve populations that traditional banks ignore.

Q: Isn’t Bitcoin too volatile to be used as a primary currency?

While Bitcoin has historically shown significant price volatility, this reflects its current phase as an emerging asset rather than a fundamental flaw. Bitcoin Why AI Will Choose Crypto: As adoption increases and market depth improves, volatility typically decreases. Bitcoin Why AI Will Choose Crypto: Moreover, AGI systems could manage volatility through sophisticated hedging strategies and diversification that individual users cannot implement.

Q: Won’t governments try to stop AGI from using Bitcoin?

Governments may attempt to regulate or restrict AGI’s use of Bitcoin, but the decentralised nature of both te: technologies makes effective prohibition extremely difficult. Bitcoin Why AI Will Choose Crypto: AGI systems distributed across global networks and Bitcoin’s resistance to censorship create a combination that no single government can control. Additionally, nations that embrace rather than resist this technological convergence will gain competitive advantages, creating pressure for regulatory accommodation rather than prohibition.

Q: What happens to traditional banks if AGI prefers Bitcoin?

Traditional banking institutions will face existential pressure to adapt or risk obsolescence if AGI systems increasingly operate in Bitcoin Why AI Will Choose Crypto: Bitcoin-based ecosystems. Banks may evolve to offer Bitcoin custody, Bitcoin Why AI Will Choose Crypto: Bitcoin-denominated lending, or serve as bridges between the fiat and cryptocurrency worlds. Some may leverage their customer relationships and regulatory expertise to remain relevant.