4 Altcoins to Consider During Crypto Conditions in 2026 the cryptocurrency market is known for its cycles of volatility, correction, and recovery. When improving crypto conditions begin to take shape, investors often look beyond Bitcoin and Ethereum to identify promising opportunities in the altcoin space. Altcoins, which include all cryptocurrencies other than Bitcoin, tend to perform strongly during periods of renewed market confidence, increased liquidity, and technological innovation. Understanding which projects stand out during these phases can help investors align with long-term growth narratives rather than short-term hype.

As market sentiment shifts from fear to optimism, factors such as rising trading volume, improving on-chain metrics, and growing institutional interest often signal a healthier crypto ecosystem. During these periods, altcoins with strong fundamentals, real-world utility, and active development communities tend to gain traction. This article explores 4 altcoins to consider during improving crypto conditions, focusing on why these projects matter, how they fit into broader blockchain trends, and what makes them appealing in a recovering market environment.

The goal is not to provide financial advice, but to offer an in-depth, educational overview that helps readers better understand the dynamics of altcoin investing. By examining use cases, technological strengths, and market positioning, readers can make more informed decisions as crypto conditions continue to evolve.

4 Altcoins to Consider During Crypto

Improving crypto conditions typically refer to a phase where the market shows signs of stabilization and renewed growth after a downturn. This often includes higher market capitalization, increased user activity, positive regulatory developments, and a return of investor confidence. During such times, capital tends to flow from major cryptocurrencies into altcoins, creating opportunities for outsized returns.

One key driver of improving crypto conditions is innovation. Blockchain networks that solve real problems, such as scalability, interoperability, or decentralized finance efficiency, attract attention when the market is ready to reward utility over speculation. Another important factor is macroeconomic sentiment, where easing financial pressures and greater risk appetite encourage participation in digital assets.

In these conditions, altcoins with strong narratives and tangible progress often outperform. The following sections explore four such altcoins that are frequently discussed during periods of market recovery and optimism.

Altcoin One: Ethereum-Based Scaling Solutions

Why Scaling Solutions Matter in a Recovering Market

As crypto adoption grows, network congestion and high transaction fees become critical challenges. During improving crypto conditions, user activity increases, making scalability solutions more relevant than ever. Ethereum-based scaling projects focus on improving transaction speed and reducing costs while maintaining security and decentralization.

These solutions benefit directly from increased usage of decentralized applications, decentralized finance platforms, and non-fungible tokens. When market confidence returns, developers and users alike re-engage with blockchain ecosystems, placing additional demand on underlying infrastructure.

Growth Potential During Improving Crypto Conditions

Scaling-focused altcoins often experience renewed interest during market recoveries because they address practical pain points. Their value proposition becomes clearer as more users interact with blockchain networks. Layer 2 solutions, transaction efficiency, and network scalability are LSI keywords closely tied to this narrative, reinforcing their relevance in a growing market.

As improving crypto conditions attract more capital and users, projects that enhance usability tend to see stronger adoption metrics. This can translate into increased token demand and a more sustainable growth trajectory compared to purely speculative assets.

Altcoin Two: Interoperability-Focused Blockchain Networks

The Role of Interoperability in the Crypto Ecosystem

Interoperability has become a cornerstone of blockchain development. As multiple networks coexist, the ability for them to communicate and share data is essential. Interoperability-focused altcoins aim to connect different blockchains, allowing assets and information to move seamlessly across ecosystems.

During improving crypto conditions, collaboration often replaces competition as a dominant theme. Projects that enable cross-chain functionality align well with this shift, as they support a more unified and efficient blockchain landscape.

Interoperability Gains Attention During Market Recovery

When the market is bearish, experimentation slows. However, in a recovering market, developers revisit ambitious ideas, and interoperability becomes a priority. Cross-chain technology, blockchain connectivity, and decentralized networks are LSI keywords that highlight the strategic importance of these projects.

Interoperability altcoins often benefit from partnerships and integrations that expand their reach. As improving crypto conditions encourage ecosystem growth, these networks can act as foundational infrastructure, supporting innovation across multiple platforms.

Altcoin Three: Decentralized Finance Infrastructure Tokens

The Evolution of DeFi in Improving Crypto Conditions

Decentralized finance has reshaped how users interact with financial services. From lending and borrowing to trading and yield generation, DeFi platforms offer alternatives to traditional systems. Infrastructure-focused DeFi altcoins provide the backbone that enables these services to function efficiently and securely.

In periods of improving crypto conditions, DeFi activity tends to rebound strongly. Users regain confidence in deploying capital, and total value locked across platforms often increases. This renewed activity highlights the importance of reliable DeFi infrastructure.

Long-Term Value of DeFi Infrastructure Projects

Infrastructure tokens are less about flashy features and more about stability and performance. They support smart contracts, liquidity protocols, and decentralized exchanges. Decentralized finance, smart contract platforms, and crypto liquidity are LSI keywords that reinforce their relevance.

As improving crypto conditions attract both retail and institutional participants, robust DeFi infrastructure becomes essential. Projects that prioritize security, scalability, and user experience are well-positioned to benefit from this renewed interest.

Altcoin Four: Web3 and Data-Focused Blockchain Projects

The Rise of Web3 in a Healthier Crypto Market

Web3 represents the next evolution of the internet, emphasizing user ownership, decentralized data, and trustless interactions. Altcoins focused on Web3 infrastructure aim to support decentralized storage, identity, and data management solutions.

Improving crypto conditions often coincide with renewed interest in long-term technological shifts. As speculation gives way to utility, Web3-focused projects gain visibility for their role in reshaping digital interactions.

Data Utility and Market Confidence

Data-focused blockchain projects address critical issues such as privacy, transparency, and data monetization. Web3 technology, decentralized data, and blockchain innovation are LSI keywords that align with this sector’s growth narrative.

When crypto conditions improve, enterprises and developers are more willing to experiment with decentralized solutions. This creates opportunities for Web3 altcoins to demonstrate real-world use cases, driving adoption and long-term value creation.

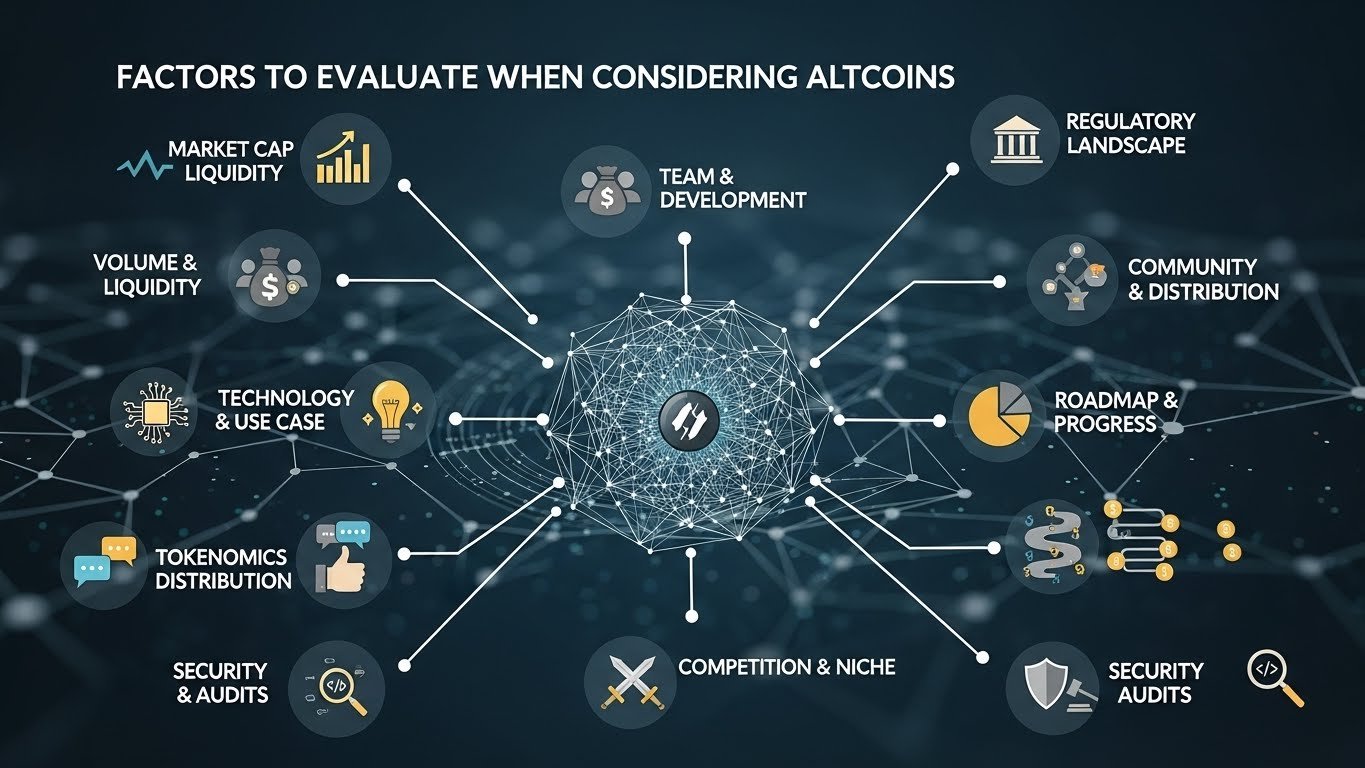

Factors to Evaluate When Considering Altcoins

Understanding which altcoins to consider during improving crypto conditions requires more than following trends. Fundamental analysis plays a crucial role in assessing long-term potential. Factors such as development activity, community engagement, and real-world adoption provide insight into a project’s sustainability.

Market cycles can amplify both gains and losses. Therefore, evaluating how a project performed during previous market phases can offer valuable perspective. Altcoins that demonstrate resilience and consistent progress tend to inspire greater confidence when conditions improve.

Additionally, broader market sentiment, regulatory clarity, and technological advancements all influence altcoin performance. By considering these elements together, investors can better navigate the complexities of a recovering crypto market.

Risks and Realistic Expectations

While improving crypto conditions create opportunities, they also come with risks. Altcoins are generally more volatile than established cryptocurrencies, and market optimism can sometimes lead to overvaluation. Understanding this balance is essential for setting realistic expectations.

Technological challenges, competition, and changing regulations can impact even the most promising projects. Diversification and ongoing research remain important strategies for managing risk. Recognizing that market cycles are unpredictable helps maintain a long-term perspective.

Altcoins should be viewed as part of a broader investment strategy rather than standalone bets. By focusing on projects with clear utility and strong fundamentals, investors can better align with sustainable growth trends.

The Broader Impact of Improving Crypto Conditions

Improving crypto conditions do more than influence prices. They encourage innovation, attract talent, and foster collaboration across the blockchain industry. As confidence returns, funding for new ideas increases, and the pace of development accelerates.

This environment benefits altcoins that are positioned as infrastructure or foundational technologies. Their growth supports the broader ecosystem, creating a positive feedback loop that reinforces market recovery. Over time, this can lead to greater mainstream acceptance of blockchain solutions.

Understanding these dynamics helps contextualize why certain altcoins gain attention during market upswings. It also highlights the importance of focusing on long-term value rather than short-term price movements.

Conclusion

Identifying 4 altcoins to consider during improving crypto conditions requires a thoughtful approach grounded in fundamentals, market trends, and technological relevance. As the crypto market transitions into healthier conditions, opportunities often emerge in projects that solve real problems and support ecosystem growth.

Scaling solutions, interoperability networks, DeFi infrastructure tokens, and Web3-focused projects each represent key areas of innovation. Their relevance increases as user activity, developer engagement, and capital flow return to the market. By understanding their roles and potential, readers can better navigate the evolving landscape of digital assets.

Ultimately, improving crypto conditions reward patience, research, and a long-term mindset. While volatility remains a constant, focusing on quality projects with clear use cases can help align with the next phase of blockchain growth.

FAQs

Q: What does improving crypto conditions mean for altcoin investors?

Improving crypto conditions generally indicate a phase where market sentiment is turning positive after a downturn. For altcoin investors, this often means increased liquidity, higher trading volumes, and renewed interest in innovative blockchain projects. During such periods, altcoins with strong fundamentals tend to gain attention as investors seek higher growth potential beyond major cryptocurrencies.

Q: Why are altcoins more attractive during market recovery phases?

Altcoins often outperform during recovery phases because they typically have smaller market capitalizations and greater growth potential. As confidence returns, investors are more willing to take calculated risks, allocating capital to projects that offer unique technology or niche use cases. This environment can amplify gains for well-positioned altcoins.

Q: How can investors evaluate which altcoins to consider during improving crypto conditions?

Investors can evaluate altcoins by examining factors such as development activity, real-world adoption, community support, and long-term vision. It is also important to understand how a project fits into broader blockchain trends like scalability, interoperability, or decentralized finance. These elements help determine whether an altcoin has sustainable potential.

Q: Are altcoins riskier than major cryptocurrencies in improving markets?

Altcoins generally carry higher risk due to greater volatility and less established track records. While improving crypto conditions can enhance their performance, they are still more susceptible to market swings. Managing this risk requires diversification, realistic expectations, and ongoing research into each project’s fundamentals.

Q: Can improving crypto conditions lead to long-term growth for altcoins?

Improving crypto conditions can create a foundation for long-term growth, especially for altcoins that focus on utility and innovation. When market recovery is supported by technological progress and real adoption, some altcoins can transition from speculative assets to essential components of the blockchain ecosystem.