Bitcoin and Ether faced significant downward pressure, marking a challenging start to the final month of the year. This latest downturn has reignited concerns about market stability and investor sentiment across the digital asset ecosystem. Crypto Sell-Off Bitcoin: As the world’s leading cryptocurrencies tumbled, the ripple effects extended throughout the broader crypto market, triggering widespread liquidations and testing the resolve of both retail and institutional investors.

The renewed selling pressure comes at a particularly sensitive time for cryptocurrency markets, as multiple macroeconomic factors converge to create a challenging environment for risk assets. Understanding the causes behind this dramatic price action and its potential implications has become crucial for anyone invested in or following the digital currency space. This comprehensive analysis explores the factors driving the current sell-off, examines its impact on various market participants, and considers what might lie ahead for Bitcoin, Ether, and the broader cryptocurrency ecosystem.

The Magnitude of Monday’s Cryptocurrency Decline

Bitcoin experienced a decline of nearly eight percent, trading around eighty-four thousand three hundred five dollars, representing one of the most significant single-day drops in recent months. The selling pressure intensified during Asian trading hours and continued throughout the North American session, catching many traders off guard after a brief period of relative stability.

Ether suffered an even steeper fall, dropping approximately ten percent to reach twenty-seven hundred thirty-two dollars, highlighting the vulnerability of alternative cryptocurrencies during periods of market stress. The second-largest cryptocurrency by market capitalization has faced particular challenges in recent weeks, with technical indicators suggesting additional downside risk if key support levels fail to hold.

The selloff extended well beyond the two largest cryptocurrencies. Solana declined by about ten percent to approximately one hundred twenty-four dollars, while other prominent tokens also registered losses, demonstrating the breadth of the market downturn. This widespread decline suggests that the selling pressure stems from broader market dynamics rather than issues specific to individual cryptocurrencies.

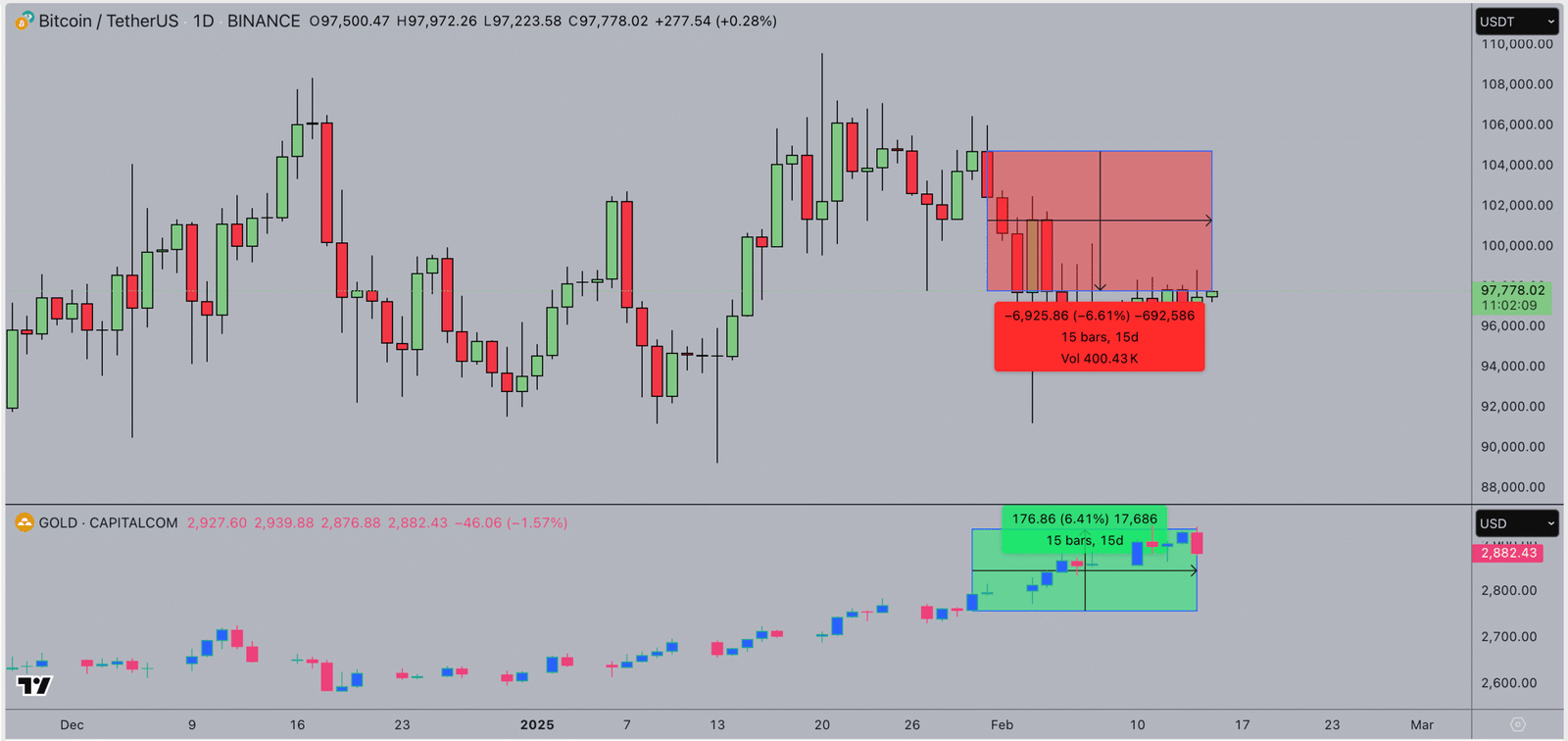

The crypto market liquidations reached alarming levels, with approximately seven hundred million dollars in leveraged positions wiped out within hours. Long positions bore the brunt of these liquidations, accounting for nearly four hundred million dollars of the total. These forced liquidations create a cascading effect, as automated selling to meet margin requirements pushes prices lower, triggering additional liquidations in a self-reinforcing cycle.

Macroeconomic Pressures Weighing on Digital Assets

The current cryptocurrency sell-off cannot be understood in isolation from broader macroeconomic developments. Multiple factors have converged to create what analysts describe as a distinctly risk-off environment, prompting investors to reassess their exposure to volatile assets like cryptocurrencies.

Federal Reserve Policy and Interest Rate Uncertainty

One of the most significant headwinds facing crypto markets stems from uncertainty surrounding Federal Reserve monetary policy. Crypto Sell-Off Bitcoin: Macroeconomic concerns, including uncertainty over a possible rate cut, continue to weigh on investors’ minds, creating an atmosphere of caution across financial markets. While market participants had previously priced in an eighty to eighty-seven percent probability of a twenty-five basis point rate cut in December, Crypto Sell-Off Bitcoin: recent inflation data and Fed commentary have introduced considerable doubt.

The relationship between interest rates and cryptocurrency prices has become increasingly pronounced as institutional participation in crypto markets has grown. Higher interest rates make risk-free government bonds more attractive relative to volatile assets, Crypto Sell-Off Bitcoin: while also increasing borrowing costs for leveraged positions. Crypto Sell-Off Bitcoin: This dynamic creates downward pressure on cryptocurrency prices as investors rotate into safer, yield-bearing instruments.

Bank of Japan Policy Shift

Adding to the global risk-off sentiment, developments in Japan have sent shockwaves through international markets. Japan’s two-year bond yield surged above one percent for the first time since two thousand eight, fueling expectations of the Bank of Japan tightening. Crypto Sell-Off Bitcoin: This represents a dramatic shift in the global liquidity environment, as Japan has long been a source of cheap funding for carry trades and speculative positions.

When Japanese government bonds begin offering meaningful yields, they suddenly become attractive alternatives to riskier assets. Investors who previously felt compelled to seek returns in volatile markets like cryptocurrency can now earn reasonable returns with minimal risk. This reallocation of capital away from high-beta assets like Bitcoin and Ether has contributed significantly to the current selling pressure.

China’s Regulatory Warning

Regional regulatory developments have added another layer of complexity to the market environment. A statement by the People’s Bank of China warning of illegal activities relating to digital currencies pressured Hong Kong-listed shares of digital assets-related companies. While China has maintained a restrictive stance on cryptocurrencies for several years, renewed enforcement warnings can trigger immediate selling as investors fear broader crackdowns or reduced accessibility in important markets.

The impact of Chinese regulatory actions extends beyond direct cryptocurrency trading. Companies involved in mining, custody services, and blockchain development with exposure to Chinese markets face immediate stock price pressure when regulatory warnings emerge. This creates additional negative sentiment that can spill over into cryptocurrency prices themselves.

Technical Factors Amplifying the Decline

Beyond macroeconomic fundamentals, several technical factors have amplified the severity of the current crypto market crash. Understanding these dynamics is essential for grasping why relatively modest initial selling can evolve into dramatic price collapses.

Excessive Leverage in the System

There’s an estimated seven hundred eighty-seven billion dollars outstanding leverage in perpetual crypto futures, against some one hundred thirty-five billion dollars outstanding in exchange-traded funds. This enormous leverage creates extraordinary fragility in the market structure. When prices begin declining, leveraged positions face margin calls, forcing holders to either add collateral or close positions through selling.

The ratio of futures leverage to spot market capitalization has reached levels that many analysts find concerning. In traditional markets, such extreme leverage ratios would be impossible due to regulatory constraints and risk management requirements. The largely unregulated nature of cryptocurrency futures markets allows leverage ratios that can reach two hundred times in some instances, creating conditions ripe for violent price swings.

Thin Weekend Liquidity

The timing of the selloff, beginning during Asian hours on Monday following weekend trading, highlights another structural vulnerability in cryptocurrency markets. Unlike traditional financial markets that close on weekends, crypto markets operate twenty-four hours a day, seven days a week. However, liquidity often diminishes significantly during weekend hours, particularly during certain geographic time zones.

When selling pressure emerges during periods of thin liquidity, the price impact of each transaction magnifies. A few hundred million dollars in strategic selling during low-liquidity periods can trigger price declines that erase over one hundred billion dollars in market capitalization. This mathematical reality stems from the marginal price-setting mechanism of markets, where the most recent transaction determines the valuation of all outstanding tokens.

Technical Chart Patterns Signaling Weakness

Ether has confirmed a death cross, a bearish pattern marked by the fifty-day simple moving average crossing below the two-hundred-day moving average. This technical development signals that short-term price trends are underperforming longer-term trajectories, potentially foreshadowing an extended bear market. While the predictive value of technical indicators remains debated, they become self-fulfilling prophecies when enough traders base their decisions on them.

Bitcoin’s monthly moving average convergence divergence histogram printed its first red bar below zero in November, confirming a shift from bullish to bearish momentum. Historically, this indicator has preceded prolonged downturns in every major Bitcoin cycle since two thousand twelve. The appearance of this signal adds weight to concerns that the current correction may have significant room to run.

Impact on Crypto-Related Stocks and Companies

The digital asset sell-off has extended well beyond cryptocurrencies themselves, severely impacting publicly traded companies with cryptocurrency exposure. Understanding which entities face the greatest risk provides insight into the broader implications of the market downturn.

Corporate Bitcoin Treasuries Under Pressure

Companies that have adopted Bitcoin as a treasury asset face immediate mark-to-market losses on their balance sheets. Strategy Inc., formerly known as MicroStrategy, which holds substantial Bitcoin reserves, has seen its stock decline to one-year lows. The company’s aggressive Bitcoin acquisition strategy, once celebrated during bull markets, now faces scrutiny as the value of its holdings deteriorates.

The risks extend beyond simple price exposure. Some analysts have raised concerns that if Strategy Inc.’s valuation continues declining, the company might theoretically face pressure to sell Bitcoin to maintain its financial structure. While such scenarios may be exaggerated, they reflect genuine concerns about the sustainability of corporate Bitcoin treasury strategies during extended bear markets.

Mining Companies and Infrastructure Providers

Bitcoin and Ethereum mining companies face a double challenge during market downturns. Not only does the value of their existing cryptocurrency holdings decline, but their ongoing mining operations become less profitable as the dollar value of newly minted coins falls. Companies like Marathon Digital Holdings have experienced stock declines mirroring the broader cryptocurrency market weakness.

Infrastructure providers, exchanges, and custody services also feel the impact through reduced transaction volumes and trading activity. Coinbase Global, the largest cryptocurrency exchange in the United States, typically sees its stock price correlate strongly with Bitcoin and Ether prices. Lower cryptocurrency prices often translate to reduced trading volumes, directly impacting the company’s revenue from transaction fees.

Traditional Finance with Crypto Exposure

Even traditional financial institutions with relatively modest cryptocurrency exposure face scrutiny during major selloffs. Financial technology companies that have integrated cryptocurrency trading features or payment services experience pressure as investors reassess the wisdom of crypto-adjacent business models. Robinhood Markets, which offers cryptocurrency trading alongside traditional securities, has seen its shares decline in sympathy with the broader digital asset market.

Institutional Versus Retail Investor Behavior

The current market environment reveals stark differences in how various classes of investors respond to cryptocurrency volatility. The movement is predominantly retail driven, which is concerning because retail reacts very differently than institutional investors. This behavioral divergence creates distinct dynamics that shape market outcomes during periods of stress.

Retail investors, who comprise a significant portion of cryptocurrency market participants, tend to exhibit more emotional trading behavior. During downturns, retail selling can intensify rapidly as fear spreads through social media channels and online communities. The decentralized and opaque nature of cryptocurrency markets makes it difficult to gauge sentiment accurately, potentially leading to overshooting in both directions.

Institutional investors, by contrast, often view significant price declines as potential accumulation opportunities. Many institutional participants employ systematic strategies that involve buying during periods of market stress, viewing temporary volatility as a cost of accessing long-term returns. However, institutional support may not be sufficient to prevent further declines if retail capitulation becomes severe enough.

The dichotomy between institutional accumulation and retail distribution creates interesting market dynamics. On-chain analytics suggest that long-term holders continue accumulating Bitcoin despite price weakness, while newer entrants who purchased at higher prices face mounting losses. This pattern resembles previous cryptocurrency market cycles, where patient accumulation during downturns eventually sets the stage for subsequent rallies.

Cryptocurrency Market Structure Vulnerabilities

The events of December 1st highlight several structural vulnerabilities inherent in cryptocurrency markets that distinguish them from traditional financial markets. Understanding these differences is crucial for assessing both the severity of current challenges and potential paths forward.

Fragmented Global Regulation

Fragmented oversight, ranging from outright bans in some jurisdictions to lenient frameworks in others, has exacerbated volatility. The lack of unified global regulatory standards creates uncertainty that manifests in increased price volatility. Investors must constantly monitor regulatory developments across multiple jurisdictions, each of which can trigger significant price movements.

The regulatory fragmentation also creates opportunities for regulatory arbitrage, where activities migrate to jurisdictions with lighter oversight. While this flexibility appeals to some market participants, it also introduces systemic risks. Exchanges and service providers operating in loosely regulated environments may employ practices that would be prohibited in more developed regulatory frameworks, potentially creating hidden vulnerabilities.

Market Manipulation Concerns

Suspected wash trading, where trading volume is artificially inflated, has been identified on decentralized exchanges, creating a false illusion of demand. The prevalence of potentially manipulative practices undermines market integrity and makes it difficult for legitimate participants to assess true supply and demand dynamics. When artificial volume distorts price discovery, markets become less efficient and more prone to sudden dislocations.

The relative youth and limited regulatory oversight of cryptocurrency markets make them more susceptible to manipulation compared to traditional financial markets. While regulatory bodies in major jurisdictions have begun increasing enforcement actions, the decentralized and often pseudonymous nature of cryptocurrency transactions makes detecting and prosecuting manipulation challenging.

Historical Context and Comparative Analysis: Crypto Sell-Off Bitcoin

Placing the current Bitcoin price decline within a historical context provides a valuable perspective on its severity and potential implications. Cryptocurrency markets have experienced numerous boom-bust cycles since Bitcoin’s inception, each offering lessons relevant to current circumstances.

The current decline, while significant, remains modest compared to previous cryptocurrency bear markets. Bitcoin has experienced multiple instances where it declined by seventy percent or more from peak to trough. The two thousand eighteen bear market saw Bitcoin fall from nearly twenty thousand dollars to approximately three thousand two hundred dollars, while the two thousand twenty-two downturn brought prices from nearly seventy thousand dollars to below sixteen thousand dollars.

What distinguishes the current period is the increased institutional participation and integration with traditional financial markets. All three major crypto assets show a positive correlation to the Nasdaq one hundred ranging from point two to point six on a one-year rolling basis. This growing correlation suggests that cryptocurrency markets have matured and become more intertwined with broader financial system dynamics.

The maturation of cryptocurrency markets cuts both ways. On one hand, institutional participation and regulatory development provide more stability and legitimacy. On the other hand, increased correlation with traditional markets means cryptocurrencies may lose some of their portfolio diversification benefits. During periods of broad risk-off sentiment, cryptocurrencies now tend to decline alongside equities rather than providing an uncorrelated return stream.

Recovery Prospects and Market Outlook

Despite the current challenges facing cryptocurrency markets, several factors suggest that the long-term trajectory remains intact, even as near-term volatility persists. Understanding both the risks and opportunities in the current environment requires a nuanced analysis of technical, fundamental, and sentiment indicators.

Technical Support Levels

First support lies near eighty-four thousand five hundred dollars, defined by the trendline linking two thousand twenty-three to two thousand twenty-four higher lows. If this level holds, it could provide the foundation for a stabilization or recovery. However, a break below this support would expose lower levels, potentially around seventy-four thousand five hundred dollars, representing the lows from earlier in the year.

The presence of nearly two billion dollars in short positions between current levels and ninety-two thousand five hundred dollars, with thirteen billion dollars up to one hundred three thousand dollars, creates potential fuel for a short squeeze if sentiment shifts. Short squeezes occur when rising prices force short sellers to buy to cover their positions, accelerating upward price momentum.

Fundamental Adoption Trends

Despite near-term price weakness, fundamental adoption metrics continue showing strength in certain areas. The approval and launch of cryptocurrency exchange-traded funds in various jurisdictions has provided regulated access for institutional and retail investors who previously faced barriers to direct cryptocurrency ownership. While ETF flows have been mixed recently, the infrastructure for traditional finance participation continues expanding.

Developments in cryptocurrency use cases beyond pure speculation also continue advancing. The growth of decentralized finance applications, improvements in blockchain scalability, and increasing integration with traditional payment systems represent genuine technological and adoption progress. These fundamental developments may not prevent cyclical price declines but contribute to long-term value proposition strengthening.

Seasonal Patterns and Year-End Dynamics

Historical analysis reveals that cryptocurrency markets often experience what some traders call a “Santa Claus rally” during December, as year-end positioning and holiday optimism boost prices. However, analysts caution against assuming seasonal patterns will hold given the unusual circumstances of two thousand twenty-five. The combination of macroeconomic uncertainty, elevated leverage, and technical weakness may override typical seasonal tendencies.

The upcoming Federal Reserve interest rate decision, expected later in December, represents a major catalyst that could significantly influence cryptocurrency market direction. A rate cut, if delivered, might provide the relief that risk assets need to stage a year-end recovery. Conversely, if the Fed holds rates steady or signals a more hawkish stance than expected, additional downside pressure could materialize.

Strategies for Navigating the Current Environment

For investors and traders attempting to navigate the current cryptocurrency market volatility, several principles emerge from analysis of the current situation and historical precedents. While no strategy eliminates risk in inherently volatile markets, certain approaches may help manage exposure appropriately.

Long-term investors with conviction in cryptocurrency’s fundamental value proposition may view current price levels as accumulation opportunities, particularly if they believe that temporary macroeconomic headwinds will eventually resolve. This approach requires strong risk tolerance and the ability to withstand further potential declines without panic selling. Historical evidence suggests that patient accumulation during bear markets has rewarded investors who maintain discipline.

More cautious participants might consider waiting for clearer signs of market stabilization before committing significant capital. Technical indicators suggesting trend reversals, improvements in market sentiment metrics, or fundamental catalysts like regulatory clarity could provide more confidence that a durable bottom has formed. The cost of this patience is potentially missing early stages of recovery, but the benefit is avoiding further losses if the decline continues.

Risk management becomes paramount during volatile periods. Investors should carefully assess whether their cryptocurrency allocation remains appropriate given their overall portfolio, risk tolerance, and financial circumstances. The classic advice to never invest more than one can afford to lose applies with particular force to cryptocurrency markets, which combine substantial volatility with unique risks not present in traditional assets.

Broader Implications for Digital Asset Ecosystem

The current crypto market downturn carries implications extending beyond immediate price movements, potentially shaping the future development of the digital asset ecosystem. How the market navigates this challenging period may influence regulatory approaches, institutional adoption trajectories, and technological development priorities.

Regulatory scrutiny typically intensifies during market downturns as policymakers respond to investor losses and call for increased protection. The current selloff may accelerate regulatory initiatives in various jurisdictions, potentially bringing more clarity but also imposing new compliance requirements on market participants. The industry faces a delicate balance between welcoming regulatory legitimacy and preserving the innovation and accessibility that characterize cryptocurrency markets.

The stress test that current market conditions impose on cryptocurrency infrastructure reveals strengths and weaknesses in market design. Exchanges, custodians, and other service providers that maintain stability and continue operating smoothly during volatility build trust and market share. Conversely, platforms that experience technical difficulties, liquidity problems, or operational challenges during stress periods face reputational damage that may prove lasting.

Innovation often accelerates during bear markets as developers and entrepreneurs focus on building sustainable value rather than riding speculative waves. The current environment may foster development of more robust infrastructure, improved user experiences, and practical applications that demonstrate cryptocurrency utility beyond speculation. These developments, while less visible than price action, ultimately determine long-term ecosystem health.

Conclusion

The sharp decline in Bitcoin and Ether prices on December first, two thousand twenty-five, represents more than a simple market correction. It reflects the convergence of multiple macroeconomic pressures, technical vulnerabilities, and structural characteristics unique to cryptocurrency markets. The nearly eight percent drop in Bitcoin and ten percent decline in Ether, accompanied by hundreds of millions in liquidations, demonstrates the continued volatility inherent in digital asset markets.

The factors driving this cryptocurrency sell-off are numerous and interconnected. Uncertainty surrounding Federal Reserve monetary policy, shifts in Bank of Japan interest rate stance, regulatory warnings from China, excessive leverage in futures markets, and technical weakness all contributed to creating a perfect storm of selling pressure. The impact extended beyond cryptocurrencies themselves, affecting publicly traded companies with digital asset exposure and highlighting the growing integration between crypto and traditional financial markets.

Despite the near-term challenges, the long-term narrative for cryptocurrencies remains a subject of debate among analysts and investors. Historical precedent suggests that sharp corrections, while painful, have typically given way to eventual recoveries in cryptocurrency markets. However, the increased correlation with traditional financial markets and maturation of the asset class mean that recovery trajectories may differ from previous cycles.

As the digital asset ecosystem continues evolving, participants must remain vigilant about both risks and opportunities. Crypto Sell-Off Bitcoin: The current environment demands careful risk management, thorough analysis, and realistic expectations about volatility. Crypto Sell-Off Bitcoin: Whether the present decline represents a temporary setback in an ongoing bull market or the beginning of an extended bear phase remains to be seen. Crypto Sell-Off Bitcoin: What is certain is that cryptocurrency markets continue to provide both challenges and opportunities for those willing to navigate their inherent complexity and volatility.

FAQs

Q: What caused Bitcoin and Ether to fall sharply in December 2025?

The decline resulted from multiple converging factors, including uncertainty about Federal Reserve interest rate policy, Crypto Sell-Off Bitcoin: the Bank of Japan signaling potential rate increases, Crypto Sell-Off Bitcoin: warnings from China’s central bank about illegal cryptocurrency activities, and technical factors such as excessive leverage in the market.

Q: How low could Bitcoin and Ether prices go in this sell-off?

Technical analysts identify key support levels for Bitcoin around eighty-four thousand five hundred dollars, with additional support near seventy-four thousand five hundred dollars if current levels fail to hold. For Ether, Crypto Sell-Off Bitcoin: the outlook appears more challenging following the confirmation of a death cross technical pattern.

Q: Are cryptocurrency markets correlated with stock markets?

Yes, cryptocurrency markets have shown increasing correlation with traditional equity markets, particularly technology stocks. Bitcoin, Ether, Crypto Sell-Off Bitcoin: and Solana all demonstrate positive correlations with the Nasdaq one hundred index, ranging from point two to point six.

Q: Should investors buy cryptocurrencies during this decline?

Investment decisions depend on individual circumstances, Crypto Sell-Off Bitcoin: including risk tolerance, investment timeframe, and overall portfolio composition. Crypto Sell-Off Bitcoin: Historical patterns show that patient accumulation during bear markets has rewarded long-term investors, but near-term volatility may persist.

Q: How do leveraged liquidations amplify cryptocurrency price declines?

When cryptocurrency prices fall, traders using leverage face margin calls requiring them to either add collateral or close positions. Crypto Sell-Off Bitcoin: Forced selling to meet margin requirements pushes prices lower, triggering additional liquidations in a cascading effect.